UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

Chairman of the Board, May 1, 2023 Dear Shareholder: It is my pleasure to invite you to the 2023 Annual Meeting of Shareholders of W&T Offshore, Inc. scheduled to be held on June 14, 2023, at 8:00 a.m., Central Daylight Time. The Annual Meeting will be virtual, conducted exclusively via live webcast at www.virtualshareholdermeeting.com/WTI2023. We believe that using a virtual format for the Annual Meeting provides easier and greater access to the Annual Meeting, which enables participation by the broadest number of shareholders, as well as positive environmental impacts. I hope you will attend the virtual meeting. Details of the business to be conducted at the Annual Meeting are provided in the attached Notice of Annual Meeting and Proxy Statement. Our Board of Directors has determined that owners of record of our Common Stock at the close of business on April 20, 2023, are entitled to notice of, and have the right to vote at, the Annual Meeting and any reconvened meeting following any adjournment, postponement or relocation of the meeting. We have elected to furnish proxy materials to our shareholders on the Internet pursuant to rules adopted by the Securities and Exchange Commission. We believe these rules enable us to provide you with the information you need, while making delivery more efficient, more cost effective and friendlier to the environment. In accordance with these rules, beginning on or about May 1, 2023, we sent a Notice of Internet Availability of Proxy Materials to our shareholders. Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. Therefore, I urge you to promptly vote using the Internet or telephone voting procedures described on the Notice of Internet Availability of Proxy Materials or vote and submit your proxy by signing, dating and returning the enclosed proxy card in the enclosed envelope (if you have requested a paper copy of the proxy materials). If you decide to attend the Annual Meeting, you will be able to vote at the Annual Meeting, even if you have previously submitted your proxy. On behalf of the Board of Directors and our employees, I would like to express my appreciation for your continued interest in our affairs. Sincerely, |

|

| |

W&T Offshore, Inc. 5718 Westheimer Road | |||

|

Tracy W. Krohn | ||

Notice of 2023

Annual Meeting of Shareholders

Meeting Information

| Meeting Date and Time June 14, 2023, at 8:00 a.m., Central Daylight Time |

|

| Virtual Shareholders’ Meeting Notice is hereby given that the 2023 Annual Meeting of Shareholders of W&T Offshore, Inc., a Texas corporation, will be held virtually at www.virtualshareholdermeeting.com/WTI2023 |

Meeting Agenda

Proposal | Description | Board |

1 | to elect five directors to hold office until the 2024 Annual Meeting of Shareholders and until their successors are duly elected and qualified; | FOR each nominee |

2 | to approve, on an advisory basis, the frequency of future advisory votes on compensation of the Company’s named executive officers, pursuant to Item 402 of Regulation S-K; | 1 YEAR |

3 | to approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the accompanying Proxy Statement pursuant to Item 402 of Regulation S-K; | FOR |

4 | to ratify the appointment of Ernst & Young LLP as our independent registered public accountants for the year ending December 31, 2023; | FOR |

5 | to amend our Articles of Incorporation to increase our authorized share capital; | FOR |

6 | to amend our Articles of Incorporation to eliminate supermajority voting requirements; | FOR |

7 | to amend our Articles of Incorporation to provide shareholders the ability to amend our Bylaws; | FOR |

8 | to amend our Articles of Incorporation to lower the ownership threshold required for shareholders to call a special shareholder meeting; | FOR |

9 | to amend our Articles of Incorporation to provide shareholders the ability to act via written consent; | FOR |

10 | to approve the W&T Offshore, Inc. 2023 Incentive Compensation Plan; and | FOR |

11 | to transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

Only shareholders of record at the close of business on April 20, 2023, will be entitled to notice of, and to vote at, the Annual Meeting, or any adjournment or postponement thereof, notwithstanding the transfer of any shares after such date. A list of these shareholders will be open for examination by any shareholder for ten days prior to

the Annual Meeting. If you would like to inspect the list of Company shareholders of record, please contact the Investor Relations department at investorrelations@wtoffshore.com to schedule an appointment or request access. For purposes of attendance at the Annual Meeting, all references in this notice and the accompanying proxy statement to “attend,” “present in person” or “in person” shall refer to a shareholder’s virtual presence at the Annual Meeting.

Voting

Pursuant to rules adopted by the Securities and Exchange Commission, we have elected to provide access to our proxy solicitation materials primarily via the Internet, rather than mailing paper copies of these materials to each shareholder. On or about May 1, 2023, we will mail to each shareholder a Notice of Internet Availability of Proxy Materials with instructions on how to access the proxy materials, vote or request paper copies. Your vote is important.

| Vote by Internet You may submit a proxy electronically via the Internet, using the website listed on the Notice of Availability. Please have your Notice of Availability, which includes your personal control number, in hand when you log onto the website. Internet voting facilities will close and no longer be available on the date and time specified on the Notice of Availability. |

| Vote by Telephone If you request paper copies of the proxy materials by mail, you may submit a proxy by telephone using the toll-free number listed on the proxy card. Please have your proxy card in hand when you call. Telephone voting facilities will close and no longer be available on the date and time specified on the proxy card. |

| Vote by Mail If you request paper copies of the proxy materials by mail, you may submit a proxy by signing, dating and returning your proxy card in the pre-addressed envelope provided. If mailed, your completed and signed proxy card must be received by June 13, 2023. |

| Vote in Person You may vote in person at the virtual Annual Meeting by completing a ballot as directed during the virtual Annual Meeting; however, attending the meeting without completing a ballot will not count as a vote. |

We urge you to review the accompanying Proxy Statement carefully and to submit your proxy as soon as possible so that your shares will be represented at the meeting.

By Order of the Board of Directors, | |

Jonathan C. Curth | |

Jonathan C. Curth | |

Executive Vice President, General Counsel and Corporate Secretary |

Houston, Texas

May 1, 2023

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDERS

MEETING TO BE HELD ON JUNE 14, 2023

This Notice of Annual Meeting and Proxy Statement and our Annual Report to Shareholders are available at www.proxyvote.com.

Table of Contents

| 1 | |

1 | ||

1 | ||

2 | ||

4 | ||

5 | ||

6 | ||

7 | ||

8 | ||

9 | ||

9 | ||

10 | ||

12 | ||

13 | ||

13 | ||

14 | ||

14 | ||

15 | ||

19 | ||

20 | ||

20 | ||

20 | ||

21 | ||

22 | ||

22 | ||

22 | ||

23 | ||

23 | ||

PROPOSAL 4 Ratification of Appointment of Independent Accountants | 24 | |

24 | ||

24 |

25 | ||

25 | ||

25 | ||

26 | ||

26 | ||

26 | ||

PROPOSAL 6 Amendment to the Articles of Incorporation to Eliminate Supermajority Voting Requirements | 27 | |

27 | ||

27 | ||

Purpose and Effect of the Sixty-Six and Two-Thirds Percent Voting Amendment | 28 | |

28 | ||

28 | ||

29 | ||

29 | ||

29 | ||

29 | ||

30 | ||

30 | ||

31 | ||

31 | ||

31 | ||

31 | ||

32 | ||

32 |

33 | ||

33 | ||

33 | ||

33 | ||

34 | ||

34 | ||

PROPOSAL 10 The W&T Offshore, Inc. 2023 Incentive Compensation Plan Proposal | 35 | |

35 | ||

35 | ||

35 | ||

36 | ||

37 | ||

43 | ||

43 | ||

Securities Authorized for Issuance under Equity Compensation Plans | 44 | |

44 | ||

45 | ||

Corporate Governance Guidelines; Code of Business Conduct and Ethics | 45 | |

45 | ||

45 | ||

46 | ||

49 | ||

50 | ||

50 | ||

51 | ||

51 | ||

51 | ||

52 | ||

53 | ||

53 | ||

54 | ||

55 |

W&T Offshore, Inc. | NYSE: WTI | iii |

Proxy

Summary

This summary highlights information contained elsewhere in this proxy statement and in our other public filings. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

About Us

Founded in 1983, W&T Offshore, Inc. (“W&T” or the “Company”) is an independent oil and natural gas producer, active in the exploration, development and acquisition of oil and natural gas properties in the Gulf of Mexico. As of December 31, 2022, the Company holds working interests in 47 offshore producing fields in federal and state waters (45 fields producing and 2 fields capable of producing, which include 39 fields in federal waters and 8 in state waters). The Company currently has under lease approximately 625,000 gross acres (457,000 net acres) spanning across the outer continental shelf off the coasts of Louisiana, Texas, Mississippi and Alabama, with approximately 8,000 gross acres in Alabama State waters, 458,000 gross acres on the conventional shelf and approximately 159,000 gross acres in the deepwater. A majority of the Company’s daily production is derived from wells it operates.

