UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material under §240.14a-12 |

W&T Offshore, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

(1) |

Title of each class of securities to which transaction applies:

|

|

(2) |

Aggregate number of securities to which transaction applies:

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

(4) |

Proposed maximum aggregate value of transaction:

|

|

(5) |

Total fee paid:

|

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) |

Amount Previously Paid:

|

|

(2) |

Form, Schedule or Registration Statement No.:

|

|

(3) |

Filing Party:

|

|

(4) |

Date Filed:

|

March 26, 2020

Dear Shareholder:

It is my pleasure to invite you to the 2020 Annual Meeting of Shareholders of W&T Offshore, Inc. scheduled to be held on Wednesday, May 6, 2020 at 8:00 a.m., Central Daylight Time, at our offices, Nine Greenway Plaza, Suite 300, Houston, Texas 77046. I hope you will be able to attend.

Details of the business to be conducted at the Annual Meeting are provided in the attached Notice of Annual Meeting and Proxy Statement. Our Board of Directors has determined that owners of record of our Common Stock at the close of business on March 19, 2020 are entitled to notice of, and have the right to vote at, the Annual Meeting and any reconvened meeting following any adjournment, postponement or relocation of the meeting.

We have elected to furnish proxy materials to our shareholders on the Internet pursuant to rules adopted by the Securities and Exchange Commission. We believe these rules enable us to provide you with the information you need, while making delivery more efficient, more cost effective and friendlier to the environment. In accordance with these rules, beginning on or about March 26, 2020, we sent a Notice of Internet Availability of Proxy Materials to our shareholders.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. Therefore, I urge you to promptly vote using the Internet or telephone voting procedures described on the Notice of Internet Availability of Proxy Materials or vote and submit your proxy by signing, dating and returning the enclosed proxy card in the enclosed envelope (if you have requested a paper copy of the proxy materials). If you decide to attend the Annual Meeting, you will be able to vote in person, even if you have previously submitted your proxy.

On behalf of the Board of Directors and our employees, I would like to express my appreciation for your continued interest in our affairs. I look forward to greeting as many of you as possible at the meeting.

| Sincerely, | ||

|

||

| Tracy W. Krohn | ||

| Chairman of the Board, | ||

| Chief Executive Officer and President |

Nine Greenway Plaza, Suite 300

Houston, Texas 77046

Phone (713) 626-8525

NOTICE OF 2020 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 6, 2020

Notice is hereby given that the 2020 Annual Meeting of Shareholders of W&T Offshore, Inc., a Texas corporation, will be held at our offices, Nine Greenway Plaza, Suite 300, Houston, Texas 77046, on May 6, 2020 at 8:00 a.m., Central Daylight Time, for the following purposes:

|

(1) |

to elect five directors to hold office until the 2021 Annual Meeting of Shareholders and until their successors are duly elected and qualified; |

|

(2) |

to approve the first amendment to our 2004 Directors Compensation Plan to increase the number of shares of common stock to be issued under awards thereunder; |

| (3) | to approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the accompanying Proxy Statement pursuant to Item 402 of Regulation S-K; |

|

(4) |

to ratify the appointment of Ernst & Young LLP as our independent registered public accountants for the year ending December 31, 2020; and |

|

(5) |

to transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

Only shareholders of record at the close of business on March 19, 2020 will be entitled to notice of, and to vote at, the Annual Meeting, or any adjournment or postponement thereof, notwithstanding the transfer of any shares after such date. A list of these shareholders will be open for examination by any shareholder for ten days prior to the Annual Meeting at our principal executive offices at Nine Greenway Plaza, Suite 300, Houston, Texas 77046.

Pursuant to rules adopted by the Securities and Exchange Commission, we have elected to provide access to our proxy solicitation materials primarily via the Internet, rather than mailing paper copies of these materials to each shareholder. On or about March 26, 2020, we will mail to each shareholder a Notice of Internet Availability of Proxy Materials with instructions on how to access the proxy materials, vote or request paper copies. Your vote is important. We urge you to review the accompanying Proxy Statement carefully and to submit your proxy as soon as possible so that your shares will be represented at the meeting.

| By Order of the Board of Directors, | ||

|

||

| Shahid A. Ghauri | ||

| Vice President, General Counsel and Corporate Secretary |

Houston, Texas

March 26, 2020

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE SHAREHOLDERS MEETING TO BE HELD ON MAY 6, 2020

This Notice of Annual Meeting and Proxy Statement and our Annual Report to Shareholders are available at www.proxyvote.com.

