UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-32414

W&T OFFSHORE, INC.

(Exact name of registrant as specified in its charter)

| Texas | 72-1121985 | |

| (State of incorporation) | (IRS Employer Identification Number) | |

| Nine Greenway Plaza, Suite 300 | ||

| Houston, Texas | 77046-0908 | |

| (Address of principal executive offices) | (Zip Code) | |

(713) 626-8525

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.00001 | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company. Yes ¨ No þ

The aggregate market value of the registrant’s common stock held by non-affiliates was approximately $1,989,030,775 based on the closing sale price of $58.51 per share as reported by the New York Stock Exchange on June 30, 2008.

The number of shares of the registrant’s common stock outstanding on February 20, 2009 was 76,289,286.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement relating to the Annual Meeting of Shareholders, to be filed within 120 days of the end of the fiscal year covered by this report, are incorporated by reference into Part III of this Form 10-K.

W&T OFFSHORE, INC.

| Page | ||||

| Item 1. | 1 | |||

| Item 1A. | 10 | |||

| Item 1B. | 24 | |||

| Item 2. | 25 | |||

| Item 3. | 31 | |||

| Item 4. | 32 | |||

| 32 | ||||

| Item 5. | 33 | |||

| Item 6. | 36 | |||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

40 | ||

| Item 7A. | 55 | |||

| Item 8. | 57 | |||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

90 | ||

| Item 9A. | 90 | |||

| Item 9B. | 90 | |||

| Item 10. | 91 | |||

| Item 11. | 91 | |||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

91 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

91 | ||

| Item 14. | 91 | |||

| Item 15. | 91 | |||

| 97 | ||||

| 57 | ||||

| 95 | ||||

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934, that involve risks, uncertainties and assumptions. If the risks or uncertainties materialize or the assumptions prove incorrect, our results may differ materially from those expressed or implied by such forward-looking statements and assumptions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, such as those statements that address activities, events or developments that we expect, believe or anticipate will or may occur in the future. These statements are based on certain assumptions and analyses made by us in light of our experience and perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate in the circumstances. Certain factors that may affect our financial condition and results of operations are discussed in Item 1A. “Risk Factors” and Item 7A. “Quantitative and Qualitative Disclosures About Market Risk” of this Annual Report on Form 10-K and may be discussed or updated from time to time in subsequent reports filed with the Securities and Exchange Commission. We assume no obligation, nor do we intend, to update these forward-looking statements. Unless the context requires otherwise, references in this Annual Report on Form 10-K to “W&T,” “we,” “us,” “our” and the “Company” refer to W&T Offshore, Inc. and its consolidated subsidiaries.

i

| Item 1. | Business |

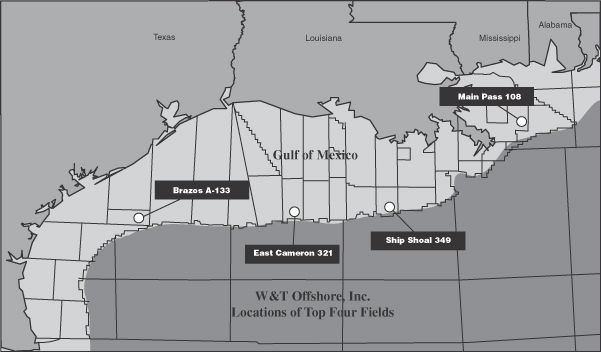

W&T Offshore, Inc. is a Texas corporation originally organized as a Nevada corporation in 1988, and successor by merger to W&T Oil Properties, Inc., a Louisiana corporation organized in 1983. We are an independent oil and natural gas producer, active in the acquisition, exploitation, exploration and development of oil and natural gas properties in the Gulf of Mexico, where we have developed significant technical expertise and where high production rates associated with hydrocarbon deposits have historically provided us the best opportunity to achieve a rapid return on our invested capital. We have leveraged our historic experience in the conventional shelf (water depths of less than 500 feet) to develop higher impact capital projects in the Gulf of Mexico in both the deepwater (water depths in excess of 500 feet) and the deep shelf (well depths in excess of 15,000 feet and water depths of less than 500 feet). We have acquired rights to develop and exploit new prospects and acquired existing oil and natural gas properties in both the deepwater and the deep shelf, while at the same time continuing our focus on the conventional shelf. We have interests in leases covering approximately 1.4 million gross acres (0.8 million net acres) spanning across the outer continental shelf off the coasts of Louisiana, Texas, Mississippi and Alabama. Approximately 79% of our total gross acreage is held-by-production.

Based on a reserve report prepared by Netherland, Sewell & Associates, Inc., our independent petroleum consultant, our total proved reserves at December 31, 2008 were 491.1 Bcfe. We calculate that our total proved reserves had a present value of estimated future net revenues discounted at 10% (“PV-10”), after considering future cash outflows related to asset retirement obligations and without deducting any future income taxes, of approximately $930.9 million and a standardized measure of discounted future cash flows of approximately $761.7 million as of December 31, 2008. Approximately 68% of our reserves were classified as proved developed (of which 38% were classified as non-producing) and 32% were classified as proved undeveloped. Classified by product, 46% of our reserves were natural gas and 54% were oil and natural gas liquids. For additional information about our proved reserves, see Item 2. “Properties – Proved Reserves.”

We seek to increase our reserves through acquisitions and drilling programs. We have focused on acquiring properties where we can develop an inventory of drilling prospects that will enable us to add reserves post-acquisition. Our acquisition team continues to work diligently to find properties that fit our profile and that we believe will add strategic and financial value to our company.

On August 24, 2006, we closed the acquisition of a wholly-owned subsidiary of Kerr-McGee Oil & Gas Corporation (“Kerr-McGee”) by merger for approximately $1.1 billion. The properties acquired included interests in approximately 100 fields on 242 offshore blocks spreading across the Western, Central and Eastern U.S. Gulf of Mexico, primarily in water depths of less than 1,000 feet. This transaction was financed through a combination of cash on hand, bank financing and proceeds from a public offering of our common stock.

On December 21, 2007, we entered into an agreement with Apache Corporation (“Apache”) to acquire its interest in Ship Shoal 349 field for $116.6 million in cash. This field is located off the coast of Louisiana and covers two federal offshore lease blocks, Ship Shoal blocks 349 and 359. The transaction closed on January 29, 2008, with an effective date of January 1, 2008. The acquisition increased our working interest in this field to 100% from approximately 59%, and the estimated proved oil and gas reserves acquired were 60.5 Bcfe. This acquisition was funded from cash on hand. For additional details about this transaction, refer to Note 4 to our consolidated financial statements.

For the year ended December 31, 2008, capital expenditures for oil and gas properties of $774.9 million included $116.6 million for the acquisition of Apache’s interest in Ship Shoal 349 field, $337.6 million for exploration activities, $265.3 for development activities and $55.4 million for seismic, capitalized interest and other leasehold costs. We participated in the drilling of 24 exploratory wells and two development wells of which 21 were on the conventional shelf and five were on the deep shelf. Both of the development wells were successful and 18 of the exploratory wells were successful. We operate 12 of the 18 successful exploratory wells.

