_________

_________Exhibit 10.5

W&T OFFSHORE, INC.

AMENDED AND RESTATED INCENTIVE COMPENSATION PLAN

Executive Annual Incentive Award Agreement

For Fiscal Year 2018

This potential Annual Incentive Award (the “Award”) is granted on November 1, 2018 (the “Award Date”), by W&T Offshore, Inc., a Texas corporation (the “Company”) to the executive whose name appears in the footer below (“Awardee” or “you”).

WHEREAS, the Company in order to induce you to enter into and to continue to dedicate service to the Company and to materially contribute to the success of the Company agrees to grant you this Award; and

WHEREAS, this Award is granted to you pursuant to the W&T Offshore, Inc. Amended and Restated Incentive Compensation Plan, as may be amended from time to time (the “Plan”), and the following terms and conditions of this agreement (the “Agreement”) for the Company’s 2018 fiscal year.

NOW, THEREFORE, in consideration of and mutual covenants set forth herein and for other valuable consideration hereinafter set forth, the Award is hereby granted on the following terms and conditions:

1.Terms and Conditions. The Award is subject to all the terms and conditions of the Plan. All capitalized terms not defined in this Agreement shall have the meaning stated in the Plan. If there is any inconsistency between the terms of this Agreement and the terms of the Plan, the terms of the Plan shall control unless this Agreement expressly states that an exception to the Plan is being made.

2.Definitions. For purposes of this Agreement, the following terms shall have the meanings stated below.

(a)“Base Salary” means the base salary you received as an employee during the Performance Period, (i) including any amounts deferred pursuant to an election under any 401(k) plan, pre-tax premium plan, deferred compensation plan, or flexible spending account sponsored by the Company or any Subsidiary, and any overtime paid to you as an offshore employee required by your standard work schedule, but (ii) excluding any incentive compensation, employee benefit, or other benefit paid or provided under any incentive, bonus or employee benefit plan sponsored by the Company or any Subsidiary, all overtime paid other than as specified in (i) above and/or any excellence award, gains upon stock option exercises, restricted stock grants or vesting, moving or travel expense reimbursement, sign on bonus, imputed income, or tax gross-ups, without regard to whether the payment or gain is taxable income to you.

(b)“Disability” means your permanent disability as defined in your Individual Agreement. In the event that there is no existing written Individual Agreement between you and the Company or if any such agreement does not define Disability, the term “Disability” shall mean: (i) a physical or mental impairment of sufficient severity that, in the sole opinion of the

Executive (2018):

Company, (A) you are unable to continue performing the duties assigned to you prior to such impairment or (B) your condition entitles you to disability benefits under any insurance or employee benefit plan of the Company or its Subsidiaries, and (ii) the impairment or condition is cited by the Company as the reason for your termination; provided, however, that in all cases, the term Disability shall be applied and interpreted in compliance with section 409A of the Code and the regulations thereunder.

(c)“Individual Agreement” means any employment or severance agreement, if any, between you and the Company or any Subsidiary.

(d)“Performance Goals” means the performance criteria established by the Committee pursuant to Section 8 of the Plan and set forth in Appendix A attached hereto.

(e)“Performance Period” means the Company’s complete fiscal year ending December 31, 2018.

(f)“Total Performance Score” means the aggregate number of points, expressed as a percentage, you are assigned as a result of the Committee’s review, analysis and certification of the achievement of the applicable Performance Goals set forth in Appendix A attached hereto for the Performance Period. Your Total Performance Score, shall be expressed as a percentage set forth using the chart below:

|

Total Performance Score in Points |

Total Performance Score Expressed as a Percentage |

|

200 |

200% |

|

100 |

100% |

|

50 |

50% |

|

0 |

0% |

(g)“Individual Performance Multiplier” means a number based on your Individual Performance Score (defined below). Your Individual Performance Score corresponds to the Company’s view of your individual performance and contribution to the success of the Company, on a scale of one to five, as determined by your supervisor and subject to the review of the Chief Executive Officer and the Compensation Committee (the “Individual Performance Score”). It is intended, but not required, that the Individual Performance Scores be provided in tenths, e.g., 4.1.