Business Highlights

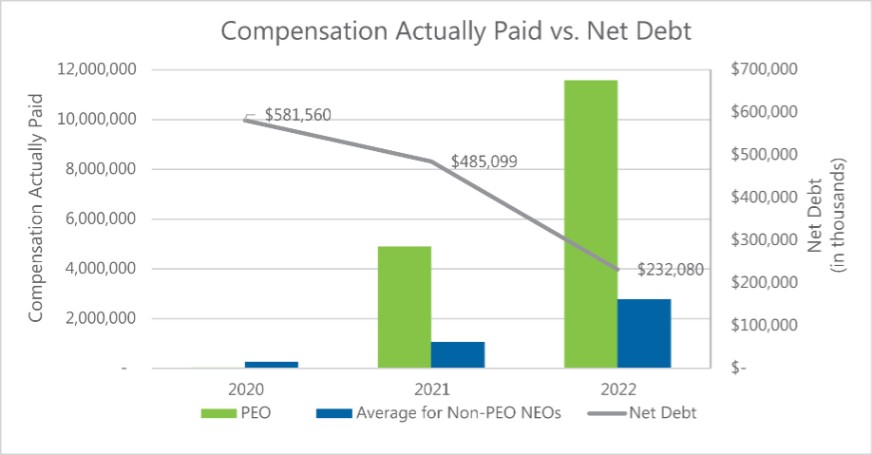

In 2022, we completed one of the most successful years in our long history. We continued to execute on the strategy that has guided our success for the past four decades, which is focused on maximizing cash flow generation, operating efficiently, improving the profitability of our assets, and opportunistically capitalizing on accretive acquisition opportunities. Some material highlights from 2022 are:

40.1 MBoe/d (49% liquids) |

| 47 |

| $563.7 MM |

| $376.4 MM |

| $253.0 MM | ||||||||||

|

|

| ||||||||||||||||

Production | Total Fields | Adjusted EBITDA(1) | Free Cash Flow(1) | Net Debt Reduction(1) | ||||||||||||||

| (1) | Please see Annex C to this proxy statement for definitions of, and additional information about, the non-GAAP financial measures listed on this page. |

Results of Shareholder Outreach Program: Changes for 2023

Compensation Changes

Based on numerous meetings we held with shareholders in 2022, last year we changed our compensation program to reflect their highest concerns. First, we adopted a three-year performance period in our long-term incentive plan. With the consent of Mr. Krohn, we eliminated tax gross-up payments provided for in his employment agreement. Further, we followed our shareholders’ advice and described the metrics of our bonus plans with greater particularly in our 2022 proxy statement. This year, we engaged with shareholders again, and we are making substantial changes to our compensation programs based on additional feedback from our shareholders, intended to better align practices with our peer group and confirm our commitment to pay and performance alignment over the long-term.

| ||||

|

| |||

These changes include: | ||||

|

| |||

For more detail on shareholder communications and Company responses to certain compensation issues raised in resultant discussions, please see “—Shareholder Votes on Executive Compensation and Company Responses” and

“—Compensation Changes for 2023” in the Compensation Discussion and Analysis Section of this proxy statement.

Shareholder Rights and Governance Changes

We have also proposed substantial changes to our shareholder rights and governance practices based on feedback from our shareholders. The changes enacted by the Board include the establishment of an ESG Committee, which will assist in setting the Company’s general strategy relating to ESG matters and in developing, implementing, and monitoring initiatives and policies based on that strategy, and the increase of the size and diversity of the board to five members to add Nancy Chang, the new chair of the ESG Committee.

| ||||

|

| |||

The Board has also proposed for shareholder approval the following changes to the Company’s Articles of Incorporation: | ||||

|

| |||

Mr. Tracy W. Krohn, our Chairman of the Board, Chief Executive Officer and President, and who is our largest shareholder, controlling approximately 32.9% of the voting power entitled to vote at the Annual Meeting as of April 20, 2023, intends to vote “FOR” these changes.

W&T Offshore, Inc. | NYSE: WTI | 3 |

ESG Highlights

We also continued our ESG journey in 2022, affirming our commitment to environmental stewardship, sound corporate governance, and contributing positively to our employees and the communities where we work and operate. These values have been cornerstones of our culture since we founded the Company nearly 40 years ago.

ENVIRONMENT ● Committed to protecting and preserving the environment ● Formed a new ESG Committee of the Board to assist in development of ESG strategies and initiatives ● Added additional environmental policies and trainings to existing robust program ● Focused on implementing best practices and strategies to help reduce emissions o Spill Ratio: W&T’s ratio in 2022 was 0.057 compared to 1.83 GOM average in 2021 |

|

|

SOCIAL ● Strengthened ties with our people, investors, business partners and local communities ● Focused on safety, open communication, and trust to continue building a strong culture ● Continued to develop our workforce through professional and safety trainings ● 62.5% of our executive officers and board members are women or minorities ● Required diversity training throughout organization |

| |

GOVERNANCE ● Strong Board oversight responsible for strategy, governance and creating long-term value ● Expanded background and experience of the Board of Directors with new addition, Dr. Nancy Chang ● Incentivized ESG performance, with a portion of employee and executive compensation tied to ESG performance metrics ● Focused on being a responsible corporate citizen with policies and procedures creating highest legal and ethical standards ● Continued commitment to shareholder outreach to solicit feedback and respond to shareholder concerns |

|

4 | 2023 Proxy Statement |

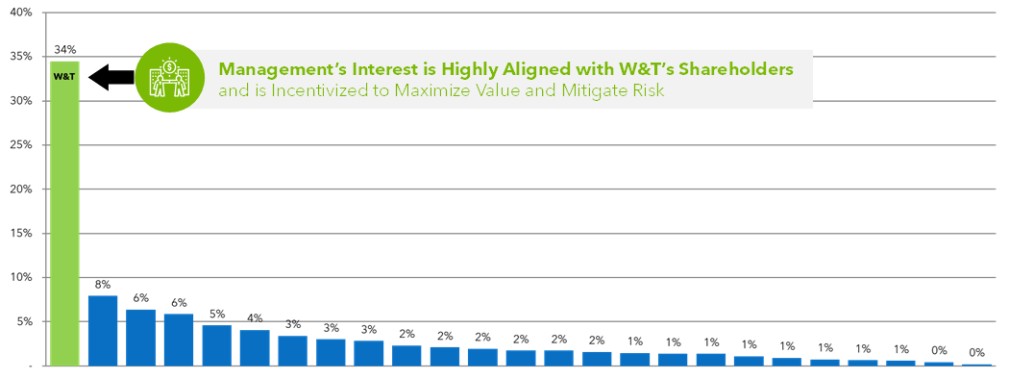

Insider Ownership

Our insider ownership is, and has consistently been, one of the highest among our peers. We believe this ownership helps align the interests of our executive management team and Board of Directors with those of our shareholders.

W&T Offshore, Inc. | NYSE: WTI | 5 |

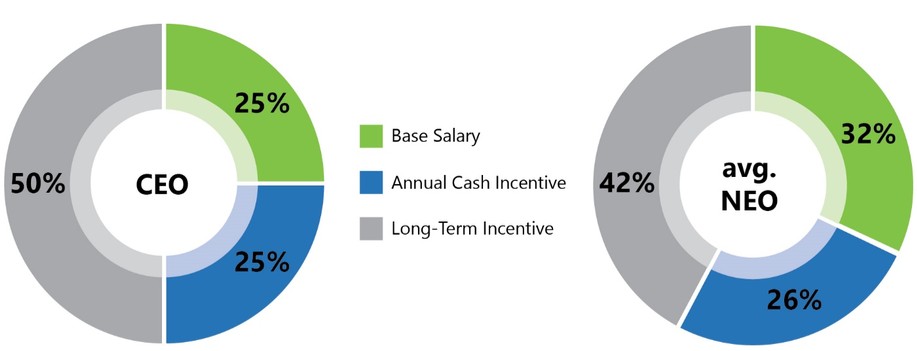

2022 Executive Compensation Highlights

The primary objectives of our compensation program are to attract, as needed, and retain the best possible executive talent, to stimulate management’s efforts on our behalf in a way that supports our financial performance objectives and business strategy, and to align their incentives with enhancement of long-term shareholder value.