Nine Greenway Plaza, Suite 300

Houston, Texas 77046

Phone (713) 626-8525

TABLE OF CONTENTS

|

THE ANNUAL MEETING |

1 |

|

Purposes of the 2020 Annual Meeting |

1 |

|

Voting Rights and Solicitation |

1 |

|

Voting Procedures |

3 |

|

Revoking Your Proxy |

3 |

|

Copies of the Annual Report |

3 |

|

PROPOSAL 1 ELECTION OF DIRECTORS |

4 |

|

Information about the Nominees |

4 |

|

Recommendation of the Board |

5 |

|

PROPOSAL 2 AMENDMENT TO THE W&T OFFSHORE, INC. 2004 DIRECTORS COMPENSATION PLAN |

6 |

|

Introduction |

6 |

|

Reason for Proposed Amendment and the Request for Shareholder Approval |

6 |

|

Summary of the Directors Compensation Plan |

6 |

|

Awards Under the Directors Compensation Plan |

7 |

|

Recapitalizations and Changes in Control |

8 |

|

Miscellaneous Provisions |

8 |

|

United States Federal Income Tax Consequences |

8 |

|

New Plan Awards |

10 |

|

Required Vote |

10 |

|

Recommendation of the Board |

10 |

|

PROPOSAL 3 ADVISORY VOTE ON EXECUTIVE COMPENSATION |

11 |

|

Introduction |

11 |

|

Text of the Resolution to be Adopted |

12 |

|

Recommendation of the Board |

12 |

|

PROPOSAL 4 RATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTS |

13 |

|

Recommendation of the Board |

13 |

|

CORPORATE GOVERNANCE |

14 |

|

Corporate Governance Guidelines; Code of Business Conduct and Ethics |

14 |

|

Independence |

14 |

|

Board Leadership Structure |

14 |

|

Standing Committees of the Board |

14 |

|

Risk Oversight |

15 |

|

Compensation Committee Interlocks and Insider Participation |

16 |

|

Consulting Fees and Services and Conflicts of Interest |

16 |

|

Meetings of the Board and the Committees of the Board |

16 |

|

Legal Proceedings |

16 |

|

Director Nomination Process |

16 |

|

Identifying and Evaluating Nominees for Directors |

17 |

|

Director Skills Matrix |

17 |

|

Director Compensation |

17 |

|

2019 Director Compensation Table |

18 |

|

Communications with the Board |

18 |

|

CORPORATE RESPONSIBILITY |

19 |

|

Health, Safety and Environmental (HS&E) Programs |

19 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

21 |

|

Section 16(a) Beneficial Ownership Reporting Compliance |

22 |

|

EQUITY COMPENSATION PLAN INFORMATION |

23 |

|

Securities Authorized for Issuance Under Equity Compensation Plans |

23 |

|

COMPENSATION DISCUSSION AND ANALYSIS |

24 |

|

Introduction |

24 |

|

Compensation Philosophy and Objectives |

24 |

|

Role of the Compensation Committee, its Consultants and Management |

25 |

|

Market Analysis |

26 |

|

Elements and Purpose of Executive Compensation |

27 |

|

Setting Executive Compensation in 2019 |

33 |

|

Compensation Policies |

35 |

|

Employment Agreements, Severance Benefits and Change of Control Provisions |

37 |

|

Shareholder Votes on Executive Compensation |

37 |

|

2020 Compensation Decisions |

38 |

|

COMPENSATION COMMITTEE REPORT |

39 |

|

EXECUTIVE COMPENSATION AND RELATED INFORMATION |

40 |

|

Summary Compensation Table |

40 |

|

2019 Grants of Plan-Based Awards |

41 |

|

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards |

41 |

|

Percentage of Base Salary and Cash Discretionary Bonus in Comparison to Total Compensation |

42 |

|

Outstanding Equity Awards at December 31, 2019 |

42 |

|

Stock Vested Table for 2019 |

42 |

|

Potential Payments Upon Termination or a Change in Control |

43 |

|

Risk Assessment Related to our Compensation Structure |

46 |

|

Pay Ratio |

46 |

|

AUDIT COMMITTEE AND INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

48 |

|

Audit Committee Report |

48 |

|

Principal Accounting Fees and Services |

49 |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS |

50 |

|

SHAREHOLDER PROPOSALS |

50 |

|

OTHER MATTERS |

51 |

W&T OFFSHORE, INC.

Nine Greenway Plaza, Suite 300

Houston, Texas 77046

PROXY STATEMENT

2020 ANNUAL MEETING OF SHAREHOLDERS

THE ANNUAL MEETING

This proxy statement is solicited by and on behalf of the Board of Directors (the “Board” or the “Board of Directors”) of W&T Offshore, Inc. (the “Company”) for use at the 2020 Annual Meeting of Shareholders (the “Annual Meeting”) scheduled to be held on May 6, 2020 at the offices of the Company, Nine Greenway Plaza, Suite 300, Houston, Texas 77046, at 8:00 a.m., Central Daylight Time, or at any adjournments, postponements or relocations thereof. Unless the context requires otherwise, references in this proxy statement to “we,” “us,” “our” and the “Company” refer to W&T Offshore, Inc. The solicitation of proxies by the Board will be conducted primarily electronically, or by mail for those shareholders requesting paper copies of proxy materials. Officers, directors and employees of the Company may also solicit proxies personally or by telephone, e-mail or other forms of wire or facsimile communication. These officers, directors and employees will not receive any extra compensation for these services. The Company will reimburse brokers, custodians, nominees and fiduciaries for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of common stock of the Company (the “Common Stock”). The costs of the solicitation will be borne by the Company. The Company has retained Georgeson Inc. (“Georgeson”) to assist in the solicitation of proxies. On or about March 26, 2020, we will begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice of Availability”) containing instructions on how to access the proxy materials and vote online. We will make these proxy materials available to you over the Internet or, upon your request, will deliver paper copies of these materials to you by mail, in connection with the solicitation of proxies by the Board for the Annual Meeting.