1

During the three-year period ended December 31, 2008, we participated in the drilling of 57 exploratory wells, of which 43 were successful (which we define as completed or planned for completion). For a more detailed discussion of our drilling activity and capital expenditures, see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources – Capital expenditures.”

We participated in bidding for Gulf of Mexico leases on the outer continental shelf (“OCS”) at the March 2008 OCS Lease Sale 206 conducted by the U.S. government through the Minerals Management Service (“MMS”). The MMS awarded us leases covering four OCS blocks located on the conventional shelf in the central Gulf of Mexico for a total lease bonus of approximately $3.3 million. We also participated in OCS Lease Sale 207 in August 2008 and we were awarded one lease for a lease bonus of approximately $2.5 million.

During the second half of 2008, oil and natural gas prices fell from record high levels. The declines in oil and natural gas prices coincided with a significant deterioration in the financial markets and the economy in general. As a result of continued economic uncertainty, our drilling activity and capital expenditures in 2009 will be less than our drilling activity and capital expenditures in 2008. Our capital expenditure budget for 2009 is expected to approximate $220 million to $270 million and includes estimates for the completion of wells that were in progress at the end of 2008, wells or projects that we are presently committed to, lease saving operations, development wells where the rig is on location, scheduled recompletions and the development of our Green Canyon Block 646 prospect (“Daniel Boone”). We anticipate fully funding our 2009 capital expenditures with internally generated cash flow and cash on hand. Our capital expenditure budget does not include any amounts for potential acquisitions.

Business Strategy

We plan to continue to acquire and exploit reserves on the OCS, the area of our historical success, or in other areas outside of the Gulf of Mexico that are compatible with our technical expertise and could yield rates of return comparable to those we have historically achieved. We believe attractive acquisition opportunities will continue to arise in the Gulf of Mexico as the major integrated oil companies and other large independent oil and gas exploration and production companies continue to divest properties to focus on larger and more capital-intensive projects that better match their long-term strategic goals. Because of ongoing market turmoil, we also believe that other less well-capitalized producers may seek buyers for their properties, which could create opportunities for us.

We believe a significant portion of our acreage has exploration potential below currently producing zones, including deep shelf reserves at subsurface depths greater than 15,000 feet. Although the cost to drill deep shelf wells can be significantly higher than shallower wells, the reserve targets are typically larger and the use of existing infrastructure, when available, can increase the economic potential of these wells.

We believe our financial approach has contributed to our success and has positioned us to capitalize on new opportunities. Historically, we have limited our annual capital spending for exploration, exploitation and development activities to net cash provided by operating activities and we have used capacity under our credit agreement for acquisitions and to balance working capital fluctuations. In 2009, we expect to fund our capital expenditures with internally generated cash flow and cash on hand.

Competition

The oil and natural gas industry is highly competitive. We are currently focused almost exclusively in the Gulf of Mexico area and compete for the acquisition of oil and natural gas properties primarily on the basis of the price to be paid for such properties. We compete with numerous entities, including major domestic and foreign oil companies, other independent oil and natural gas concerns and individual producers and operators. Many of these competitors are large, well established companies and have financial and other resources substantially

2

greater than ours. Our ability to acquire additional oil and natural gas properties and to discover reserves in the future will depend upon our ability to evaluate and select suitable properties and consummate transactions in a highly competitive environment. Because of the deterioration of the capital markets, especially for companies with similar credit profiles, acquiring properties and funding exploration and development activities has become significantly more challenging. For a more thorough discussion of how competition could impact our ability to successfully complete our business strategy, see Item 1A. “Risk Factors.”

Oil and Natural Gas Marketing and Delivery Commitments

We sell our oil and natural gas through third-party marketing companies. We are not dependent upon, or contractually limited to, any one purchaser or small group of purchasers. However, in 2008 we sold over 10% of our production to each of Shell Trading and Chevron. See “Concentration of Credit Risk” in Note 1 to our consolidated financial statements for additional information about our sales to these customers. Due to the nature of oil and natural gas markets and because oil and natural gas are freely traded commodities and there are numerous purchasers in the Gulf of Mexico, we do not believe the loss of a single purchaser or a few purchasers would materially affect our ability to sell our production.

Regulation

General. Various aspects of our oil and natural gas operations are subject to extensive and continually changing regulation as legislation affecting the oil and natural gas industry is under constant review for amendment or expansion. Numerous departments and agencies, both federal and state, are authorized by statute to issue, and have issued, rules and regulations binding upon the oil and natural gas industry and its individual members. The Federal Energy Regulatory Commission (“FERC”) regulates the transportation and sale for resale of natural gas in interstate commerce pursuant to the Natural Gas Act of 1938 (“NGA”) and the Natural Gas Policy Act of 1978 (“NGPA”). In 1989, however, Congress enacted the Natural Gas Wellhead Decontrol Act, which removed all remaining price and nonprice controls affecting wellhead sales of natural gas, effective January 1, 1993. While sales by producers of natural gas and all sales of crude oil, condensate and natural gas liquids can currently be made at uncontrolled market prices, Congress could reenact price controls in the future.

Regulation and transportation of natural gas. Our sales of natural gas are affected by the availability, terms and cost of transportation. The price and terms for access to pipeline transportation are subject to extensive regulation. In recent years, the FERC has undertaken various initiatives to increase competition within the natural gas industry. As a result of initiatives like FERC Order No. 636, issued in April 1992, the interstate natural gas transportation and marketing system has been substantially restructured to remove various barriers and practices that historically limited non-pipeline natural gas sellers, including producers, from effectively competing with interstate pipelines for sales to local distribution companies and large industrial and commercial customers. The most significant provisions of Order No. 636 require that interstate pipelines provide firm and interruptible transportation service on an open access basis that is equal for all natural gas supplies. In many instances, the results of Order No. 636 and related initiatives have been to substantially reduce or eliminate the interstate pipelines’ traditional role as wholesalers of natural gas in favor of providing only storage and transportation services.

Similarly, the natural gas pipeline industry may also be subject to state regulations which may change from time to time. During the 2007 legislative session, the Texas State Legislature passed H.B. 3273 (“Competition Bill”) and H.B. 1920 (“LUG Bill”). The Competition Bill gives the Railroad Commission of Texas (“RRC”) the ability to use either a cost-of-service method or a market-based method for setting rates for natural gas gathering and intrastate transportation pipelines in formal rate proceedings. It also gives the RRC specific authority to enforce its statutory duty to prevent discrimination in natural gas gathering and transportation, to enforce the requirement that parties participate in an informal complaint process and to punish purchasers, transporters, and gatherers for taking discriminatory actions against shippers and sellers. The Competition Bill also provides producers with the unilateral option to determine whether or not confidentiality provisions are included in a

3

contract to which a producer is a party for the sale, transportation, or gathering of natural gas. The LUG Bill modifies the informal complaint process at the RRC with procedures unique to lost and unaccounted for gas issues. It extends the types of information that can be requested, provides producers with an annual audit right, and provides the RRC with the authority to make determinations and issue orders in specific situations. Both the Competition Bill and the LUG Bill became effective September 1, 2007.