Compensation Component | Purpose |

Base Salary | Base salary is primarily designed to reward current and past performance and may be adjusted from time to time to realign salaries with market levels. |

Annual Cash Incentive Compensation | Annual cash incentive awards are granted to incentivize our Named Executive Officers largely to assist us in achieving our annual performance goals, as well as, to a lesser degree, to achieve their individual performance goals. |

Long-Term Incentive Compensation | The long-term incentive award is designed with two main goals in mind: ● to align the interests of Named Executive Officers and shareholders by creating a mechanism through which the executives are reasonably likely to build a substantial equity oriented financial interest in the Company; and ● retention. |

Our Executives’ 2022 target Pay Mix

6 | 2023 Proxy Statement |

Governance Highlights

| Shareholder Rights |

|

| board practices | ||

|

| |||||

BOARD NOMINEES OVERVIEW

Director Name | Notable Experiences | Key Skills | Independent | Committee |

Tracy W. Krohn | Founder, Chief Executive Officer and President of the Company and Chairman of the Board of Directors | Executive Leadership Industry Experience M&A and Strategic Planning | None. | |

Virginia Boulet | Adjunct Professor at Loyola Law School Managing Director of Legacy Capital, LLC Partner at Phelps Dunbar, LLP | Other Board Experience Executive Leadership Human Resources |

| Nominating & Corporate Governance (Chair), Compensation and ESG |

Nancy Chang 73 | Chief Executive Officer of Ansun Biopharma, Inc. Chairman and Founder of Apex Capital Co-Founder, President, Chief Executive Officer and Chairman of Tanox, Inc. | Environmental/Sustainability Experience Executive Leadership Cyber-security |

| ESG (Chair), Audit and Nominating and Corporate Governance |

Daniel O. Conwill IV | Owner and Operator of Felix’s Restaurant Group Co-Chief Executive Officer and Head of Investment Banking at Seaport Global Securities Executive Vice President and Co-Director of Corporate Finance at Jefferies & Company, Inc. | Financial Oversight and Accounting Executive Leadership M&A and Strategic Planning |

| Compensation (Chair), Audit and ESG |

B. Frank Stanley | Co-Chief Executive Officer and Chief Financial Officer of Retail Concepts, Inc. Chief Financial Officer of Southpoint Porsche Audi WGW Ltd. Chief Financial Officer of Design Research, Inc. | Financial Oversight and Accounting Industry Experience Executive Leadership |

| Audit (Chair), Compensation, ESG and Nominating & Corporate Governance |

W&T Offshore, Inc. | NYSE: WTI | 7 |

Cautionary Note Regarding Forward-Looking Statements

This proxy statement includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding our ESG goals, commitments, and strategies and other ESG related information. When used in this proxy statement, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “forecast,” “may,” “objective,” “plan,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These statements involve risks and uncertainties. Actual results could differ materially from any future results expressed or implied by the forward-looking statements for a variety of reasons, including due to the risks and uncertainties that are discussed in our most recently filed Annual Report on Form 10-K and other filings we make with the SEC. We assume no obligation to update any forward-looking statements or information, which speak as of their respective dates.

8 | 2023 Proxy Statement |

The Annual

Meeting

This proxy statement is solicited by and on behalf of the Board of Directors (the “Board” or the “Board of Directors”) of W&T Offshore, Inc. (the “Company”) for use at the 2023 Annual Meeting of Shareholders (the “Annual Meeting”) scheduled to be held on June 14, 2023, virtually at www.virtualshareholdermeeting.com/WTI2023 at 8:00 a.m., Central Daylight Time, or at any adjournments, postponements or relocations thereof. Unless the context requires otherwise, references in this proxy statement to “we,” “us,” “our” and the “Company” refer to W&T Offshore, Inc. The solicitation of proxies by the Board will be conducted primarily electronically, or by mail for those shareholders requesting paper copies of proxy materials. Officers, directors and employees of the Company may also solicit proxies personally or by telephone, e-mail or other forms of wire or facsimile communication. These officers, directors and employees will not receive any extra compensation for these services. The Company will reimburse brokers, custodians, nominees and fiduciaries for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of common stock of the Company (the “Common Stock”). The costs of the solicitation will be borne by the Company. The Company has retained Georgeson Inc. (“Georgeson”) to assist in the solicitation of proxies. On or after May 1, 2023, we will begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice of Availability”) containing instructions on how to access the proxy materials and vote online. We will make these proxy materials available to you over the Internet or, upon your request, will deliver paper copies of these materials to you by mail, in connection with the solicitation of proxies by the Board for the Annual Meeting.

The Annual Meeting will be virtual, conducted exclusively via live webcast at www.virtualshareholdermeeting.com/WTI2023. We believe that using a virtual format for the Annual Meeting provides easier and greater access to the Annual Meeting, which enables participation by the broadest number of shareholders, as well as positive environmental impacts. You will not be able to attend the Annual Meeting physically in person.

Purposes of the 2023 Annual Meeting

The purposes of the Annual Meeting are to: (1) elect five directors to hold office until the 2024 Annual Meeting of Shareholders and until their successors are duly elected and qualified; (2) to approve, on an advisory basis, the frequency of future advisory votes on compensation of the Company’s named executive officers, pursuant to Item 402 of Regulation S-K; (3) approve, on an advisory basis, the compensation of the Company’s named executive officers, pursuant to Item 402 of Regulation S-K; (4) ratify the appointment of Ernst & Young LLP as our independent registered public accountants for the year ending December 31, 2023; (5) amend the Company’s amended and restated articles of incorporation (the “Articles of Incorporation”) to increase the Company’s authorized share capital; (6) amend the Articles of Incorporation to eliminate supermajority voting requirements; (7) amend the Articles of Incorporation to provide shareholders the ability to amend the Company’s Bylaws; (8) amend the Articles of Incorporation to lower the ownership threshold required for shareholders to call a special shareholder meeting; (9) amend the Articles of Incorporation to provide shareholders the ability to act via written consent; (10) approve the W&T Offshore, Inc. 2023 Incentive Compensation Plan; and (11) transact such

other business as may properly come before the meeting and any adjournment, postponement or relocation thereof. Although the Board does not anticipate that any other matters will come before the Annual Meeting, your executed proxy gives the official proxies the right to vote your shares at their discretion on any other matter properly brought before the Annual Meeting.

Voting Rights and Solicitation

Only shareholders of record at the close of business on April 20, 2023 (the “Record Date”) will be entitled to notice of and to vote at the Annual Meeting. As of the Record Date, there were 146,460,902 shares of Common Stock outstanding, each of which is entitled to one vote on any matter to come before the meeting. Common Stock is the only class of outstanding equity securities of the Company. The holders of issued and outstanding shares of Common Stock representing at least a majority of the outstanding shares of Common Stock, present in person or represented by proxy at the Annual Meeting, will constitute a quorum necessary to hold a valid meeting. The person who is appointed by the chairman of the meeting to be the inspector of election will treat the holders of all shares of Common Stock represented by a returned, properly executed proxy, including shares that abstain from voting, as present for purposes of determining the existence of a quorum at the Annual Meeting. Each share of common stock present or represented at the Annual Meeting will be entitled to one vote on any matter to come before the shareholders. If you hold your shares in “street name,” you will receive instructions from your broker or other nominee describing how to vote your shares. If you do not instruct your broker or nominee how to vote your shares, they may vote your shares as they decide as to each matter for which they have discretionary authority under the rules of the New York Stock Exchange (“NYSE”). For Proposal 4 (Ratification of the Appointment of Independent Accountants) to be voted on at the Annual Meeting, brokers and other nominees will have discretionary authority in the absence of timely instructions from you.