Individual Performance Score 1.02.02.13.04.05.0

Individual Performance Multiplier 000.100.531.001.90

An Individual Performance Score of between one and two results in an Individual Performance Multiplier of zero and therefore no Award whatsoever is earned. For the avoidance of doubt, you must have an Individual Performance Score of at least 2.1 in order to earn an Award.

2

Executive (2018):

3.Effect of Award Agreement. This Award is subject to all of the terms and conditions of the Agreement and the Plan; all decisions or interpretations of the Agreement and the Plan by the Committee are binding, conclusive and final.

4.Award Percentage. Your award percentage is __% (“Award Percentage”).

5.Maximum Performance Levels. The maximum Total Performance Score you may be assigned shall not exceed 200.

6.Award Calculation.

(a)Subject to the terms and conditions set forth in the Plan and this Agreement, including, without limitation, Sections 5 and 8, your Award is equal to the dollar amount obtained by multiplying the following four numbers: your Base Salary, Award Percentage, Total Performance Score (expressed as a percentage), and Individual Performance Multiplier.

(i)The Total Performance Score will be calculated using straight-line interpolation.

(ii)Any Award that is earned will be paid in cash as soon as practicable after the Committee has certified the applicable Performance Goals were achieved for the Performance Period, but in no event later than the seventy-fifth (75th) day following the date the Performance Period ends. However, notwithstanding anything within this Agreement to the contrary, the Company will not pay any Awards unless and until the following financial condition is achieved on or before December 31, 2020: Adjusted EBITDA less Interest Expense Incurred, as reported by the Company in its announced Earnings Release with respect to the end of any fiscal quarter plus the three preceding fiscal quarters, exceeds $200 million. In such case the cash payment will be made within 30 days following the achievement of this financial condition, but subject to all the terms of this Agreement, including but not limited to Sections 7(b) and 8; provided that the Committee in its sole discretion retains the right to pay any Award otherwise earned regardless of whether such financial condition is achieved.

(iii)You must be employed prior to September 30 within the Performance Period in order to be eligible to participate in the Plan for the Performance Period.

(b)Subject to (i) and (ii) above, as an example calculation, an individual with a Base Salary of $100,000, an Individual Performance Score of 4.0 (resulting in an Individual Performance Multiplier of 1.0), a Total Performance Score of 90 and an Award Percentage of 30%, shall receive the following award:

$27,000 = ($100,000) x (1.0) x (0.9) x (0.3)

7.Effect of Termination of Employment. Notwithstanding any provisions to the contrary below in the remainder of this Section 7, in the event of any inconsistency between this Section 7 and any written Individual Agreement you may have, the terms of such an Individual

3

Executive (2018):

Agreement will control. In the event you do not have an Individual Agreement or your Individual Agreement does not address the treatment of Annual Incentive Awards under the Plan, and your employment is terminated at any time on or after the Award Date and before the Award is paid, your Award will be treated as follows:

(a)Death or Disability. If your termination of employment is a result of your death or Disability, as determined by the Company in its sole and complete discretion, you will receive a pro-rata Award, if an Award is payable for the Performance Period, based on the Base Salary and Individual Performance Multiplier you received during the Performance Period (the “Pro-Rata Award”). Subject to Section 6(a)(ii), you, your beneficiaries, or your estate, as applicable, will be paid in cash as soon as practicable after the Committee has certified the applicable Performance Goals were achieved for the Performance Period, but in no event later than the seventy-fifth (75th) day following the date the Performance Period ends; provided, however, that you must have been employed with the Company for a minimum of 90 days during the Performance Period in order to be eligible for a Pro-Rata Award described in this Section 7(a).

(b)Terminations other than Death or Disability. Unless your termination of employment is a result of your death or Disability, you must be employed by the Company or a Subsidiary on the date Awards are paid in order to be eligible to receive payment of an Award. You have no vested interest in the Award prior to the Award actually being paid to you by the Company. If your employment with the Company or a Subsidiary terminates for any reason other than your death or Disability, whether your termination is voluntary or involuntary, with or without cause, you will not be eligible to receive payment of any Award for the Performance Period.