The Outer Continental Shelf Lands Act (“OCSLA”), which is administered by the MMS and the FERC, requires that all pipelines operating on or across the OCS provide open access, non-discriminatory transportation service. One of the FERC’s principal goals in carrying out OCSLA’s mandate is to increase transparency in the market to provide producers and shippers working in the OCS with greater assurance of open access service on pipelines located on the OCS and non-discriminatory rates and conditions of service on such pipelines. On June 18, 2008, the MMS issued a final rule, effective August 18, 2008, that implements a hotline, alternative dispute resolution procedures, and complaint procedures for resolving claims of having been denied open and nondiscriminatory access to pipelines on the OCS.

In August 2005, Congress enacted the Energy Policy Act of 2005 (“EPAct 2005”). Among other matters, EPAct 2005 amends the NGA to make it unlawful for “any entity,” including otherwise non-jurisdictional producers such as W&T, to use any deceptive or manipulative device or contrivance in connection with the purchase or sale of natural gas or the purchase or sale of transportation services subject to regulation by the FERC, in contravention of rules prescribed by the FERC. The FERC’s rules implementing this provision make it unlawful, in connection with the purchase or sale of natural gas subject to the jurisdiction of the FERC, or the purchase or sale of transportation services subject to the jurisdiction of the FERC, for any entity, directly or indirectly, to use or employ any device, scheme or artifice to defraud; to make any untrue statement of material fact or omit to make any such statement necessary to make the statements made not misleading; or to engage in any act or practice that operates as a fraud or deceit upon any person. EPAct 2005 also gives the FERC authority to impose civil penalties for violations of the NGA up to $1 million per day per violation. The new anti-manipulation rule does not apply to activities that relate only to intrastate or other non-jurisdictional sales or gathering, but does apply to activities of otherwise non-jurisdictional entities to the extent the activities are conducted “in connection with” gas sales, purchases or transportation subject to FERC jurisdiction, which now includes the annual reporting requirements under Order 704. It therefore reflects a significant expansion of the FERC’s enforcement authority. We do not anticipate we will be affected any differently than other producers of natural gas.

In December 2007, the FERC issued rules (“Order 704”) requiring that any market participant, including a producer such as W&T, that engages in wholesale sales or purchases of natural gas that equal or exceed 2.2 million MMBtus during a calendar year must annually report, starting May 1, 2009, such sales and purchases to the FERC. These rules are intended to increase the transparency of the wholesale natural gas markets and to assist the FERC in monitoring such markets and in detecting market manipulation. We do not anticipate that we will be affected any differently than other producers of natural gas.

Additional proposals and proceedings that might affect the natural gas industry are pending before Congress, the FERC, state commissions and the courts. The natural gas industry historically has been very heavily regulated. As a result, there is no assurance that the less stringent regulatory approach recently pursued by the FERC and Congress will continue.

While the changes by these federal and state regulators for the most part affect us only indirectly, they are intended to further enhance competition in natural gas markets. We cannot predict what further action the FERC, MMS or state regulators will take on these matters; however, we do not believe that any such action taken will affect us differently, in any material way, than other natural gas producers with which we compete.

Oil and natural gas liquids transportation rates. Our sales of crude oil, condensate and natural gas liquids are not currently regulated and are transacted at market prices. In a number of instances, however, the ability to

4

transport and sell such products is dependent on pipelines whose rates, terms and conditions of service are subject to FERC jurisdiction under the Interstate Commerce Act. In other instances, the ability to transport and sell such products is dependent on pipelines whose rates, terms and conditions of service are subject to regulation by state regulatory bodies under state statutes.

As it relates to intrastate crude oil, condensate and natural gas liquids pipelines, state regulation is generally less rigorous than the federal regulation of interstate pipelines. State agencies have generally not investigated or challenged existing or proposed rates in the absence of shipper complaints or protests, which are infrequent and are usually resolved informally.

We do not believe that the regulatory decisions or activities relating to interstate or intrastate crude oil, condensate or natural gas liquids pipelines will affect us in a way that materially differs from the way it affects other crude oil, condensate and natural gas liquids producers or marketers.

Regulation of oil and natural gas exploration and production. Our exploration and production operations are subject to various types of regulation at the federal, state and local levels. Such regulations include requiring permits, bonds and pollution liability insurance for the drilling of wells, regulating the location of wells, the method of drilling, casing, operating, plugging and abandoning wells, and governing the surface use and restoration of properties upon which wells are drilled. Many states also have statutes or regulations addressing conservation of oil and gas resources, including provisions for the unitization or pooling of oil and natural gas properties, the establishment of maximum rates of production from oil and natural gas wells and the regulation of spacing of such wells.

Federal leases. Most of our operations are conducted on federal oil and natural gas leases, which are administered by the MMS pursuant to the OCSLA. These leases are awarded based on competitive bidding and contain relatively standardized terms. These leases require compliance with detailed MMS regulations and orders that are subject to interpretation and change by the MMS.

For offshore operations, lessees must obtain MMS approval for exploration, development and production plans prior to the commencement of such operations. These plans must include certain information on the potential environmental impacts of the lessee’s proposed activities, including waste and air emissions projected to be generated by the activities, proposed environmental monitoring activities, and potential impacts on marine mammals and endangered and threatened species. In addition to permits required from other agencies such as the Coast Guard, the Army Corps of Engineers and the Environmental Protection Agency, lessees must obtain a permit from the MMS prior to the commencement of drilling operations. The MMS has promulgated regulations requiring offshore production facilities, structures and producer-operated pipelines located on the OCS to meet stringent engineering, construction and safety specifications. The MMS also restricts the flaring or venting of natural gas and prohibits the flaring of liquid hydrocarbons and oil without prior authorization. Similarly, the MMS has promulgated other regulations governing the plugging and abandonment of wells located offshore and the installation and removal of all production facilities, structures and pipelines.

To cover the various obligations of lessees on the OCS, the MMS generally requires that lessees have substantial net worth or post bonds or other acceptable assurances that such obligations will be satisfied. The cost of these bonds or assurances can be substantial and there is no assurance that they can be obtained in all cases. We are currently exempt from supplemental bonding requirements by the MMS. Under some circumstances, the MMS may require any of our operations on federal leases to be suspended or terminated. Any such suspension or termination could materially adversely affect our financial condition and results of operations.

The MMS also administers the collection of royalties under the terms of the OCSLA and the oil and natural gas leases issued thereunder. The amount of royalties due is based upon the terms of the oil and natural gas leases as well as the regulations promulgated by the MMS. The MMS regulations governing the calculation of royalties and the valuation of crude oil produced from federal leases is determined based on the New York Mercantile Exchange prices adjusted for locality and quality differentials. MMS regulations also govern the treatment of operations carried out under joint operating agreements.