We intend to hold our Annual Meeting in person. However, we are monitoring the developments regarding the coronavirus, or COVID-19, and preparing in the event any changes for our Annual Meeting are necessary or appropriate. If we determine to make any changes, such as to the location or to hold the meeting by remote communication, we will announce the change in advance and provide instructions on how shareholders can participate under the “SEC Filings” subsection of the “Investors” section of the Company’s website at www.wtoffshore.com.

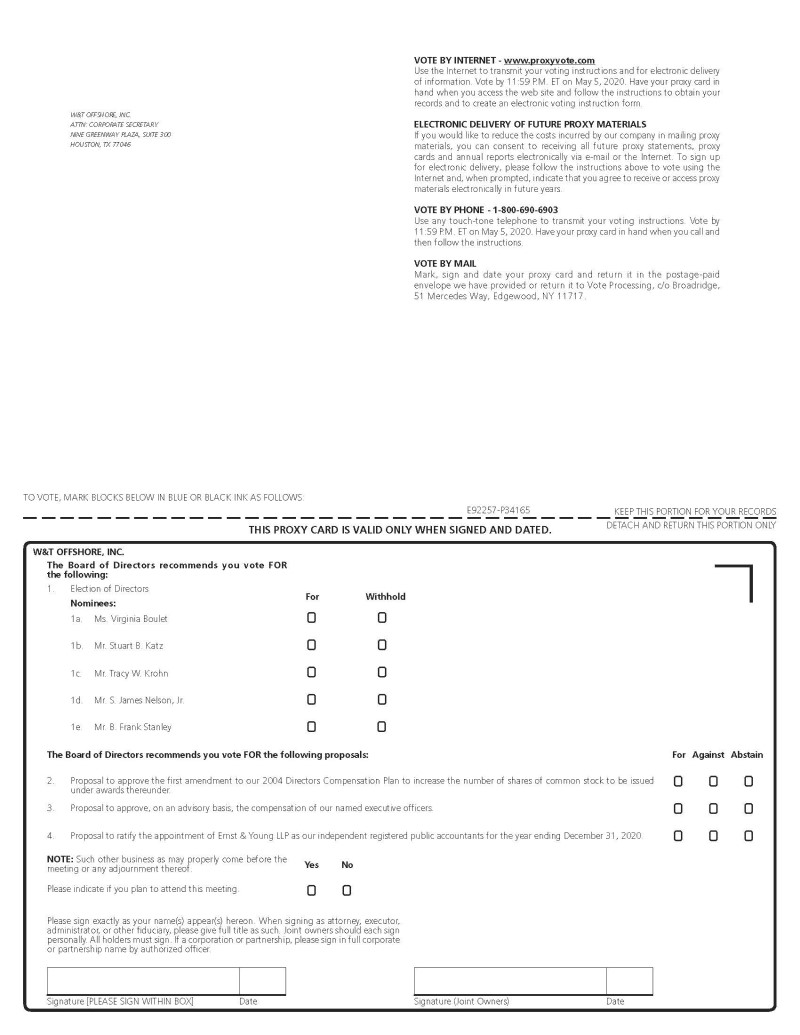

Purposes of the 2020 Annual Meeting

The purposes of the Annual Meeting are: (1) to elect five directors to hold office until the 2021 Annual Meeting of Shareholders and until their successors are duly elected and qualified; (2) to approve an amendment to our 2004 Directors Compensation Plan (as amended, the “Directors Compensation Plan”) to increase the number of authorized shares of Common Stock; (3) to approve, on an advisory basis, the compensation of the Company’s named executive officers, pursuant to Item 402 of Regulation S-K; (4) to ratify the appointment of Ernst & Young LLP as our independent registered public accountants for the year ending December 31, 2020; and (5) to transact such other business as may properly come before the meeting and any adjournment, postponement or relocation thereof. Although the Board does not anticipate that any other matters will come before the Annual Meeting, your executed proxy gives the official proxies the right to vote your shares at their discretion on any other matter properly brought before the Annual Meeting.

Voting Rights and Solicitation

Only shareholders of record at the close of business on March 19, 2020 (the “Record Date”) will be entitled to notice of and to vote at the Annual Meeting. As of the Record Date, there were 141,668,942 shares of Common Stock outstanding, each of which is entitled to one vote on any matter to come before the meeting. Common Stock is the only class of outstanding equity securities of the Company. The holders of issued and outstanding shares representing at least a majority of the outstanding shares of Common Stock, present in person or represented by proxy at the Annual Meeting, will constitute a quorum necessary to hold a valid meeting. The person who is appointed by the chairman of the meeting to be the inspector of election will treat the holders of all shares of Common Stock represented by a returned, properly executed proxy, including shares that abstain from voting, as present for purposes of determining the existence of a quorum at the Annual Meeting. Each share of Common Stock present or represented at the Annual Meeting will be entitled to one vote on any matter to come before the shareholders. If you hold your shares in “street name,” you will receive instructions from your broker or other nominee describing how to vote your shares. If you do not instruct your broker or nominee how to vote your shares, they may vote your shares as they decide as to each matter for which they have discretionary authority under the rules of the New York Stock Exchange (“NYSE”). For Proposal 4 (Ratification of the Appointment of Ernst & Young LLP) to be voted on at the Annual Meeting, brokers and other nominees will have discretionary authority in the absence of timely instructions from you.