There are also non-discretionary matters for which brokers and other nominees do not have discretionary authority to vote unless they receive timely instructions from you. For Proposal 1 (Election of Directors), Proposal 2 (Frequency of Future Advisory Votes to Approve the Compensation of Named Executive Officers), Proposal 3 (Advisory Vote on Executive Compensation), Proposal 5 (Amendment to the Articles of Incorporation to Increase the Company’s Authorized Share Capital), Proposal 6 (Amendment to the Articles of Incorporation to Eliminate Supermajority Voting Requirements), Proposal 7 (Amendment to the Articles of Incorporation to Provide Shareholders the Ability to Amend the Bylaws), Proposal 8 (Amendment to the Articles of Incorporation to Lower the Ownership Threshold Required for Shareholders to Call a Special Shareholder Meeting), Proposal 9 (Amendment to the Articles of Incorporation to Provide Shareholders the Ability to Act via Written Consent) and Proposal 10 (Approval of the W&T Offshore, Inc. 2023 Incentive Compensation Plan) to be voted on at the Annual Meeting, you must provide timely instructions on how the broker or other nominee should vote your shares. When a broker or other nominee does not have discretion to vote on a particular matter, you have not given timely instructions on how the broker or other nominee should vote your shares and the broker or other nominee indicates it does not have authority to vote such shares on its proxy, a “broker non-vote” results. Although any broker non-vote would be counted as present at the meeting for purposes of determining a quorum, it would be treated as not entitled to vote with respect to non-discretionary matters.

Abstentions occur when shareholders are present at the Annual Meeting but fail to vote or voluntarily withhold their vote for any of the matters upon which the shareholders are voting.

10 | 2023 Proxy Statement |

The following is a summary of the vote required to approve each proposal, as well as the effect of broker non-votes and abstentions.

| ● | Proposal 1 (Election of Directors): To be elected, each nominee for election as a director must receive the affirmative vote of a plurality of the shares present in person or represented by proxy and entitled to vote on the election of directors. This means that director nominees with the most votes are elected. Votes may be cast in favor of or withheld from the election of each nominee. Votes that are withheld from a director’s election will be counted toward a quorum, but will not affect the outcome of the vote on the election of a director. Broker non-votes will not be taken into account in determining the outcome of the election. |

| ● | Proposal 2 (Frequency of Future Advisory Votes to Approve the Compensation of Named Executive Officers): The affirmative vote of a majority of the shares present at the meeting in person or represented by proxy and entitled to vote on the proposal is required to approve, on an advisory basis, the frequency of future advisory votes on the compensation of the Company’s named executive officers to occur every three years, every two years or every year. Because this proposal has three possible substantive responses (every three years, every two years or every one year), if none of the frequency alternatives receives the vote of the holders of a majority of the shares present at the meeting in person or represented by proxy and entitled to vote on the proposal, then we will consider shareholders to have approved the frequency selected by holders of a plurality of the votes cast. An abstention has the same effect as a vote “AGAINST” the proposal and broker non-votes have no effect on the outcome of the vote. |

| ● | Proposal 3 (Advisory Vote to Approve the Compensation of Named Executive Officers): The affirmative vote of a majority of the shares present at the meeting in person or represented by proxy and entitled to vote on the proposal is required to approve, by non-binding vote, executive compensation. An abstention has the same effect as a vote “AGAINST” the proposal and broker non-votes have no effect on the outcome of the vote. If more votes are cast “AGAINST” this proposal than “FOR”, the Board and the Compensation Committee will carefully consider the outcome of the vote when making future compensation decisions for executive officers, but the Board and the Compensation Committee are not bound by the outcome of such vote. |

| ● | Proposal 4 (Ratification of the Appointment of Independent Accountants): The affirmative vote of a majority of the shares present at the meeting in person or represented by proxy and entitled to vote on the proposal is required to ratify the appointment of our independent registered public accounting firm. An abstention has the same effect as voting “AGAINST” the proposal. Brokers have discretionary authority in the absence of timely instructions from their customers to vote on this proposal. As a result, there may be no broker non-votes with respect to this proposal. If more votes are cast “AGAINST” this proposal than “FOR”, the Board will take such decision into consideration in selecting independent auditors for the Company, but the Board is not bound by the outcome of such vote. |

| ● | Proposal 5 (Amendment to the Articles of Incorporation to Increase the Company’s Authorized Share Capital): The affirmative vote of holders of at least two-thirds of the outstanding shares of Common Stock is required to approve the amendment to the Articles of Incorporation to increase the Company’s authorized share capital. An abstention and a broker non-vote each have the same effect as voting “AGAINST” the proposal. |

W&T Offshore, Inc. | NYSE: WTI | 11 |

| ● | Proposal 6 (Amendment to the Articles of Incorporation to Eliminate Supermajority Voting Requirements): The affirmative vote of holders of at least two-thirds of the outstanding shares of Common Stock is required to approve the amendment to the Articles of Incorporation to eliminate supermajority voting requirements. An abstention and a broker non-vote each have the same effect as voting “AGAINST” the proposal. |

| ● | Proposal 7 (Amendment to the Articles of Incorporation to Provide Shareholders the Ability to Amend the Bylaws): The affirmative vote of holders of at least two-thirds of the outstanding shares of Common Stock is required to approve the amendment to the Articles of Incorporation to provide shareholders the ability to amend the Bylaws. An abstention and a broker non-vote each have the same effect as voting “AGAINST” the proposal. |

| ● | Proposal 8 (Amendment to the Articles of Incorporation to Lower the Ownership Threshold Required for Shareholders to Call a Special Shareholder Meeting): The affirmative vote of holders of at least two-thirds of the outstanding shares of Common Stock is required to approve the amendment to the Articles of Incorporation to lower the ownership threshold required for shareholders to call a special shareholder meeting. An abstention and a broker non-vote each have the same effect as voting “AGAINST” the proposal. |

| ● | Proposal 9 (Amendment to the Articles of Incorporation to Provide Shareholders the Ability to Act via Written Consent): The affirmative vote of holders of at least two-thirds of the outstanding shares of Common Stock is required to approve the amendment to the Articles of Incorporation to provide shareholders the ability to act via written consent. An abstention and a broker non-vote each have the same effect as voting “AGAINST” the proposal. |

| ● | Proposal 10 (Approval of the W&T Offshore, Inc. 2023 Incentive Compensation Plan): The affirmative vote of a majority of the shares present at the meeting in person or represented by proxy and entitled to vote on the proposal is required to approve the 2023 Plan Proposal. An abstention has the same effect as voting “AGAINST” the proposal. Broker non-votes have no effect on the outcome of the vote. |

Mr. Tracy W. Krohn, our Chairman of the Board, Chief Executive Officer and President, and who is our largest shareholder, controlling approximately 32.9% of the voting power entitled to vote at the Annual Meeting as of April 20, 2023, intends to vote all of his shares of Common Stock in accordance with the Board’s recommendations set forth herein.

The Board has retained Georgeson to act as a proxy solicitor in conjunction with the Annual Meeting. We have agreed to pay Georgeson a fee of approximately $11,000, plus reasonable expenses, costs and disbursements for proxy solicitation services.

Voting Procedures

If you are a registered shareholder, you may vote your shares or submit a proxy to have your shares voted by one of the following methods:

| ● | By Internet. You may submit a proxy electronically via the Internet, using the website listed on the Notice of Availability. Please have your Notice of Availability, which includes your personal control number, in |

12 | 2023 Proxy Statement |

| hand when you log onto the website. Internet voting facilities will close and no longer be available on the date and time specified on the Notice of Availability. |

| ● | By Telephone. If you request paper copies of the proxy materials by mail, you may submit a proxy by telephone using the toll-free number listed on the proxy card. Please have your proxy card in hand when you call. Telephone voting facilities will close and no longer be available on the date and time specified on the proxy card. |

| ● | By Mail. If you request paper copies of the proxy materials by mail, you may submit a proxy by signing, dating and returning your proxy card in the pre-addressed envelope provided. If mailed, your completed and signed proxy card must be received by June 13, 2023. |

| ● | In Person. You may vote in person at the virtual Annual Meeting by completing a ballot as directed during the virtual Annual Meeting; however, attending the meeting without completing a ballot will not count as a vote. |

Revoking Your Proxy

You may revoke your proxy in writing at any time before it is exercised at the Annual Meeting by: (i) delivering to the Corporate Secretary of the Company a written notice of the revocation; (ii) signing, dating and delivering to the Corporate Secretary of the Company a proxy with a later date; or (iii) attending the Annual Meeting virtually and voting your shares in person. Your attendance at the Annual Meeting will not revoke your proxy unless you give written notice of revocation to the Corporate Secretary of the Company before your proxy is exercised or unless you vote your shares in person at the virtual Annual Meeting before your proxy is exercised.

Copies of the Annual Report

Upon written request, we will provide any shareholder, without charge, a copy of our annual report on Form 10-K for the year ended December 31, 2022 (the “Form 10-K”), but without exhibits. Shareholders should direct requests to W&T Offshore, Inc., Attn: Corporate Secretary, 5718 Westheimer Road, Suite 700, Houston, TX 77057. The Form 10-K and the exhibits filed with it are available on our website, www.wtoffshore.com in the “Investors—SEC Filings” section. These materials do not constitute a part of the proxy solicitation material.