5

Environmental regulations. We are subject to stringent federal, state and local environmental laws. These laws, among other things, govern the issuance of permits to conduct exploration, drilling and producing operations, the amounts and types of materials that may be released into the environment, the discharge and disposal of waste materials, the remediation of contaminated sites and the reclamation and abandonment of wells, sites and facilities. Numerous governmental departments issue rules and regulations to implement and enforce such laws, which are often difficult and costly to comply with and which carry substantial civil and even criminal penalties for failure to comply. Some laws, rules and regulations relating to protection of the environment may, in certain circumstances, impose strict liability for environmental contamination, rendering a person liable for environmental damages and cleanup costs without regard to negligence or fault on the part of such person. Other laws, rules and regulations may restrict the rate of oil and natural gas production below the rate that would otherwise exist or even prohibit exploration and production activities in sensitive areas. In addition, state laws often require various forms of remedial action to prevent pollution, such as closure of inactive pits and plugging of abandoned wells. The regulatory burden on the oil and natural gas industry increases our cost of doing business and consequently affects our profitability. The remediation, reclamation and abandonment of wells, platforms and other facilities are significant costs to us. These costs are considered a normal, recurring cost of our on-going operations. Our domestic competitors are generally subject to the same laws and regulations.

The effects of Hurricanes Ivan, Katrina and Rita during the 2004 and 2005 hurricane seasons, and Hurricanes Ike and Gustav in 2008, significantly impacted oil and gas operations on the OCS. The effects included structural damage to fixed production facilities, semi-submersibles and jack-up drilling rigs. The MMS continues to be concerned about the loss of these facilities and rigs as well as the potential for catastrophic damage to key infrastructure and the resultant pollution from future storms. In an effort to reduce the potential for future damage, the MMS has periodically issued guidance aimed at improving platform survivability by taking into account environmental and oceanic conditions in the design of platforms and related structures. Recommended practices for the use of moored rigs during hurricane season were issued in 2006 in a Notice to Lessees (“NTL”) to ensure that consistent proper site assessments are performed and minimum design return periods are established across the Gulf of Mexico in an effort to decrease the number of moored rig failures during hurricanes. Additional operational enhancements were implemented by the MMS during the 2007 and 2008 hurricane seasons. In 2007, an NTL provided further guidance to insure that the design of new OCS platforms and related structures fully considers specific environmental conditions at the platform location in compliance with the requirements of 30 CFR 250.900(a). An NTL issued in 2008 also provided guidance to insure the fitness of any jack-up drilling rig that may be used to conduct operations during hurricane season. It is possible that similar, if not more stringent, requirements will be issued by the MMS for the 2009 hurricane season. These new requirements could increase our operating costs.

We believe that we are in substantial compliance with current applicable environmental laws and regulations and that continued compliance with existing requirements will not have a material adverse impact on our operations. However, environmental laws and regulations have been subject to frequent changes over the years and the imposition of more stringent requirements could have a material adverse effect upon our capital expenditures, earnings or competitive position, including the suspension or cessation of operations in affected areas. As such, there can be no assurance that material cost and liabilities will not be incurred in the future.

The Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”) imposes liability, without regard to fault, on certain classes of persons that are considered to be responsible for the release of oil or a “hazardous substance” into the environment. These persons include the current or former owner or operator of the disposal site or sites where the release occurred and companies that disposed or arranged for the disposal of hazardous substances. Under CERCLA, such persons are subject to joint and several liability for the cost of investigating and cleaning up hazardous substances that have been released into the environment, for damages to natural resources and for the cost of certain health studies. In addition, companies that incur liability frequently also confront third party claims because it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances or other pollutants released into the environment from a polluted site.

6

The Federal Solid Waste Disposal Act, as amended by the Resource Conservation and Recovery Act of 1976 (“RCRA”), regulates the generation, transportation, storage, treatment and disposal of hazardous wastes and can require cleanup of hazardous waste disposal sites. RCRA currently excludes drilling fluids, produced waters and certain other wastes associated with the exploration, development or production of oil and natural gas from regulation as “hazardous waste.” Disposal of such non-hazardous oil and natural gas exploration, development and production wastes is usually regulated by state law. Other wastes handled at exploration and production sites or generated in the course of providing well services may not fall within this exclusion. Moreover, stricter standards for waste handling and disposal may be imposed on the oil and natural gas industry in the future. From time to time, legislation is proposed in Congress that would revoke or alter the current exclusion of exploration, development and production wastes from the RCRA definition of “hazardous wastes,” thereby potentially subjecting such wastes to more stringent handling, disposal and cleanup requirements. If such legislation were enacted, it could have a significant impact on our operating costs as well as the oil and natural gas industry in general. The impact of future revisions to environmental laws and regulations cannot be predicted.

Our operations are also subject to the Clean Air Act, as amended, (“CAA”) and comparable state and local requirements. We may be required to incur certain capital expenditures in the future for air pollution control equipment in connection with obtaining and maintaining operating permits and approvals for air emissions. However, we believe our operations will not be materially adversely affected by any such requirements and the requirements are not expected to be any more burdensome to us than to other similarly situated companies involved in oil and natural gas exploration and production activities.

Recent scientific studies have suggested that emissions of certain gases, commonly referred to as “greenhouse gases” and including carbon dioxide and methane, may be contributing to warming of the earth’s atmosphere. In response to such studies, the U.S. Congress is considering legislation to reduce emissions of greenhouse gases. President Obama has expressed support for legislation to restrict or regulate emissions of greenhouse gases. In addition, more than one-third of the states, either individually or through multi-state regional initiatives, already have begun implementing legal measures to reduce emissions of greenhouse gases, primarily through the planned development of emission inventories or regional greenhouse gas cap and trade programs. Depending on the particular program, we could be required to purchase and surrender allowances for greenhouse gas emissions resulting from our operations, prepare an inventory of greenhouse gas emissions resulting from our operations, or pay a tax on the greenhouse gas emissions resulting from our operations. These requirements could increase our operational and compliance costs and result in reduced demand for the oil and natural gas we produce.

Also, as a result of the United States Supreme Court’s decision on April 2, 2007 in Massachusetts, et al. v. Environmental Protection Agency (“EPA”), the EPA may regulate greenhouse gas emissions from mobile sources such as cars and trucks even if Congress does not adopt new legislation specifically addressing emissions of greenhouse gases. The Court’s holding in Massachusetts that greenhouse gases including carbon dioxide fall under the federal CAA’s definition of “air pollutant” may also result in future regulation of carbon dioxide and other greenhouse gas emissions from stationary sources. In July 2008, the EPA released an “Advance Notice of Proposed Rulemaking” regarding possible future regulation of greenhouse gas emissions under the CAA, in response to the Supreme Court’s decision in Massachusetts. In the notice, the EPA evaluated the potential regulation of greenhouse gases under the CAA and other potential methods of regulating greenhouse gases. Although the notice did not propose any specific, new regulatory requirements for greenhouse gases, it indicates that federal regulation of greenhouse gas emissions could occur in the near future even if Congress does not adopt new legislation specifically addressing emissions of greenhouse gases. Although it is not possible at this time to predict how legislation or new regulations that may be adopted to address greenhouse gas emissions would impact our business, any such new federal, regional or state restrictions on emissions of carbon dioxide or other greenhouse gases that may be imposed in areas in which we conduct business could result in increased compliance costs or additional operating restrictions, which could have a material adverse effect on our business and the demand for the oil and natural gas we produce.