There are also non-discretionary matters for which brokers and other nominees do not have discretionary authority to vote unless they receive timely instructions from you. For Proposal 1 (Election of Directors), Proposal 2 (Amendment to the W&T Offshore, Inc. 2004 Directors Compensation Plan) or Proposal 3 (Advisory Vote on Executive Compensation) to be voted on at the Annual Meeting, you must provide timely instructions on how the broker or other nominee should vote your shares. When a broker or other nominee does not have discretion to vote on a particular matter, you have not given timely instructions on how the broker or other nominee should vote your shares and the broker or other nominee indicates it does not have authority to vote such shares on its proxy, a “broker non-vote” results. Although any broker non-vote would be counted as present at the meeting for purposes of determining a quorum, it would be treated as not entitled to vote with respect to non-discretionary matters.

Abstentions occur when shareholders are present at the Annual Meeting but fail to vote or voluntarily withhold their vote for any of the matters upon which the shareholders are voting.

The following is a summary of the vote required to approve each proposal, as well as the effect of broker non-votes and abstentions.

|

● |

Item 1 (Election of Directors): To be elected, each nominee for election as a director must receive the affirmative vote of a plurality of all votes cast. This means that director nominees with the most votes are elected. Votes may be cast in favor of or withheld from the election of each nominee. Votes that are withheld from a director’s election will be counted toward a quorum, but will not affect the outcome of the vote on the election of a director. Broker non-votes will not be taken into account in determining the outcome of the election. |

|

● |

Item 2 (Amendment to the W&T Offshore, Inc. 2004 Directors Compensation Plan): The affirmative vote of a majority of the shares present at the meeting in person or by proxy is required in order for the amendment to be approved at the Annual Meeting. An abstention has the same effect as voting “AGAINST” the proposal and broker non-votes will not be taken into account in determining the outcome of the election. |

|

● |

Item 3 (Approval of Executive Compensation): The affirmative vote of a majority of the shares present at the meeting in person or by proxy is required to approve, by non-binding vote, executive compensation. An abstention has the same effect as voting “AGAINST” the proposal. Brokers do not have discretionary authority to vote on this proposal. Broker non-votes are not considered to be entitled to vote and do not affect the outcome. |

|

● |

Item 4 (Ratification of the Appointment of Independent Accountants): The affirmative vote of a majority of the shares present at the meeting in person or by proxy is required to ratify the appointment of our independent registered public accounting firm. An abstention has the same effect as voting “AGAINST” the proposal. Brokers have discretionary authority in the absence of timely instructions from their customers to vote on this proposal. As a result, there will be no broker non-votes with respect to this proposal. |

The Board has retained Georgeson to act as a proxy solicitor in conjunction with the Annual Meeting. We have agreed to pay Georgeson a fee of approximately $8,500, plus reasonable expenses, costs and disbursements for proxy solicitation services.

Voting Procedures

If you are a registered shareholder, you may vote your shares or submit a proxy to have your shares voted by one of the following methods:

|

● |

By Internet. You may submit a proxy electronically via the Internet, using the website listed on the Notice of Availability. Please have your Notice of Availability, which includes your personal control number, in hand when you log onto the website. Internet voting facilities will close and no longer be available on the date and time specified on the Notice of Availability. |

|

● |

By Telephone. If you request paper copies of the proxy materials by mail, you may submit a proxy by telephone using the toll-free number listed on the proxy card. Please have your proxy card in hand when you call. Telephone voting facilities will close and no longer be available on the date and time specified on the proxy card. |

|

● |

By Mail. If you request paper copies of the proxy materials by mail, you may submit a proxy by signing, dating and returning your proxy card in the pre-addressed envelope provided. |

|

● |

In Person. You may vote in person at the Annual Meeting by completing a ballot; however, attending the meeting without completing a ballot will not count as a vote. |

Revoking Your Proxy

You may revoke your proxy in writing at any time before it is exercised at the Annual Meeting by: (i) delivering to the Corporate Secretary of the Company a written notice of the revocation; (ii) signing, dating and delivering to the Corporate Secretary of the Company a proxy with a later date; or (iii) attending the Annual Meeting and voting your shares in person. Your attendance at the Annual Meeting will not revoke your proxy unless you give written notice of revocation to the Corporate Secretary of the Company before your proxy is exercised or unless you vote your shares in person at the Annual Meeting before your proxy is exercised.