W&T Offshore, Inc. | NYSE: WTI | 13 |

Proposal 1

Election of Directors

Currently, the Company’s Board is composed of the following five directors: Ms. Virginia Boulet, Dr. Nancy Chang and Messrs. Daniel O. Conwill IV, Tracy W. Krohn and B. Frank Stanley. At the Annual Meeting, five directors are to be elected, each of whom will serve until the 2024 Annual Meeting and until his or her successor is duly elected and qualified.

Each nominee has consented to be nominated and to serve if elected. If any nominee is unable to serve as a director, the shares represented by the proxies will be voted, in the absence of contrary indication, for any substitute nominee that the Board may designate or the size of the Board may be reduced. We know of no reason why any nominee would be unable to serve.

Recommendation of the Board

| THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE FIVE NOMINEES LISTED BELOW. |

Information about the Nominees

| Virginia Boulet, 69 |

| SKILLS: | ||

DIRECTOR SINCE: March 2005 | COMMITTEES: Compensation ESG Nominating and Corporate Governance (Chair) |

M&A and | |||

Virginia Boulet, age 69, has served on the Board since March 2005. She is currently Chair of the Nominating and Corporate Governance Committee and a member of the Compensation Committee and ESG Committee. From 2004 through 2018, Ms. Boulet was an adjunct professor of law at Loyola University Law School. From April 2014 to 2021, she was employed as Managing Director of Legacy Capital, LLC. From 2002 to March 2014, Ms. Boulet was employed as Special Counsel to Adams and Reese, LLP, a law firm. Prior to 2002, Ms. Boulet was a partner at the New Orleans law firms of Phelps Dunbar, LLP and Jones Walker LLP. Ms. Boulet has over 30 years of experience in mergers and acquisitions, equity securities offerings, general business matters and counseling clients regarding compliance with federal securities laws and regulations. Ms. Boulet currently serves on the board of directors of Ouster, Inc. (NYSE: OUST) (“Ouster”), where she is the chair of the Nominating and Governance Committee. She also previously served on the board of directors of Velodyne Lidar, Inc. (NYSE: VLDR), a lidar technology company, from October 2021 until its merger with Ouster in February 2023, where she served as chair of the nominating and corporate governance committee, as well as a member of the board’s compensation committee. She has also served on the board of directors of Lumen Technologies, Inc. (NYSE: LUMN), a telecommunications company, from May 1995 through May 2021. Service on the various boards of directors and committees, along with her long career in corporate, securities and banking law, as well as her academic experience, has provided her with the background and experience of board processes, function, exercise of diligence and oversight of management. In the past, she served as President and Chief Operating Officer of IMDiversity, Inc., an on-line recruiting company. Ms. Boulet received a B.A. in Medieval History from Yale University, and a J.D., cum laude, from Tulane University Law School. With her public company board experience and recruiting experience as president of a recruiting company, we believe Ms. Boulet is well suited as a member of our Board, the Compensation Committee, the ESG Committee and to the Nominating and Corporate Governance Committee functions of identifying and evaluating individuals qualified to become board members and evaluating our corporate governance policies. Her legal background also provides her with a high level of technical expertise in reviewing transactions and agreements and addressing legal issues presented to the Board. |

Financial Oversight | ||||

Industry Experience | |||||

Executive Leadership | |||||

Other Outside | |||||

Cyber Security | |||||

Diversity | |||||

W&T Offshore, Inc. | NYSE: WTI | 15 |

| Nancy Chang, 73 |

| SKILLS: | ||

DIRECTOR SINCE: April 2023 | COMMITTEES: Audit ESG (Chair) Nominating and Corporate Governance |

M&A and | |||

Dr. Nancy Chang, age 73, has served on the Board since April 2023. She is currently the chair of the ESG Committee and a member of the Audit Committee and Nominating and Corporate Governance Committee. Dr. Chang is currently serving as a member of the board of directors of Ansun Biopharma, Inc., a clinical late-stage biopharmaceutical company focused on the development of unique host-directed anti-viral therapies for respiratory viruses, where she was the Chief Executive Officer from March 2017 until stepping down in July 2022. In addition to her role with Ansun Biopharma, Inc., she has also served as the Chairman and Founder of Apex Capital, an investment management company focused on investments in healthcare, education and socially responsible ventures, since January 2009 and has served as president of the Tang Family Foundation since March 2009. Prior to joining the Board, Dr. Chang also served on the board of directors of Helix Acquisition Corp. from October 2020 until its business combination in April 2022. From 2007 to 2012, Dr. Chang was the Founder, Chairperson and Senior Managing Director of Caduceus Asia Partners at OrbiMed Advisors L.L.C., one of the largest healthcare focused investment management firms in the world. Prior to that, Dr. Chang was the Co-Founder, President, Chief Executive Officer and Chairman of Tanox, Inc., a company focused on the development of therapeutics to address major unmet medical needs in the areas of asthma, allergy, inflammation, HIV infection and other diseases affecting the human immune system, from 1986 to 2006, where she led the company through an initial public offering in 2000 and growth to a $1 billion public valuation until its acquisition by Genentech Inc. in 2007. From 1980 to 1986, Dr. Chang held several leadership positions at Centocor Biotech Inc. (now a division of Johnson & Johnson), where she served as director of research and made substantial contributions to the development of monoclonal antibody as therapeutics and to the HIV field including the development of the first HIV diagnosis assay. In addition, Dr. Chang has served on the boards of a number of companies, including Helix Acquisition Corp., Charles River Laboratory International, Inc., Eddingpharm (Cayman) Inc., Crown Bioscience Inc., Applied Optoelectronics, Inc., SciClone Pharmaceuticals, Inc., and a number of other private companies, and she has served on the board of directors of the Federal Reserve Bank in Houston. Dr. Chang was also a member of the board of directors at BIO and BioHouston. Throughout her career, she received numerous awards from academic, industrial, national and international organizations. She was named the Most Respected Woman in Biotechnology in 2005, Forbes Twenty-Five Notable Chinese Americans list in 2008 and was the first woman to receive the Biotechnology Heritage Award in 2012. She has published more than 35 papers on topics ranging from monoclonal antibodies to human immunodeficiency virus (HIV) and holds seven patents. Dr. Chang graduated from National Tsing Hua University in Taiwan and Brown University and received her Ph. D. from the Division of Medical Sciences at Harvard Medical School in 1979. We believe that Dr. Chang’s impressive experience as both an executive at various companies and as a member of the board of directors of both public and private entities, along with her experience in the technology and biomedical fields, makes her a valuable member of the Board. In particular, we believe that Dr. Chang’s experiences as founder and executive of a successful, publicly-traded company and one of the largest healthcare-focused investment management firms in the world bring valuable and unique perspectives, talents and insights to the Board. |

Financial Oversight | ||||

Executive Leadership | |||||

Environmental/ | |||||

Other Outside | |||||

Cyber Security | |||||

Diversity | |||||

16 | 2023 Proxy Statement |

| Daniel O. Conwill IV, 62 |

| SKILLS: | ||

DIRECTOR SINCE: May 2021 | COMMITTEES: Audit Compensation (Chair) ESG |

M&A and | |||

Daniel O. Conwill IV, age 62, has served on the Board since May 2021. He is currently the Chair of the Compensation Committee and a member of the Audit Committee and the ESG Committee. Mr. Conwill is currently the owner and operator of Felix’s Restaurant Group, which owns and operates seafood restaurants in New Orleans and along the Gulf Coast and which he purchased in 2012. From July 2019 until June 2022, Mr. Conwill was the Chief Financial Officer of Durfort Holdings, SRL, an international conglomerate engaged in the manufacture and sale of cigars and other tobacco products. From 2014 until April 2019, Mr. Conwill served as Co-Chief Executive Officer and Head of Investment Banking at Seaport Global Securities (“Seaport”). Prior to joining Seaport, Mr. Conwill was the Founder, Chairman of the board of directors and Chief Executive Officer and manager of the Investment Banking Group at Global Hunter Securities (“Global Hunter”), which he started in 2005 and where he served in such roles until its merger with Seaport in 2013. Prior to forming Global Hunter, Mr. Conwill was Executive Vice President and Co-Director of Corporate Finance at Jefferies & Company, Inc. (“Jefferies & Co”). While at Jefferies & Co, Mr. Conwill founded its oil and gas investment banking group in 1993 and managed that group until his departure in 2005. Prior to joining Jefferies & Co in 1993, Mr. Conwill was a Managing Director in Corporate Finance at Howard, Weil, Labouisse, Friedrichs, Inc. Mr. Conwill’s professional career started in the tax department with Arthur Andersen & Co. Mr. Conwill received his Bachelor’s and Master’s Degrees in Accounting from the University of Mississippi and has a law degree from the University of Mississippi’s School of Law. Mr. Conwill brings valuable leadership and management skills as a result of his roles as the Chairman of the board of directors and Chief Executive Officer of Global Hunter and Co-Chief Executive Officer of Seaport. We believe that this experience, as well as the financial and advisory and capital markets experience that he has gained through his over 30 years in investment banking and in particular his experience in advising oil and gas companies, make him a valuable part of our Board and member of our Audit, Compensation, and ESG Committees. |