7

The Federal Water Pollution Control Act of 1972, as amended, (the “Clean Water Act”) imposes restrictions and controls on the discharge of oil, produced waters and other wastes into navigable waters. Permits must be obtained to discharge pollutants into state and federal waters and to conduct construction activities in waters and wetlands. Certain state regulations and the general permits issued under the Federal National Pollutant Discharge Elimination System (“NPDES”) program prohibit the discharge of produced waters and sand, drilling fluids, drill cuttings and certain other substances related to the oil and natural gas industry into certain coastal and offshore waters, unless otherwise authorized. In October 2007, the EPA issued a new general NPDES permit applicable to discharges from oil and gas exploration and production activities in the Western Gulf of Mexico. This revised permit contains a requirement to contain maintenance waste such as removed paint and materials associated with surface preparation and coating applications to “the maximum extent practicable to prevent discharge,” which includes a requirement to contain airborne materials such as spent or oversprayed abrasives, paint chips, and paint overspray. The permit also requires that certain recommended practices for containing waste be implemented prior to conducting sandblasting or similar maintenance activities. Further, the EPA has adopted regulations requiring certain oil and natural gas exploration and production facilities to obtain permits for storm water discharges. Cost may be associated with the treatment of wastewater or developing and implementing storm water pollution prevention plans. The Clean Water Act, the Oil Pollution Act of 1990 (“OPA90”) and comparable state statutes provide for civil, criminal and administrative penalties for unauthorized discharges of oil and other pollutants and impose liability on parties responsible for those discharges for the cost of cleaning up any environmental damage caused by the release and for natural resource damages resulting from the release. We believe that our operations comply in all material respects with the requirements of the Clean Water Act, OPA90, and state statutes enacted to control water pollution.

Underground injection is the subsurface placement of fluid through a well, such as the reinjection of brine produced and separated from oil and natural gas production. The Safe Drinking Water Act of 1974, as amended, established a regulatory framework for underground injection, with the main goal being the protection of usable aquifers. The primary objective of injection well operating requirements is to ensure the mechanical integrity of the injection apparatus in order to prevent migration of fluids from the injection zone into underground sources of drinking water. Hazardous waste injection well operations are strictly controlled and certain wastes, absent an exemption, cannot be injected into underground injection control wells. In Louisiana and Texas, no underground injection may take place except as authorized by permit or rule. We currently own and operate less than five permitted underground injection wells. Failure to abide by our permits could subject us to civil and/or criminal enforcement. We believe that we are in compliance in all material respects with the requirements of applicable state underground injection control programs and our permits.

Executive Order 13158, issued on May 26, 2000, directs federal agencies to safeguard existing Marine Protected Areas (“MPAs”) in the United States and establish new MPAs. The order requires federal agencies to avoid harm to MPAs to the extent permitted by law and to the maximum extent practicable. It also directs the EPA to propose new regulations under the Clean Water Act to ensure appropriate levels of protection for the marine environment. This order has the potential to adversely affect our operations by restricting areas in which we may carry out future development and exploration projects and/or causing us to incur increased operating expenses.

Federal Lease Stipulations address the reduction of potential taking of protected marine species (sea turtles, marine mammals, Gulf sturgeon and other listed marine species). The MMS also issues numerous NTL’s that provide formal guidelines on implementation of OCS regulations and standards. Recent NTL’s prescribing measures to minimize threats to protected marine species with which we must comply include 2007-G02 Implementation of Seismic Survey Mitigation Measures and Protected Species Observer Program, 2007-G03 Marine Trash and Debris Awareness and Elimination, 2007-GO4 Vessel Strike Avoidance and Injured/Dead Protected Species Reporting, and 2004-G06 Structure Removal Operations, among others. MMS conditions permit approvals on collection and removal of debris resulting from activities related to exploration, development and production of offshore leases.

8

Certain flora and fauna that have officially been classified as “threatened” or “endangered” are protected by the Endangered Species Act. This law prohibits any activities that could “take” a protected plant or animal or reduce or degrade its habitat area. If endangered species are located in an area where we wish to conduct seismic surveys, development or abandonment operations, the work could be prohibited or delayed or expensive mitigation might be required.

Our oil and natural gas operations include a production platform in the Gulf of Mexico located in a National Marine Sanctuary. As a result, we are subject to additional federal regulation, including by the National Oceanic and Atmospheric Administration. Unique regulations related to operations in a sanctuary include prohibition of drilling activities within certain protected areas, restrictions on the types of water and other substances that may be discharged, required depths of discharge in connection with drilling and production activities and limitations on mooring of vessels. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, incurrence of investigatory or remedial obligations or the imposition of injunctive relief.

Other statutes that provide protection to animal and plant species and which may apply to our operations include, but are not necessarily limited to, the National Environmental Policy Act, the Coastal Zone Management Act, the Emergency Planning and Community Right-to-Know Act, the Endangered Species Act, the Marine Mammal Protection Act, the Marine Protection, Research and Sanctuaries Act, the Fish and Wildlife Coordination Act, the Magnuson-Stevens Fishery Conservation and Management Act, the Migratory Bird Treaty Act and the National Historic Preservation Act. These laws and regulations may require the acquisition of a permit or other authorization before construction or drilling commences and may limit or prohibit construction, drilling and other activities on certain lands lying within wilderness or wetlands and other protected areas, may require certain mitigation measures to avoid harm to wildlife, and impose substantial liabilities for pollution resulting from our operations. The permits required for our various operations are subject to revocation, modification and renewal by issuing authorities.

Various pieces of equipment and structures we own have been coated with lead-based paints as was customary in the industry at the time these pieces of equipment were fabricated and constructed. These paints may contain lead at a concentration high enough to be considered a regulated hazardous waste when removed. If we need to remove such paints in connection with maintenance or other activities and they qualify as a regulated hazardous waste, the costs of their disposal would increase. High lead levels in the paint might also require us to institute certain administrative and/or engineering controls required by the Occupational Safety and Health Act and MMS to ensure worker safety during paint removal.

Naturally Occurring Radioactive Materials (“NORM”) contaminate minerals, minerals extraction and processing equipment used in the oil and natural gas industry. The resulting NORM waste from such contamination is regulated by federal and state laws. Standards have been developed for worker protection; treatment, storage and disposal of NORM and NORM waste; management of waste piles, containers and tanks; and limitations on the relinquishment of NORM contaminated land for unrestricted use under RCRA and state laws. We do not anticipate any material expenditures in connection with our compliance with RCRA and applicable state law related to NORM waste.

We maintain insurance covering well control, property and hurricane damage, which may cover some, but not all, of the risks described above. Most significantly, the insurance we maintain does not cover the risks described above which occur over a sustained period of time. Further, there can be no assurance that such insurance will continue to be available to cover such risks or that such insurance will be available at a cost that would justify its purchase. The occurrence of a significant environmental event not fully insured or indemnified against could have a material adverse effect on our financial condition and results of operations.

Seasonality

For a discussion of seasonal changes that affect our business, see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Inflation and Seasonality.”