Copies of the Annual Report

Upon written request, we will provide any shareholder, without charge, a copy of our annual report on Form 10-K for the year ended December 31, 2019 (the “Form 10-K”), but without exhibits. Shareholders should direct requests to W&T Offshore, Inc., Attn: Corporate Secretary, Nine Greenway Plaza, Suite 300, Houston, Texas 77046. The Form 10-K and the exhibits filed with it are available on our website, www.wtoffshore.com in the “SEC Filings” subsection of the “Investors” section. These materials do not constitute a part of the proxy solicitation material.

PROPOSAL 1

ELECTION OF DIRECTORS

Currently, the Company’s Board is composed of the following five directors: Ms. Virginia Boulet and Messrs. Stuart B. Katz, Tracy W. Krohn, S. James Nelson, Jr. and B. Frank Stanley. At the Annual Meeting, five directors are to be elected, each of whom will serve until the 2021 Annual Meeting and until his or her successor is duly elected and qualified. Each nominee has consented to be nominated and to serve if elected. If any nominee is unable to serve as a director, the shares represented by the proxies will be voted, in the absence of contrary indication, for any substitute nominee that the Board may designate or the size of the Board may be reduced. We know of no reason why any nominee would be unable to serve.

Information about the Nominees

|

Virginia Boulet, age 66, has served on the Board since March 2005. She is currently Chair of the Nominating and Corporate Governance Committee and a member of the Compensation Committee. From 2004 through 2018, Ms. Boulet was an adjunct professor of law at Loyola University Law School. Since April 2014, she has been employed as Managing Director of Legacy Capital, LLC. From 2002 to March 2014, Ms. Boulet was employed as Special Counsel to Adams and Reese, LLP, a law firm. Prior to 2002, Ms. Boulet was a partner at the law firm Phelps Dunbar, LLP. Ms. Boulet has over 20 years of experience in mergers and acquisitions, equity securities offerings, general business matters and counseling clients regarding compliance with federal securities laws and regulations. Ms. Boulet currently serves on the board of directors of CenturyLink, Inc., a telecommunications company. She also serves as chair of the nominating and corporate governance committee of CenturyLink, as well as a member of the board’s compensation committee. Service on this board and its committees has provided her the background and experience of board processes, function, exercise of diligence and oversight of management. In the past, she served as President and Chief Operating Officer of IMDiversity, Inc., an on-line recruiting company. Ms. Boulet received a B.A. in Medieval History from Yale University, and a J.D., cum laude, from Tulane University Law School. With her public company board experience and recruiting experience as president of a recruiting company, Ms. Boulet is well suited as a member of our Board, the Compensation Committee and to the Nominating and Corporate Governance Committee functions of identifying and evaluating individuals qualified to become board members and evaluating our corporate governance policies. Her legal background also provides her with a high level of technical expertise in reviewing transactions and agreements and addressing the myriad of legal issues presented to the Board. |

|

Stuart B. Katz, age 65, previously served on the Board from 2002 to 2008 and was reappointed to serve on the Board in April 2011. Mr. Katz serves on our Audit Committee, is Chairman of our Compensation Committee and also serves as Presiding Director. Since 2007, Mr. Katz has served as Chief Executive Officer and member of the board of directors of Alconox, Inc., a private company engaged in the manufacturing and marketing of specialty chemicals. From 2001 to 2010, Mr. Katz was a Managing Director of Jefferies Capital Partners (“JCP”), a private equity investment fund. In 2002, Mr. Katz joined the Board in connection with JCP’s investment in the Company. In May 2008, Mr. Katz declined to stand for reelection to the Board in connection with JCP’s divestment of its remaining equity interest in the Company. Prior to joining JCP in 2001, Mr. Katz had been an investment banker with Furman Selz LLC and its successors for over 16 years. Mr. Katz received a B.S. in engineering from Cornell University and a J.D. from Fordham Law School. Mr. Katz is a member of the bar of the State of New York. Mr. Katz brings valuable leadership and management skills as a result of his role as Chief Executive Officer of Alconox, as well as a result of his service as a member of the board of directors of a number of other companies, including other public companies. We believe that this experience, as well as the investment management experience he has gained through the ownership of controlling equity positions in connection with his activities with JCP, make him a valuable part of our Board and member of our Audit Committee and Compensation Committee. |

|

Tracy W. Krohn, age 65, has served as Chief Executive Officer since he founded the Company in 1983 and as Chairman since 2004 and was also Treasurer from 1997 until 2006. He also served as President of the Company since its founding until September 2008 and again since March 2017. During 1996 to 1997, Mr. Krohn was Chairman and Chief Executive Officer of Aviara Energy Corporation. Mr. Krohn has been actively involved in the oil and gas business since graduating with a B.S. in Petroleum Engineering from Louisiana State University in 1978. He began his career as a petroleum engineer and offshore drilling supervisor with Mobil Oil Corporation. Prior to founding the Company, from 1981 to 1983, Mr. Krohn was Senior Engineer with Taylor Energy Company. In 2013, Mr. Krohn was appointed to serve on the board of directors of the American Petroleum Institute. He also serves on the board of directors of a privately owned company. As founder of the Company, Mr. Krohn is one of the driving forces behind the Company and its success to date. Over the course of the Company’s history, Mr. Krohn has successfully grown the Company through his exceptional leadership skills and acute business judgment. |