Financial Oversight | ||||

Industry Experience | |||||

Executive Leadership | |||||

Environmental/ | |||||

Other Outside | |||||

Cyber Security | |||||

W&T Offshore, Inc. | NYSE: WTI | 17 |

| Tracy W. Krohn, 68 |

| SKILLS: | ||

DIRECTOR SINCE: 2004 | COMMITTEES: None |

M&A and | |||

Tracy W. Krohn, age 68, has served as Chief Executive Officer since he founded the Company in 1983 and as Chairman of the Board since 2004. He has also served in various other roles during his time with the Company, including as Treasurer from 1997 until 2006, and as President from its founding until September 2008 and again from March 2017 to present day. During 1996 to 1997, Mr. Krohn was Chairman and Chief Executive Officer of Aviara Energy Corporation. Mr. Krohn has been actively involved in the oil and gas business since graduating with a B.S. in Petroleum Engineering from Louisiana State University in 1978. He began his career as a petroleum engineer and offshore drilling supervisor with Mobil Oil Corporation. Prior to founding the Company, from 1981 to 1983, Mr. Krohn was Senior Engineer with Taylor Energy Company. In 2013, Mr. Krohn was appointed to serve on the board of directors of the American Petroleum Institute. As founder of the Company, Mr. Krohn is one of the driving forces behind the Company and its success to date. Over the course of the Company’s history, Mr. Krohn has successfully grown the Company through his exceptional leadership skills and acute business judgment. We believe Mr. Krohn is well-qualified to serve as a director because of his significant experience as our founder and as a significant shareholder, as well as his substantial and broad executive and technical experience in the energy sector. |

Financial Oversight | ||||

Industry Experience | |||||

Executive Leadership | |||||

Environmental/ | |||||

Other Outside | |||||

Cyber Security | |||||

18 | 2023 Proxy Statement |

| B. Frank Stanley, 68 |

| SKILLS: | ||

DIRECTOR SINCE: May 2009 | COMMITTEES: Audit (Chair) Compensation ESG Nominating and Corporate Governance |

M&A and | |||

B. Frank Stanley, age 68, has served on the Board since May 2009. Mr. Stanley is currently the Chair of the Audit Committee and a member of the Compensation Committee, the Nominating and Corporate Governance Committee and the ESG Committee. He is currently Co-Chief Executive Officer and Chief Financial Officer of Retail Concepts, Inc., a privately-held retail chain of 32 stores in 13 states with over seven hundred employees, where he has served in such roles since December 2012. Prior to joining Retail Concepts, Inc. in 1988, he was Chief Financial Officer of Southpoint Porsche Audi WGW Ltd. from 1987 to 1988. From 1985 to 1987, he was employed by KPMG Peat Marwick, holding the position of Manager, Audit in 1987. From 1983 to 1984, he was Chief Financial Officer of Design Research, Inc., a manufacturer of housing for offshore drilling platforms. From 1980 to 1982, he was Chief Financial Officer of Tiger Oilfield Rental Co., Inc. and, from 1977 to 1979, he was an accountant with Trunkline Gas Co. Mr. Stanley holds a B.B.A. in Accounting from Texas A&M University and is a certified public accountant. Mr. Stanley has an extensive background in accounting and financial matters, which we believe qualify him for service as a member of our Board, the Chair of the Audit Committee, and a member of the Compensation, Nominating and Corporate Governance, and ESG Committees. |

Financial Oversight | ||||

Industry Experience | |||||

Executive Leadership | |||||

Environmental/ | |||||

Other Outside | |||||

Cyber Security | |||||

Required Vote

To be elected, each nominee for election as a director must receive the affirmative vote of a plurality of the shares present in person or represented by proxy and entitled to vote on the election of directors. Broker non-votes and abstentions will have no effect on the outcome of the election.

Mr. Tracy W. Krohn, our Chairman of the Board, Chief Executive Officer and President, and who is our largest shareholder, controlling approximately 32.9% of the voting power entitled to vote at the Annual Meeting as of April 20, 2023, intends to vote all of his shares of Common Stock in accordance with the Board’s recommendations set forth herein.

W&T Offshore, Inc. | NYSE: WTI | 19 |

Proposal 2

Frequency of Future Advisory Votes to

Approve the Compensation of

Named Executive Officers

Recommendation of the Board

| THE BOARD RECOMMENDS YOU VOTE FOR AN ADVISORY VOTE ON THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS SET FORTH IN THE COMPANY’S PROXY STATEMENT TO OCCUR EVERY “1 YEAR”. |

Introduction

As described in Proposal 3 below, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") affords shareholders an advisory vote to approve the Company’s executive compensation program. The advisory vote on executive compensation is often referred to as a “say-on-pay vote.” As required by the Dodd-Frank Act, this Proposal 2 affords shareholders an advisory vote on the frequency of future say-on-pay votes. The advisory vote on the frequency of the say-on-pay vote is a non-binding vote as to how often future say-on-pay votes should occur: every year, every two years, or every three years. In addition, shareholders may abstain from voting on this Proposal 2. The Dodd-Frank Act requires the Company to hold the advisory vote on the frequency of the say-on-pay vote at least once every six years and, therefore, the Company expects to hold the next such vote at the 2029 annual meeting of shareholders. The Company last held such vote in 2017, and, at that time, the shareholders voted in favor of conducting an advisory vote on executive compensation every year, which the Company has previously done.

The Board believes that conducting an advisory vote on executive compensation every year will best enable shareholders to timely express their views on the Company’s executive compensation program. The Company’s executive compensation programs are designed to promote a long-term connection between pay and performance and holding an advisory vote on executive compensation every year provides the Company with direct and timely feedback on our compensation programs. Conducting an advisory vote on executive compensation every year also aligns with the feedback that we received from our larger shareholders as part of our shareholder outreach program and is consistent with the policies of proxy advisory firms such as Institutional Shareholder Services and Glass Lewis.

Shareholders should note, however, that because the advisory vote on executive compensation occurs well after the beginning of the compensation year, and because the different elements of our executive compensation programs are designed to operate in an integrated manner and to complement one another, in many cases it may

20 | 2023 Proxy Statement |

not be appropriate or feasible to change our executive compensation programs in consideration of any one year’s advisory vote on executive compensation by the time of the following year’s annual meeting of shareholders.

Shareholders are being asked to vote among the following frequency options (not solely for or against the recommendation of the Board):

Choice 1—every year;

Choice 2—every two years;

Choice 3—every three years; or

Choice 4—abstain from voting.

This advisory vote on the frequency of future say-on-pay votes is not binding on the Company or the Board. However, the Board will consider the outcome of the vote when determining the frequency of future say-on-pay votes.

Required Vote

The affirmative vote of a majority of the shares present at the meeting in person or represented by proxy and entitled to vote on the proposal is required to approve, on an advisory basis, the frequency of future advisory votes on the compensation of the Company’s named executive officers to occur every three years, every two years or every year. If none of the frequency alternatives receives the vote of the holders of a majority of the shares present at the meeting in person or represented by proxy and entitled to vote on the proposal, then we will consider shareholders to have approved the frequency selected by holders of a plurality of the votes cast. Broker non-votes and abstentions have no effect on the outcome of the vote.

Mr. Tracy W. Krohn, our Chairman of the Board, Chief Executive Officer and President, and who is our largest shareholder, controlling approximately 32.9% of the voting power entitled to vote at the Annual Meeting as of April 20, 2023, intends to vote all of his shares of Common Stock in accordance with the Board's recommendations set forth herein.