9

Employees

As of December 31, 2008, we employed 299 people. We are not a party to any collective bargaining agreements and we have not experienced any strikes or work stoppages. We consider our relations with our employees to be good.

Additional Information

We file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other items with the Securities and Exchange Commission (“SEC”). Our reports filed with the SEC are available free of charge to the general public through our website at www.wtoffshore.com. These reports are accessible on our website as soon as reasonably practicable after being filed with, or furnished to, the SEC. This Annual Report and our other filings can also be obtained by contacting: Investor Relations, W&T Offshore, Inc., Nine Greenway Plaza, Suite 300, Houston, Texas 77046 or by calling (713) 297-8024. These reports are also available at the SEC Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. The public may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

| Item 1A. | Risk Factors |

In addition to risks and uncertainties in the ordinary course of business that are common to all businesses, important factors that are specific to our industry and our company could materially impact our future performance and results of operations. We have provided below a list of these risk factors that should be reviewed when considering our securities. These are not all the risks we face and other factors currently considered immaterial or unknown to us may impact our future operations.

Risks Relating to the Oil and Natural Gas Industry and Our Business

If oil and natural gas prices decrease, we may be required to write down the carrying values and/or the estimates of total reserves of our oil and natural gas properties.

Accounting rules applicable to us require that we periodically review the carrying value of our oil and natural gas properties for possible impairment. Based on specific market factors and circumstances at the time of prospective impairment reviews and the continuing evaluation of development plans, production data, economics and other factors, we may be required to write down the carrying value of our oil and natural gas properties. A write-down constitutes a non-cash charge to earnings. Primarily as a result of the significant decline in both oil and natural gas prices as of December 31, 2008, we recorded a ceiling test impairment at December 31, 2008 of $1.2 billion ($768.8 million after-tax). The further declines in oil and natural gas prices after December 31, 2008 may require us to record an additional ceiling test impairment in 2009. No assurance can be given that we will not experience a ceiling test impairment in future periods, which could have a material adverse effect on our results of operations in the period taken. As a result of lower oil and natural gas prices, we may also reduce our estimates of the reserves that may be economically recovered, which could reduce the total value of our proved reserves. See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies – Impairment of oil and natural gas properties” and Note 1 to our consolidated financial statements for a discussion of the ceiling test.

A substantial or extended decline in oil and natural gas prices may adversely affect our business, financial condition, cash flow, liquidity or results of operations and our ability to meet our capital expenditure obligations and financial commitments and to implement our business strategy.

The price we receive for our oil and natural gas production directly affects our revenues, profitability, access to capital and future rate of growth. Oil and natural gas are commodities and are subject to wide price

10

fluctuations in response to relatively minor changes in supply and demand. Historically, the markets for oil and natural gas have been volatile and will likely continue to be volatile in the future. The prices we receive for our production and the volume of our production depend on numerous factors beyond our control. These factors include the following:

| • | changes in global supply and demand for oil and natural gas; |

| • | the actions of the Organization of Petroleum Exporting Countries (“OPEC”); |

| • | the price and quantity of imports of foreign oil, natural gas and liquefied natural gas; |

| • | acts of war or terrorism; |

| • | economic conditions; |

| • | political conditions and events, including embargoes, affecting oil-producing activity; |

| • | the level of global oil and natural gas exploration and production activity; |

| • | the level of global oil and natural gas inventories; |

| • | weather conditions; |

| • | technological advances affecting energy consumption; and |

| • | the price and availability of alternative fuels. |

Lower oil and natural gas prices may not only decrease our revenues on a per unit basis but may also reduce the amount of oil and natural gas that we can produce economically. The prices of oil and natural gas declined substantially during the second half of 2008 and have continued to decline thus far in 2009. A continued environment of depressed oil and natural gas prices, or a continued decline in such prices, would materially and adversely affect our future business, financial condition, results of operations, liquidity or ability to finance planned capital expenditures.

We have been and are currently being adversely affected by a recession in the United States and global economy.

The current recessionary economic environment has resulted in lower demand for oil and natural gas and less capital available to fund our growth. Should such conditions continue or worsen, these factors would negatively impact our profitability and/or limit our growth.

Lower oil and natural gas prices could negatively impact our ability to borrow.

Borrowings under the revolving portion of our Third Amended and Restated Credit Agreement, as amended (the “Credit Agreement”), are currently limited to $500.0 million. Availability is determined periodically at the discretion of the lenders and is based in part on oil and natural gas prices and in part on our proved reserves. Substantially all of our oil and gas properties are pledged as collateral under the Credit Agreement. The Credit Agreement limits our ability to incur additional indebtedness based on specified financial covenants, ratios or other criteria. Lower oil and natural gas prices in the future could result in a reduction in availability and also affect our ability to satisfy these covenants, ratios or other criteria and thus could reduce our ability to incur additional indebtedness. Lower oil and natural gas prices, over a sustained period of time and without a corresponding decline in the cost of goods and services necessary to conduct our operations, could affect our ability to replace reserves and thus could reduce our ability to incur additional indebtedness.

Losses and liabilities from uninsured or underinsured drilling and operating activities could have a material adverse effect on our financial condition and operations.

We could be exposed to uninsured losses in the future. The occurrence of a significant accident or other event not covered in whole or in part by our insurance could have a material adverse impact on our financial

11

condition and operations. Our insurance does not protect us against all operational risks. We do not carry business interruption insurance. In addition, pollution and environmental risks generally are not fully insurable. Because third party drilling contractors are used to drill our wells, we may not realize the full benefit of workmen’s compensation laws in dealing with their employees. For some risks, we may not obtain insurance if we believe the cost of available insurance is excessive relative to the risks presented. We are also exposed to the possibility that we will be unable to buy insurance at any price or that if we do have a claim, the insurance companies will not pay our claim.

During the year ended December 31, 2008, we spent approximately $17.7 million to remediate damage related to Hurricanes Ike and Gustav that was either not covered by insurance or has yet to be recovered from our insurance underwriters. During the years ended December 31, 2007 and 2006, we spent approximately $18.5 million and $0.5 million, respectively, to remediate hurricane damage that was not covered by insurance, all of which related to Hurricanes Katrina and Rita in 2005.

Insurance for well control and hurricane damage may become significantly more expensive for more limited coverage and some losses currently covered by insurance may not be covered in the future.

Due to increased loss experience in recent years with hurricanes in the Gulf of Mexico and the current turmoil in the financial markets, property damage and well control insurance coverage has become more limited and the cost of coverage has increased. In June 2008, we renewed our insurance policy covering well control and hurricane damage at a cost of approximately $25.5 million. The current policy limits for well control and hurricane damage are $100 million and $150 million, respectively, with an additional $100 million for well control and hurricane damage on our Ship Shoal 349 field. We also have an insurance policy with a limit of $250 million that provides coverage for removal of wreckage if mandated by any governmental authority as a result of a named windstorm. Our insurers may not continue to offer this type and level of coverage to us, or our costs may increase substantially as a result of increased premiums and the increased risk of uninsured losses that may have been previously insured, all of which could have a material adverse effect on our financial condition and results of operations.