8.Right of the Committee. The Committee has the right to increase, reduce or eliminate your Award for any reason regardless of the amount of your Total Performance Score or Individual Performance Multiplier achieved.

9.Right of the Company and Subsidiaries to Terminate Services. Nothing in this Agreement confers upon you the right to continue in the employ of the Company or any Subsidiary, or interfere in any way with the rights of the Company or any Subsidiary to terminate your employment at any time, with or without cause.

10.Effect of Transfer to New Position during the Performance Period. In the event that you are transferred to a new position with the Company or a Subsidiary during the Performance Period that confers upon you a new employment status in all or any significant aspect of your employment with the Company or a Subsidiary (including, but not limited to, a new title, rank, Base Salary, authority, duties, or other similar employment element) that is dissimilar from the position you hold upon the Award Date, the Committee has the sole discretion to determine whether or not such new position shall necessitate one or more of the following actions: (a) amending this Agreement, including, but not limited to, an amendment to the Performance Goals or the percentage of your Base Salary constituting your Target Award, (b) terminating this Agreement and any potential Award for the applicable Performance Period, (c) pro-rating your Award to reflect the number of days you actually spent in active service in your previous position, or (d) making such other adjustments as the Committee deems

4

Executive (2018):

appropriate to reflect your transfer to a new position; provided, however, that the Committee may determine in its sole discretion that no adjustment is necessary to this Agreement or Award.

11.Withholding Taxes. The Company may require you to pay to the Company (or the Company’s Subsidiary if you are an employee of a Subsidiary of the Company), an amount the Company deems necessary to satisfy its (or its Subsidiary’s) current or future obligation to withhold federal, state or local income or other taxes that you incur as a result of the Award. With respect to any such required tax withholding, the Company shall withhold from the payment to be issued to you under this Agreement the amount necessary to satisfy the Company’s obligation to withhold taxes.

12.Furnish Information. You agree to furnish to the Company all information requested by the Company to enable it to comply with any reporting or other requirements imposed upon the Company by or under any applicable statute or regulation.

13.No Liability for Good Faith Determinations. The Company, the Committee and the members of the Board shall not be liable for any act, omission or determination taken or made in good faith with respect to this Agreement or the Award granted hereunder.

14.Execution of Receipts and Releases. Any payment of cash to you, or to your legal representative, heir, legatee or distributee, in accordance with the provisions hereof, shall, to the extent thereof, be in full satisfaction of all claims of such Persons hereunder. The Company may require you or your legal representative, heir, legatee or distributee, as a condition precedent to such payment, to execute a release and receipt therefor in such form as the Company shall determine.

15.Notice. All notices required or permitted under this Agreement must be in writing and personally delivered or sent by mail and shall be deemed to be delivered on the date on which it is actually received by the person to whom it is properly addressed or if earlier the date it is sent via certified United States mail.

16.Waiver of Notice. Any person entitled to notice hereunder may waive such notice in writing.

17.Information Confidential. As partial consideration for the granting of the Award hereunder, you hereby agree to keep confidential all information and knowledge, except that which has been disclosed in any public filings required by law, that you have relating to the terms and conditions of this Agreement; provided, however, that such information may be disclosed as required by law and may be given in confidence to your spouse and tax and financial advisors. In the event any breach of this promise comes to the attention of the Company, it shall take into consideration that breach in determining whether to recommend the grant of any future similar award to you, as a factor weighing against the advisability of granting any such future award to you.

18.Nontransferability. Neither this Agreement nor this Award subject to this Agreement shall be subject in any manner to anticipation, alienation, sale, exchange, transfer, assignment, pledge, encumbrance or garnishment by your creditors or your beneficiary, except transfer by will or by the laws of descent and distribution. All rights with respect to this

5

Executive (2018):

Agreement shall be exercisable during your lifetime only by yourself or, if necessary, your guardian or legal representative.