W&T Offshore, Inc. | NYSE: WTI | 21 |

Proposal 3

Advisory Vote on

Executive Compensation

Recommendation of the Board

| THE BOARD RECOMMENDS YOU VOTE “FOR” THE APPROVAL OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS. |

Introduction

We are asking that our shareholders provide advisory, non-binding approval of the compensation paid to our Named Executive Officers, as described in the “Compensation Discussion and Analysis” (“CD&A”) section of this proxy statement. The Board recognizes that executive compensation is an important matter for our shareholders. As described in detail in the CD&A section of this proxy statement, the Compensation Committee is tasked with the implementation of our executive compensation philosophy, and the core of that philosophy has been and continues to be to pay our executive officers based on the Company’s performance. In particular, the Compensation Committee strives to attract, as needed, and retain the best possible executive talent, to incentivize the Named Executive Officers’ efforts on our behalf in a way that supports our financial performance objectives and business strategy, and to align their incentives with enhancement of shareholder value. To do so, the Compensation Committee typically uses a combination of short- and long-term incentive compensation to reward near-term excellent performance and to encourage executives’ commitment to our long-range, strategic business goals. It is always the intention of the Compensation Committee that our executive officers be compensated competitively and consistently with our strategy, sound corporate governance principles, and shareholder interests and concerns, and we believe that the 2022 decisions regarding incentive compensation were consistent with these principles.

As described in the CD&A section of this proxy statement, we believe our historical compensation program is effective, appropriate and strongly aligned with the long-term interests of our shareholders and that the total compensation packages provided to the Named Executive Officers (including potential payouts upon a termination or change of control) are reasonable and not excessive. As you consider this Proposal 3, we urge you to read the CD&A section of this proxy statement for additional details on executive compensation, including more detailed information about our compensation philosophy and objectives and the past compensation of our Named Executive Officers, and to review the tabular disclosures regarding compensation of our Named Executive Officers together with the accompanying narrative disclosures in the “Executive Compensation and Related Information” section of this proxy statement.

In connection with the shareholder outreach program discussed in this proxy statement, we have also conducted a comprehensive review of our compensation practices, and we have proposed changes to our 2023 compensation

22 | 2023 Proxy Statement |

program to more closely align our practices with our peer group and affirm the Company’s commitment to pay and performance alignment over the long-term. Those changes are not the subject of the advisory approval of the shareholders in this proxy statement, although we encourage you to see “Compensation Discussion and Analysis— Compensation Changes for 2023” for more information on such comprehensive changes to our compensation programs. These changes are not reflected in the historical 2022 compensation information presented in this proxy statement. We believe it is important for shareholders, in deciding how they will vote on this matter, to consider not just the historical 2022 compensation information, but also the substantial changes to our compensation practices driven by the recent amendment to Mr. Krohn’s employment agreement and other changes adopted by our Compensation Committee.

We believe that the shareholders, by voting for directors individually as described in Proposal 1, have always had a clear ability to express their approval or disapproval of the performance of our directors and, specifically the directors serving on the Compensation Committee; however, in 2010, Congress enacted the Dodd-Frank Act, which requires, among other things, a non-binding advisory “say-on-pay” vote and gives our shareholders the additional opportunity to express their views on our Named Executive Officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers and the philosophy, policies and practices described in this proxy statement.

As an advisory vote, Proposal 3 is not binding on the Board or the Compensation Committee, will not overrule any decisions made by the Board or the Compensation Committee, or require the Board or the Compensation Committee to take any action. Although the vote is non-binding, the Board and the Compensation Committee value the opinions of our shareholders and will carefully consider the outcome of the vote when making future compensation decisions for executive officers. In particular, to the extent there is any significant vote against the compensation of our Named Executive Officers as disclosed in this proxy statement, we will consider our shareholders’ concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns.

Text of the Resolution to be Adopted

We are asking shareholders to vote “FOR” the following resolution:

“RESOLVED, that the Company’s shareholders approve, on an advisory basis, the compensation of the Named Executive Officers, as disclosed in the Company’s Proxy Statement for the 2023 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the 2022 Summary Compensation Table and the other related tables and disclosure.”

Required Vote

The affirmative vote of a majority of the shares present at the meeting in person or represented by proxy and entitled to vote on the proposal is required to approve, by non-binding vote, executive compensation. Abstentions and broker non-votes have no effect on the outcome of the vote.

Mr. Tracy W. Krohn, our Chairman of the Board, Chief Executive Officer and President, and who is our largest shareholder, controlling approximately 32.9% of the voting power entitled to vote at the Annual Meeting as of April 20, 2023, intends to vote all of his shares of Common Stock in accordance with the Board’s recommendations set forth herein.

W&T Offshore, Inc. | NYSE: WTI | 23 |

Proposal 4

Ratification of Appointment of

Independent Accountants

Recommendation of the Board

| THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF Ernst & Young LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS. |

The Audit Committee of the Board (the “Audit Committee”) appointed Ernst & Young LLP (“EY”), independent registered public accountants, to audit our consolidated financial statements as of and for the year ending December 31, 2023. We are advised that no member of EY has any direct or material indirect financial interest in our Company or, during the past three years, has had any connection with us in the capacity of promoter, underwriter, voting trustee, director, officer or employee.

If the appointment is not ratified, the Audit Committee will consider the appointment of other independent registered public accountants. A representative of EY is expected to be present at the Annual Meeting, will be offered the opportunity to make a statement if the representative desires to do so and will be available to respond to appropriate questions.

Required Vote

The affirmative vote of a majority of the shares present at the meeting in person or represented by proxy and entitled to vote on the proposal is required to ratify the appointment of our independent registered public accounting firm. An abstention has the same effect as voting “AGAINST” the proposal. Brokers have discretionary authority in the absence of timely instructions from their customers to vote on this proposal. As a result, there may be no broker non-votes with respect to this proposal.

Mr. Tracy W. Krohn, our Chairman of the Board, Chief Executive Officer and President, and who is our largest shareholder, controlling approximately 32.9% of the voting power entitled to vote at the Annual Meeting as of April 20, 2023, intends to vote all of his shares of Common Stock in accordance with the Board’s recommendations set forth herein.

24 | 2023 Proxy Statement |

Proposal 5

Amendment to the Articles of

Incorporation to Increase the

Company’s Authorized Share Capital

Recommendation of the Board

| THE BOARD OF DIRECTORS RECOMMENDS YOU VOTE “FOR” THE APPROVAL OF THE AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION TO INCREASE THE AUTHORIZED SHARES OF COMMON STOCK TO 400,000,000 SHARES. |

The Proposal

The Board is asking shareholders to consider and vote upon an amendment to Article IV of the Articles of Incorporation to increase the Company’s authorized capital stock (the “Authorized Capital Amendment”). Article IV of the Articles of Incorporation currently authorizes 200,000,000 shares of Common Stock, par value $0.00001 per share, and 20,000,000 shares of preferred stock, par value $0.00001 per share. The Authorized Capital Amendment would increase the authorized shares of Common Stock to 400,000,000 shares, representing a 100% increase. The authorized shares of preferred stock would remain at 20,000,000. The Authorized Capital Amendment would increase the authorized number of shares of Common Stock by deleting the stricken text in red font from, and adding the double underlined text in blue font to, Article IV as follows:

The aggregate number of shares of capital stock which the Corporation shall have authority to issue is four hundred twenty million 220,000,000(420,000,000) shares, of which two hundred four hundred million (200400,000,000) shares shall be designated as Common Stock, par value $0.00001 per share, and twenty million (20,000,000) shares shall be designated as Preferred Stock, par value $0.00001 per share.

The additional shares of Common Stock authorized by the Authorized Capital Amendment would become a part of the existing class of the Company’s Common Stock and, if and when issued, would have the same rights and privileges as the shares of Common Stock currently authorized and outstanding. The Authorized Capital Amendment will not affect the par value of the Common Stock, which will remain at $0.00001 per share. The newly authorized shares of Common Stock would not (and the shares of Common Stock presently outstanding do not) entitle the holders thereof to preemptive rights to purchase shares of Common Stock or other securities or to cumulative voting rights. In addition, under Texas law, our shareholders are not entitled to dissenters’ or appraisal rights in connection with the proposed increase in the number of shares of Common Stock authorized for issuance.