Hedging transactions may limit our potential gains.

In order to manage our exposure to price risks in the marketing of our oil and natural gas, we may periodically enter into oil and gas price hedging arrangements with respect to a portion of our expected production. For example, in January 2006 we entered into commodity swap and option contracts (as required by our credit agreement) relating to approximately 14 Bcfe, or 14%, of our production in 2006, 18 Bcfe, or 14%, of our production in 2007 and 11 Bcfe, or 11%, of our production in 2008 in connection with the anticipated financing related to the acquisition of oil and natural gas properties from Kerr-McGee. While hedging transactions are intended to reduce the effects of volatile oil and natural gas prices, they may also limit our potential gains if oil and natural gas prices were to increase substantially over the price established by the contracts. In addition, such transactions may expose us to the risk of financial loss in certain circumstances, including instances in which:

| • | our production is less than expected; |

| • | there is a widening of price differentials between delivery points for our production and the delivery points assumed in the hedge arrangements; or |

| • | the counterparty to the hedge contracts fails to perform under the terms of the contracts. |

As of December 31, 2008, we did not have any open commodity derivative positions.

12

As of December 31, 2008, approximately 32% of our total proved reserves were undeveloped and approximately 38% of our total proved reserves were developed non-producing. There can be no assurance that all of those reserves will ultimately be developed or produced.

While we have plans or are in the process of developing plans for exploiting and producing a majority of our proved reserves, there can be no assurance that all of those reserves will ultimately be developed or produced. We are not the operator with respect to approximately 18% of our proved undeveloped and approximately 27% of our proved developed non-producing reserves, so we may not be in a position to control the timing of all development activities. Furthermore, there can be no assurance that all of our undeveloped and developed non-producing reserves will ultimately be produced during the time periods we have planned, at the costs we have budgeted, or at all.

Relatively short production periods for our properties subject us to high reserve replacement needs and require significant capital expenditures to replace our reserves at a faster rate than companies whose reserves have longer production periods. Our failure to replace those reserves would result in decreasing reserves, production and cash flows over time.

Unless we conduct successful development, exploitation and exploration activities or acquire properties containing proved reserves, our proved reserves will decline as those reserves are produced. Producing oil and natural gas reserves are generally characterized by declining production rates that vary depending upon reservoir characteristics and other factors. High production rates generally result in recovery of a relatively higher percentage of reserves during the initial few years of production. The vast majority of our current operations are in the Gulf of Mexico. Production from reservoirs in the Gulf of Mexico generally declines more rapidly than from reservoirs in many other producing regions of the United States. Our independent petroleum consultant estimates that, on average, 52% of our total proved reserves are depleted within three years. As a result, our need to replace reserves from new investments is relatively greater than that of producers who recover lower percentages of their reserves over a similar time period, such as those producers who have a portion of their reserves outside the Gulf of Mexico area. We may not be able to develop, exploit, find or acquire additional reserves to sustain our current production levels or to grow production at the same rates as we have in the past. In addition, due to the significant time requirements involved with exploration and development activities, particularly for wells in the deepwater or wells not located near existing infrastructure, actual oil and natural gas production from new wells may not occur, if at all, for a considerable period of time following the commencement of any particular project.

Significant capital expenditures are required to replace our reserves.

Our exploration, development and acquisition activities require substantial capital expenditures. Historically, we have funded our capital expenditures and acquisitions through a combination of cash flow from operations, bank financing and securities offerings. In order to finance future capital expenditures, we may need to alter or increase our capitalization substantially through the issuance of additional debt or equity securities, the sale of production payments or other means. These changes in capitalization may significantly affect our financial risk profile.

Future cash flows are subject to a number of variables, such as the level of production from existing wells, the prices of oil and natural gas, and our success in developing and producing new reserves. We anticipate fully funding our 2009 capital expenditures with internally generated cash flow and cash on hand. Our capital expenditure budget does not include any amounts for potential acquisitions. Planned reductions in our capital expenditures to stay within internally generated cash flow (which have been adversely affected by declining commodity prices) and cash on hand will make replacing produced reserves more difficult. If our cash flow from operations and cash on hand are not sufficient to fund our capital expenditure budget, we may not be able to access additional debt, equity or other methods of financing on an economic or timely basis to meet our requirements.

13

If we are not able to replace reserves, we may not be able to sustain production.

Our future success depends largely upon our ability to find, develop or acquire additional oil and natural gas reserves that are economically recoverable. Unless we replace the reserves we produce through successful development, exploration or acquisition activities, our proved reserves and production will decline over time. By their nature, estimates of undeveloped reserves are less certain. Recovery of undeveloped reserves could require significant capital expenditures and successful drilling operations. Our future oil and natural gas reserves, production and, therefore our cash flow and net income, are highly dependent on our success in efficiently developing and exploiting our current reserves and economically finding or acquiring additional recoverable reserves.

Competition for oil and natural gas properties and prospects is intense; some of our competitors have larger financial, technical and personnel resources that may give them an advantage in evaluating and obtaining properties and prospects.

We operate in a highly competitive environment for reviewing prospects, acquiring properties, marketing oil and natural gas and securing trained personnel. Many of our competitors have financial resources that allow them to obtain substantially greater technical expertise and personnel than we have. We actively compete with other companies in our industry when acquiring new leases or oil and natural gas properties. For example, new leases acquired from the MMS are acquired through a “sealed bid” process and are generally awarded to the highest bidder. Our competitors may be able to evaluate, bid for and purchase a greater number of properties and prospects than our financial or personnel resources permit. Our competitors may also be able to pay more for productive oil and natural gas properties and exploratory prospects than we are able or willing to pay. On the acquisition opportunities made available to us, we compete with other companies in our industry for such properties through a private bidding process, direct negotiations or some combination thereof. Our ability to acquire additional prospects and to find and develop reserves in the future will depend on our ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment. If we are unable to compete successfully in these areas in the future, our future revenues and growth may be diminished or restricted. The availability of properties for acquisition depends largely on the divesting practices of other oil and natural gas companies, commodity prices, general economic conditions and other factors we cannot control or influence.

We conduct exploration, exploitation and production operations on the deep shelf and in the deepwater of the Gulf of Mexico, which presents unique operating risks.

The deep shelf and the deepwater of the Gulf of Mexico are areas that have had limited drilling activity due, in part, to their geological complexity, depth and higher cost to drill and ultimately develop. There are additional risks associated with deep shelf and deepwater drilling that could result in substantial cost overruns and/or result in uneconomic projects or wells. Deeper targets are more difficult to detect with traditional seismic processing. Moreover, drilling costs and the risk of mechanical failure are significantly higher because of the additional depth and adverse conditions, such as high temperature and pressure. For example, the drilling of deepwater wells requires specific types of rigs with significantly higher day rates and limited availability, as compared to the rigs used in shallower water. Deepwater wells have greater mechanical risks because the wellhead equipment is installed on the sea floor. Deepwater development costs can be significantly higher than development costs for wells drilled on the conventional shelf because deepwater drilling requires larger installation equipment, sophisticated sea floor production handling equipment, expensive, state-of-the-art platforms and/or investment in infrastructure. Deep shelf development can also be more expensive than conventional shelf projects because deep shelf development requires more drilling days and higher drilling and service costs due to extreme pressure and temperatures associated with greater depths. Accordingly, we cannot assure you that our oil and natural gas exploration activities in the deep shelf, the deepwater and elsewhere will be commercially successful.