|

S. James Nelson, Jr., age 77, has served on the Board since January 2006. He is currently Chair of the Audit Committee. In 2016, he was appointed to replace Mr. Krohn as a member of the Nominating and Corporate Governance Committee. In 2004, Mr. Nelson retired after 15 years of service from Cal Dive International, Inc. (now named Helix Energy Solutions Group, Inc.), a marine contractor and operator of offshore oil and natural gas properties and production facilities, where he was a founding shareholder, Chief Financial Officer from 1990 to 2000, Vice Chairman from 2000 to 2004 and a director from 1990 to 2004. From 1985 to 1988, Mr. Nelson was the Senior Vice President and Chief Financial Officer of Diversified Energies, Inc. and from 1980 to 1985 was the Chief Financial Officer of Apache Corporation, an oil and gas exploration and production company. From 1966 to 1980, Mr. Nelson was employed with Arthur Andersen & Co., where he became a partner in 1976. Mr. Nelson received a B.S. in Accounting from Holy Cross College and holds a M.B.A. from Harvard University. He is also a certified public accountant. Additionally, since 2004, Mr. Nelson has served on the boards of directors and audit committees of Oil States International, Inc., a diversified oilfield service company, and ION Geophysical, a seismic services provider. From 2005 until the company’s sale in 2008, he was also a member of the board of directors and compensation and audit committees of Quintana Maritime LTD, a provider of dry bulk shipping services based in Athens, Greece, and from 2010 to 2012, he served as a member of the board of directors and audit and compensation committees of Genesis Energy, LP, a midstream master limited partnership. Mr. Nelson has an extensive background in public accounting both from his time as a partner at Arthur Andersen & Co. and his time as Chief Financial Officer at various companies. Mr. Nelson’s service on audit committees of other companies enables him to remain current on audit committee best practices and current financial reporting developments within the energy industry. We believe these experiences and skills qualify him to serve as the Chair of our Audit Committee and a member of the Nominating and Corporate Governance Committee. |

|

B. Frank Stanley, age 65, has served on the Board since 2009. Mr. Stanley serves as a member of our Audit, Compensation and Nominating and Corporate Governance Committees. He is currently Co-Chief Executive Officer and Chief Financial Officer of Retail Concepts, Inc., a privately-held retail chain of 31 stores in 12 states with over seven hundred employees. Prior to joining Retail Concepts, Inc. in 1988, he was Chief Financial Officer of Southpoint Porsche Audi WGW Ltd. from 1987 to 1988. From 1985 to 1987, he was employed by KPMG Peat Marwick, holding the position of Manager, Audit in 1987. From 1983 to 1984, he was Chief Financial Officer of Design Research, Inc., a manufacturer of housing for offshore drilling platforms. From 1980 to 1982, he was Chief Financial Officer of Tiger Oilfield Rental Co., Inc. and, from 1977 to 1979, he was an accountant with Trunkline Gas Co. Mr. Stanley holds a B.B.A. in Accounting from Texas A&M University and is a certified public accountant. Mr. Stanley has an extensive background in accounting and financial matters, which qualify him for service as a member of our Board and Audit, Compensation, and Nominating and Corporate Governance Committees. |

Recommendation of the Board

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE FIVE NOMINEES LISTED ABOVE.

PROPOSAL 2

AMENDMENT TO THE W&T OFFSHORE, INC. 2004 DIRECTORS COMPENSATION PLAN

Introduction

The Board of Directors, subject to the approval of our shareholders as required under the NYSE’s rules, has approved the first amendment to the Directors Compensation Plan which would authorize us to reserve and issue an additional 500,000 shares of Common Stock beyond the number of shares previously authorized for issuance pursuant to awards under the Directors Compensation Plan.

The proposed amendment to the Directors Compensation Plan is attached hereto as Appendix A, and the Directors Compensation Plan prior to giving effect to this proposed amendment, is incorporated by reference to Exhibit 10.11 of the Company’s Registration Statement on Form S-1, filed May 3, 2004 (File No. 333-115103). Pursuant to this Proposal 2, we are requesting that our shareholders vote to approve the increase in the number of shares of Common Stock approved for issuance under the Directors Compensation Plan. If our shareholders approve this Proposal 2, we intend to file, pursuant to the Securities Act of 1933, as amended, a registration statement on Form S-8 to register the additional shares available for issuance under the Directors Compensation Plan.

Reason for Proposed Amendment and the Request for Shareholder Approval

The use of stock-based awards under the Directors Compensation Plan has been a key component of our director compensation program since its adoption in 2004. The awards granted under the Directors Compensation Plan assist us in attracting and retaining capable, talented individuals to serve in the capacity of non-employee directors.

We originally reserved 100,000 shares for issuance pursuant to the Directors Compensation Plan, which was automatically increased to 666,917 shares in connection with a 6.669173211-for-1 split of our common stock in November 2004. As of December 31, 2019, 82,620 shares remained available for us to issue as awards under the Directors Compensation Plan. We have made grants of restricted stock under our Directors Compensation Plan as part of our annual directors’ compensation program, further described below under the heading “Directors Compensation.” At the time of vesting of each grant, we have the obligation to settle the award in shares of our Common Stock. An increase in available shares is necessary to continue attracting and retaining qualified non-employee directors as well as aligning our Directors’ interests with the Company’s success, which is critical to our future value growth and governance.