19.Successors. This Agreement shall be binding upon you, your legal representatives, heirs, legatees and distributees, and upon the Company, its successors and assigns.

20.Severability. If any provision of this Agreement is held to be illegal or invalid for any reason, the illegality or invalidity shall not affect the remaining provisions hereof, but such provision shall be fully severable and this Agreement shall be construed and enforced as if the illegal or invalid provision had never been included herein.

21.Amendment. Subject to Section 8, the Committee may amend this Agreement at any time; provided, however, that no such amendment may adversely affect your rights under this Agreement without your consent, except to the extent such amendment is reasonably determined by the Committee, in its sole discretion, to be necessary to comply with applicable law or to prevent a detrimental accounting impact. No amendment or addition to this Agreement shall be effective unless in writing.

22.Headings. The titles and headings of Sections are included for convenience of reference only and are not to be considered in construction of the provisions hereof.

23.Governing Law. All questions arising with respect to the provisions of this Agreement shall be determined by application of the laws of Texas, without giving any effect to any conflict of law provisions thereof, except to the extent Texas state law is preempted by federal law.

24.Consent to Texas Jurisdiction and Venue. You hereby consent and agree that state courts located in Harris County, Texas and the United States District Court for the Southern District of Texas each shall have personal jurisdiction and proper venue with respect to any dispute between you and the Company arising in connection with the Award or this Agreement. In any dispute with the Company, you will not raise, and you hereby expressly waive, any objection or defense to any such jurisdiction as an inconvenient forum.

25. The Plan. This Agreement is subject to all the terms, conditions, limitations and restrictions contained in the Plan.

26.Clawback.To the extent required by applicable law or any applicable securities exchange listing standards, or as otherwise determined by the Committee, this Award and amounts or shares paid or payable pursuant to or with respect to this Award shall be subject to the provisions of any applicable clawback policies or procedures adopted by the Company or its affiliates, which clawback policies or procedures may provide for forfeiture, repurchase and/or recoupment of this Award and amounts paid or payable pursuant to or with respect to such Award. Notwithstanding any provision of the Agreement to the contrary, the Company reserves the right, without your consent or the consent of any beneficiary of this Award, to adopt any such clawback policies and procedures, including such policies and procedures applicable to this Agreement with retroactive effect. By your acceptance of a cash payment pursuant to this

6

Executive (2018):

Agreement, you are bound by such clawback policies or procedures and you may not seek indemnification or contribution from the Company for any amounts clawed back.

7

Executive (2018):

Executed by the Company as of the Award Date.

W&T Offshore, Inc.

By: __ _________

_________

Tracy W. Krohn, Chief Executive Officer

8

Executive (2018):

Exhibit 10.5

Performance Goals

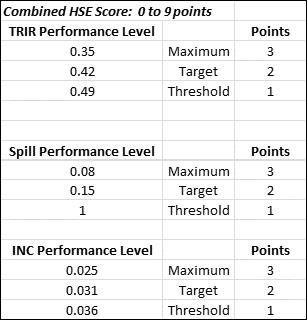

The Performance Goals for your 2018 Annual Incentive Award are set forth below and will be utilized to calculate your Total Performance Score utilizing straight-line interpolation. The Committee shall review, analyze and certify the achievement of each of the criterion below, either for the Company or yourself, as applicable, and shall determine your Total Performance Score according to the aggregate number of points, expressed as a percentage, you receive from each of the Performance Goals below. For the sake of clarity, with respect to negative metrics such as LOE and G&A, HSE&R, and Cost Control, the Performance Goals should be read as being below the “Threshold”, “Target” and “Maximum” levels.

A-1

Executive (2018):

A-2

Executive (2018):

HSE&R Score Calculation Details

TRIR (Total Recordable Incident Rate): Total Number of Recordable Cases (occupational injury requiring medical treatment) x 200,000/divided by total hours worked by all employees during the year covered

Spill ratio: Barrels spilled / millions of barrels produced

INC to Component Ratio: Number of INCs (Incidents of Non-Compliance) / number of components inspected by BSEE

A-3

Executive (2018):