14

Our estimates of future asset retirement obligations may vary significantly from period to period and are especially significant since our operations are almost exclusively in the Gulf of Mexico.

We are required to record a liability for the discounted present value of our asset retirement obligations to remove our platforms, facilities and equipment and restore the land or seabed at the end of oil and natural gas production operations. These obligations are primarily associated with plugging and abandoning wells, removing pipelines, removing and disposing of offshore platforms and site clean up. These costs are typically considerably more expensive for offshore operations as compared to most land based operations due to increased regulatory scrutiny and the logistical issues associated with working in waters of various depths. Estimating future restoration and removal costs in the Gulf of Mexico is especially difficult because most of the removal obligations are many years in the future, regulatory requirements may change and asset removal technologies and costs are constantly changing. In 2007 and 2008, we increased our estimates of future asset retirement obligations as a result of our evaluation of increased costs incurred for plugging and abandonment activities in the Gulf of Mexico. We may continue to make significant increases to our asset retirement obligations in future years.

Because we operate in the Gulf of Mexico, platforms, facilities and equipment are subject to damage or destruction as a result of hurricanes. The estimated cost to plug and abandon a well or dismantle a platform can change dramatically if the host platform from which the work was anticipated to be performed is damaged or toppled. Accordingly, our estimate of future asset retirement obligations could differ dramatically from what we may ultimately incur as a result of damage from a hurricane.

We may not be in a position to control the timing of development efforts, associated costs or the rate of production of the reserves from our non-operated properties.

As we carry out our drilling program, we will not serve as operator of all planned wells. We have limited ability to exercise influence over the operations of some non-operated properties and their associated costs. Our dependence on the operator and other working interest owners and our limited ability to influence operations and associated costs of properties operated by others could prevent the realization of our targeted returns on capital in drilling or acquisition activities. The success and timing of development and exploitation activities on properties operated by others depend upon a number of factors that will be largely outside of our control, including:

| • | the timing and amount of capital expenditures; |

| • | the availability of suitable offshore drilling rigs, drilling equipment, support vessels, production and transportation infrastructure and qualified operating personnel; |

| • | the operator’s expertise and financial resources; |

| • | approval of other participants in drilling wells; |

| • | selection of technology; and |

| • | the rate of production of the reserves. |

Our business involves many uncertainties and operating risks that can prevent us from realizing profits and can cause substantial losses.

Our development activities may be unsuccessful for many reasons, including adverse weather conditions (such as hurricanes and tropical storms in the Gulf of Mexico), cost overruns, equipment shortages and mechanical difficulties. Moreover, the successful drilling of a natural gas or oil well does not assure we will realize a profit on our investment. A variety of factors, both geological and market-related, can cause a well to become uneconomical or only marginally economical. In addition to their costs, unsuccessful wells hinder our efforts to replace reserves.

15

Our business involves a variety of operating risks, including:

| • | fires; |

| • | explosions; |

| • | blow-outs and surface cratering; |

| • | uncontrollable flows of natural gas, oil and formation water; |

| • | natural disasters, such as tropical storms, hurricanes and other adverse weather conditions; |

| • | inability to obtain insurance at reasonable rates; |

| • | failure to receive payment on insurance claims in a timely manner, or for the full amount claimed; |

| • | pipe, cement, subsea well or pipeline failures; |

| • | casing collapses; |

| • | mechanical difficulties, such as lost or stuck oil field drilling and service tools; |

| • | abnormally pressured formations or rock compaction; and |

| • | environmental hazards, such as natural gas leaks, oil spills, pipeline ruptures and discharges of toxic gases. |

If we experience any of these problems, well bores, platforms, gathering systems and processing facilities could be affected, which could adversely affect our ability to conduct operations. We could also incur substantial losses as a result of:

| • | injury or loss of life; |

| • | damage to and destruction of property, natural resources and equipment; |

| • | pollution and other environmental damage; |

| • | clean-up responsibilities; |

| • | regulatory investigation and penalties; |

| • | suspension of our operations; and |

| • | repairs required to resume operations. |

Offshore operations are also subject to a variety of operating risks related to the marine environment, such as capsizing, collisions and damage or loss from tropical storms, hurricanes or other adverse weather conditions. These conditions can cause substantial damage to facilities and interrupt production. As a result, we could incur substantial liabilities that could reduce or eliminate funds available for exploration, exploitation and acquisitions or result in the loss of property and equipment.

The geographic concentration of our properties in the Gulf of Mexico subjects us to an increased risk of loss of revenues or curtailment of production from factors affecting the Gulf of Mexico specifically.

The geographic concentration of our properties along the Texas and Louisiana Gulf Coast and adjacent waters on and beyond the outer continental shelf means that some or all of our properties could be affected by the same event should the Gulf of Mexico experience:

| • | severe weather, including tropical storms and hurricanes; |

| • | delays or decreases in production, the availability of equipment, facilities or services; |

| • | delays or decreases in the availability of capacity to transport, gather or process production; or |

| • | changes in the regulatory environment. |

16

Because all our properties could experience the same condition at the same time, these conditions could have a relatively greater impact on our results of operations than they might have on other operators who have properties over a wider geographic area. In 2008, net production of approximately 21.7 Bcfe was deferred as a result of damage caused by Hurricane Ike and, to a lesser extent, by Hurricane Gustav. In 2006, our net production was deferred by approximately 7.8 Bcfe because of the carryover effect of Hurricanes Katrina and Rita that occurred in 2005.

Properties that we purchase may not produce as projected and we may be unable to immediately identify liabilities associated with these properties or obtain protection from sellers against them.

Our business strategy includes a continuing acquisition program. Our recent growth is due in part to acquisitions of exploration and production companies, producing properties and undeveloped leasehold interests. Our acquisition of oil and natural gas properties requires assessments of many factors that are inherently inexact and may be inaccurate, including the following:

| • | acceptable prices for available properties; |

| • | amounts of recoverable reserves; |

| • | estimates of future oil and natural gas prices; |

| • | estimates of future exploratory, development and operating costs; |

| • | estimates of the costs and timing of plugging and abandonment; and |

| • | estimates of potential environmental and other liabilities. |

Our assessment of the acquired properties will not reveal all existing or potential problems nor will it permit us to become familiar enough with the properties to fully assess their capabilities and deficiencies. In the course of our due diligence, we have not historically inspected every well, platform or pipeline. Even if we had inspected each of these, our inspections may not have revealed structural and environmental problems, such as pipeline corrosion or groundwater contamination. We may not be able to obtain contractual indemnities from the seller for liabilities associated with such risks. We may be required to assume the risk of the physical condition of the properties in addition to the risk that the properties may not perform in accordance with our expectations.

We may encounter difficulties integrating the operations of newly acquired oil and natural gas properties or businesses.