If this Proposal 2 is not approved by our shareholders, the Directors Compensation Plan will continue to be effective, and there will be no impact on the rights of existing award holders under the Directors Compensation Plan. However, if this Proposal 2 is not approved by our shareholders, we do not expect to be able to issue any meaningful equity-based compensation awards pursuant to the Directors Compensation Plan in the future, and we would need to reevaluate our director compensation program in general.

Summary of the Directors Compensation Plan

The following summary provides a general description of the material features of the Directors Compensation Plan, and is qualified in its entirety by reference to the full text of the Directors Compensation Plan, prior to giving effect to the proposed amendment, incorporated by reference to Exhibit 10.11 of the Company’s Registration Statement on Form S-1, filed May 3, 2004 (File No. 333-115103). The purpose of the Directors Compensation Plan is to promote the interests of our Company and our shareholders by strengthening our ability to attract, motivate and retain directors of experience and ability, and to encourage the highest level of performance by providing our directors with a proprietary interest in our financial success and growth. While the existing Directors Compensation Plan provides for various potential awards, we have historically granted a long-term incentive to our directors utilizing restricted stock. The Directors Compensation Plan provides for grants of (i) stock options that do not qualify as incentive stock options (“Nonstatutory Options”), (ii) restricted stock awards (“Restricted Stock Awards”) and (iii) bonus stock (collectively referred to as “Awards”). Individual terms applicable to the various Awards, such as vesting or transferability, may be established by the Plan Administrator at the time of grant. Any outstanding awards in existence at the expiration date of the Directors Compensation Plan shall remain subject to the terms and conditions of the Directors Compensation Plan beyond such date.

Administration

The Compensation Committee of our Board of Directors (the “Compensation Committee” or the “Plan Administrator”) administers the Directors Compensation Plan. The Compensation Committee will consist solely of two or more directors who qualify as “outside directors” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) and “non-employee directors” under Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Plan Administrator will interpret the Directors Compensation Plan, prescribe, amend or rescind the Directors Compensation Plan’s rules and make all other determinations necessary for the Directors Compensation Plan’s administration. All determinations by the Plan Administrator which were made within the Plan Administrator’s discretion and authority regarding the Directors Compensation Plan or an individual Award shall be final and binding.

Eligibility

The four directors eligible to receive awards under the Directors Compensation Plan are the directors who are not employed by us or our subsidiaries as of December 31, 2019.

Source of Shares

Stock issued under the Directors Compensation Plan may come from authorized but unissued shares of our Common Stock or from previously issued shares of Common Stock we have acquired in the open market. If there is a forfeiture, termination or other surrender of Common Stock that underlies an Award, or our Common Stock was used to pay withholding taxes or an Option exercise price, those shares will again be available for issuance under the Directors Compensation Plan unless an applicable law or regulation prevents such re-issuance. As of March 4, 2020, the closing price of our common stock on the NYSE was $2.42.

Awards Under the Directors Compensation Plan

Options. Under the Directors Compensation Plan, the Plan Administrator may grant Nonstatutory Options to eligible persons; however, no such grants have been made to date. The exercise price of each Nonstatutory Option granted under the Directors Compensation Plan should a grant be made, will be stated in the option agreement and may vary; provided, however, that the exercise price for a Nonstatutory Option must not be less than 100% of the fair market value per share of the Common Stock as of the grant date. Nonstatutory Options may be exercised as the Plan Administrator determines. In the event that the Plan Administrator does not specify a vesting period for the award, the Nonstatutory Option will be exercised in five equal installments over a period of five years. The Plan Administrator will determine the methods and form of payment for the exercise price of a Nonstatutory Option (including, in the discretion of the Plan Administrator, payment in Common Stock or other Awards) and the methods and forms in which Common Stock will be delivered to a participant.

The Plan Administrator will determine at the time of a grant of an Option whether to require forfeiture of the Options upon a termination of service for any reason. Options will become vested upon a “Change in Control” (as defined below). Upon a termination of service, all vested but unexercised Options must be exercised within two years.

Restricted Stock Awards. A Restricted Stock Award is a grant of shares of Common Stock subject to a risk of forfeiture, restrictions on transferability and any other restrictions imposed by the Plan Administrator in its discretion. Restrictions may lapse at such times and under such circumstances as determined by the Plan Administrator. The holder of a Restricted Stock Award has rights as a shareholder, including the right to receive dividends on the Common Stock subject to the Restricted Stock Award and voting rights associated with the Common Stock underlying the Restricted Stock Award. Unless otherwise determined by the Plan Administrator, Common Stock distributed to a holder of a Restricted Stock Award in connection with a stock split or stock dividend distributed as a dividend, will be subject to restrictions and a risk of forfeiture to the same extent as the Restricted Stock Award with respect to which such Common Stock has been distributed. During the restricted period applicable to the Restricted Stock Award, the Restricted Stock Award may not be sold, transferred, pledged, hypothecated, margined or otherwise encumbered by the participant.