W&T Offshore, Inc. | NYSE: WTI | 25 |

Purpose and Effect of the Authorized Capital Amendment

As of March 31, 2022, 146,460,902 shares of Common Stock were outstanding and an additional 33,893,263 shares of Common Stock were reserved for issuance for future purposes, representing usage of 90.2%. The purpose of the Authorized Capital Amendment is to provide the Company with sufficient common share capacity to issue shares of Common Stock for general corporate purposes, including for purposes of raising capital to fund the growth of the Company’s business and to repay the Company’s outstanding indebtedness, without the further approval of the Company’s shareholders and the expense and delay of another shareholders’ meeting. The Board believes that this additional flexibility is warranted.

The Company does not propose the Authorized Capital Amendment with the intention of using the additional shares for anti-takeover purposes, although the Company could theoretically use the additional shares to make more difficult or to discourage an attempt to acquire control of the Company. The Board is not aware of any pending or threatened efforts to acquire control of the Company.

Required Vote

The affirmative vote of the holders of at least two-thirds of the outstanding shares of Common Stock is required to approve the Authorized Capital Amendment. An abstention and a broker non-vote each have the same effect as voting “AGAINST” the Authorized Capital Amendment.

Mr. Tracy W. Krohn, our Chairman of the Board, Chief Executive Officer and President, and who is our largest shareholder, controlling approximately 32.9% of the voting power entitled to vote at the Annual Meeting as of April 20, 2023, intends to vote all of his shares of Common Stock in accordance with the Board’s recommendations set forth herein.

Description of Other Immaterial Changes

If the Authorized Capital Amendment is approved, and assuming all other proposed amendments to the Articles of Incorporation described in this proxy statement are also approved, we intend to file with the Secretary of State of the State of Texas the Second Amended and Restated Certificate of Incorporation in the form attached hereto as Annex A, which includes certain other minor, immaterial changes to streamline and modernize the Articles of Incorporation. Such changes, which do not substantively affect shareholder rights, include (i) adding the date of incorporation of the Company in Texas, (ii) updating references to the Texas Business Organizations Code and (iii) the adoption of gender-neutral terms when referring to particular positions, offices or title holders (the “Immaterial Changes”). The Second Amended and Restated Certificate of Incorporation that we will file with the Secretary of State of the State of Texas will reflect only the proposed amendments that are approved and the Immaterial Changes.

26 | 2023 Proxy Statement |

Proposal 6

Amendment to the Articles of

Incorporation to Eliminate

Supermajority Voting Requirements

Recommendation of the Board

| THE BOARD RECOMMENDS YOU VOTE “FOR” THE APPROVAL OF THE SIXTY-SIX AND TWO-THIRDS PERCENT VOTING AMENDMENT TO ELIMINATE SUPERMAJORITY VOTING REQUIREMENTS. |

The Proposal

The Board is asking shareholders to consider and vote upon a proposal to approve an amendment (the “Sixty-Six and Two-Thirds Percent Voting Amendment”) to the Articles of Incorporation to provide shareholders greater opportunity to participate in governance by eliminating all supermajority voting requirements under Texas and other applicable law. Among other supermajority voting requirements, the Texas Business Organizations Code provides that, unless otherwise provided by the certificate of formation, approval of the following actions, subject to certain exceptions, requires the affirmative vote of at least two-thirds of the outstanding shares entitled to vote thereon:

| 1. | Amendments to the certificate of formation; |

| 2. | A voluntary winding up or a cancellation or revocation of a winding up; |

| 3. | A merger, conversion, exchange, or sale of all or substantially all of a corporation’s assets; and |

| 4. | A business combination with an affiliated shareholder. |

Because the Articles of Incorporation do not provide otherwise, approval of the foregoing actions requires a two-thirds vote of the Company’s shareholders. The Board proposes to lower the vote required to approve such actions to a simple majority vote by adding a new article to the Articles of Incorporation as follows:

Notwithstanding any provision of law requiring the affirmative vote of a greater percentage or proportion than a majority of the outstanding shares of all classes or of any class of stock of the Corporation entitled to vote to take or authorize any action, including without limitation (1) any amendment of these Articles of Incorporation, (2) any disposition or sale of all or substantially all of the Corporation’s assets, (3) any dissolution of the Corporation and (4) any plan of merger, consolidation or exchange, such action may be taken or authorized upon the affirmative vote of a majority of the outstanding shares of all classes or of any class of stock of the Corporation entitled to vote thereon, except as may be otherwise provided in these Articles of Incorporation or in the bylaws.

W&T Offshore, Inc. | NYSE: WTI | 27 |

Purpose and Effect of the Sixty-Six and Two-Thirds Percent Voting Amendment

Approval of the Sixty-Six and Two-Thirds Percent Voting Amendment proposal would lower the requisite vote to approve fundamental actions that would otherwise require a two-thirds vote under Texas or other law to a simple majority.

As part of its ongoing review of corporate governance matters and in deciding to approve the Sixty-Six and Two-Thirds Percent Voting Amendment proposal and to recommend that the shareholders vote to adopt the Sixty-Six and Two-Thirds Percent Voting Amendment proposal, the Board considered the existing supermajority voting requirement, including the enhanced benefit of providing shareholders greater opportunity to participate in corporate governance. In addition, the Board considered the views and opinions of the Company’s largest shareholders that engaged in the Company’s shareholder outreach program, shareholder voting guidelines of proxy advisory firms such as Institutional Shareholder Services and Glass Lewis and the opinions of various advisors on corporate governance.

Therefore, following careful consideration of the matter, and due to its belief that a majority of the outstanding voting shares standard provides greater accountability to shareholders and promotes stronger corporate governance, the Board has adopted resolutions to approve the Sixty-Six and Two-Thirds Percent Voting Amendment proposal, to declare the Sixty-Six and Two-Thirds Percent Voting Amendment proposal advisable and in the best interests of the Company and its shareholders and to submit the Sixty-Six and Two-Thirds Percent Voting Amendment proposal to its shareholders for consideration.

Required Vote

The affirmative vote of the holders of at least two-thirds of the outstanding shares of Common Stock is required to approve the Sixty-Six and Two-Thirds Percent Voting Amendment. An abstention and a broker non-vote each have the same effect as voting “AGAINST” the Sixty-Six and Two-Thirds Percent Voting Amendment.

Mr. Tracy W. Krohn, our Chairman of the Board, Chief Executive Officer and President, and who is our largest shareholder, controlling approximately 32.9% of the voting power entitled to vote at the Annual Meeting as of April 20, 2023, intends to vote all of his shares of Common Stock in accordance with the Board’s recommendations set forth herein.

Description of Other Immaterial Changes

If the Sixty-Six and Two-Thirds Percent Voting Amendment is approved, and assuming all other proposed amendments to the Articles of Incorporation described in this proxy statement are also approved, we intend to file with the Secretary of State of the State of Texas the Second Amended and Restated Certificate of Incorporation in the form attached hereto as Annex A, which includes the Immaterial Changes. The Second Amended and Restated Certificate of Incorporation that we will file with the Secretary of State of the State of Texas will reflect only the proposed amendments that are approved and the Immaterial Changes.

28 | 2023 Proxy Statement |

Proposal 7

Amendment to the Articles of

Incorporation to Provide Shareholders the

Ability to Amend the Bylaws

Recommendation of the Board

| THE BOARD RECOMMENDS YOU VOTE “FOR” THE APPROVAL OF THE SHAREHOLDER BYLAW AMENDMENT TO PROVIDE SHAREHOLDERS ABILITY TO AMEND THE BYLAWS. |

The Proposal

The Board is asking shareholders to consider and vote upon a proposal to approve an amendment (the “Shareholder Bylaw Amendment”) to the Articles of Incorporation to provide shareholders the ability to amend the Bylaws. Article XIII of the Articles of Incorporation currently provides that the Company’s shareholders are expressly prohibited from amending or repealing the Bylaws. The Shareholder Bylaw Amendment would delete the stricken text in red font from, and add the double underlined text in blue font to, Article XIII as follows:

The Board of Directors is expressly authorized to adopt, amend and repeal the bylaws. The corporation’s shareholders are hereby expressly prohibited fromauthorized to adopt, amending orand repealing the bylaws.

Purpose and Effect of the Shareholder Bylaw Amendment

The effect of the Shareholder Bylaw Amendment is to provide shareholders the ability to amend the Bylaws pursuant to Section 21.058 of the Texas Business Organizations Code, which provides that unless the certificate of formation or a bylaw adopted by the shareholders provides otherwise as to all or a part of a corporation’s bylaws, a corporation’s shareholders may amend, repeal, or adopt the corporation’s bylaws.