Bonus Stock. The Plan Administrator is authorized to grant Common Stock as a bonus, or to grant Common Stock in lieu of obligations to pay cash under the Directors Compensation Plan or under other plans or compensatory arrangements, subject to any applicable provision under Section 16 of the Exchange Act. The Plan Administrator will determine any terms and conditions applicable to grants of Common Stock.

Recapitalizations and Changes in Control

Recapitalization Adjustment

If any change is made to our capitalization, such as a stock split, stock combination, stock dividend, exchange of shares or other recapitalization, merger or otherwise, which results in an increase or decrease in the number of outstanding shares of Common Stock, appropriate adjustments will be made by the Plan Administrator as to the number and price of shares subject to an Award.

Change in Control

Upon the occurrence of a Change in Control Event (as defined within the plan), the Nonstatutory Options vest in full and become immediately exercisable, and the Restricted Stock Awards will have all restrictions immediately lapse.

Miscellaneous Provisions

Termination of Employment

Individuals must remain on the Board during the restriction period in order to retain shares of restricted stock granted under the Directors Compensation Plan. However, the Plan Administrator may, at the time of the grant, allow the restrictions to lapse with respect to a portion or portions of the restricted stock at different times during the restriction period.

Discontinuance or Amendment of the Directors Compensation Plan

Our Board of Directors may discontinue the Directors Compensation Plan, or amend the terms of the Directors Compensation Plan as permitted by applicable statutes, except that such amendment to the Directors Compensation Plan may not revoke or unfavorably alter any outstanding Award. However, the Compensation Committee does have the right to amend, alter, suspend, discontinue or terminate any Award under certain circumstances. Our Board of Directors may also not amend the Directors Compensation Plan without shareholder approval where such approval is required by Rule 16b-3 of the Exchange Act, or any other applicable law or regulation. Amendments that are required to be approved by our shareholders under the rules of any stock exchange on which our Common Stock is trading will be voted on by our shareholders at the next annual meeting following such an amendment.

Tax Withholding

Directors are responsible for the payment of all taxes associated with the grant, vesting or settlement of Awards pursuant to the Directors Compensation Plan.

United States Federal Income Tax Consequences

The following is a brief summary of certain United States federal income tax consequences of certain transactions contemplated under the Directors Compensation Plan based on federal income tax laws in effect on January 1, 2019. This summary applies to the Directors Compensation Plan as normally operated and is not intended to provide or supplement tax advice to eligible participants. The summary contains general statements based on current United States federal income tax statutes, regulations and currently available interpretations thereof. This summary is not intended to be exhaustive and does not describe state, local or foreign tax consequences or the effect, if any, of gift, estate and inheritance taxes.

Tax Consequences to Grantees under the Directors Compensation Plan

Nonstatutory Options. Participants will not realize taxable income upon the grant of a Nonstatutory Option. Upon the exercise of a Nonstatutory Option, a participant will recognize ordinary compensation income (subject to withholding) in an amount equal to the excess of (i) the amount of cash and the fair market value of the Common Stock received, over (ii) the exercise price (if any) paid therefor. A participant will generally have a tax basis in any shares of Common Stock received pursuant to the cash exercise of a Nonstatutory Option, that equals the fair market value of such shares on the date of exercise. We will generally be entitled to a deduction for federal income tax purposes that corresponds as to timing and amount with the compensation income recognized by a participant under the foregoing rules.

Under current rulings, if a participant transfers previously held shares of Common Stock in satisfaction of part or all of the exercise price of a Nonstatutory Option, no additional gain will be recognized on the transfer of such previously held shares in satisfaction of the Nonstatutory Option exercise price (although a participant would still recognize ordinary compensation income upon exercise of an Nonstatutory Option in the manner described above). Moreover, that number of shares of Common Stock received upon exercise which equals the number of shares of previously held Common Stock surrendered therefor in satisfaction of the Nonstatutory Option exercise price will have a tax basis that equals, and a capital gains holding period that includes, the tax basis and capital gains holding period of the previously held shares of Common Stock surrendered in satisfaction of the Nonstatutory Option exercise price. Any additional shares of Common Stock received upon exercise will have a tax basis that equals the amount of cash (if any) paid by the participant, plus the amount of compensation income recognized by the participant under the rules described above. If a reload option is issued in connection with a participant’s transfer of previously held Common Stock in full or partial satisfaction of the exercise price of a Nonstatutory Option, the tax consequences of the reload option will be as provided above for a Nonstatutory Option, depending on whether the reload option itself is a Nonstatutory Option.

The Directors Compensation Plan generally provides that the Awards may only be transferred according to the laws of descent and distribution; and the Directors Compensation Plan allows the Plan Administrator to permit the transfer of Awards only in limited circumstances, such as a qualified domestic relations order or to certain family members with the Plan Administrator’s prior consent.

If a participant transfers a vested Nonstatutory Option to another person and retains no interest in or power over it, the transfer is treated as a completed gift. The amount of the transferor’s gift (or generation-skipping transfer, if the gift is to a grandchild or later generation) equals the value of the Nonstatutory Option at the time of the gift. The value of the Nonstatutory Option may be affected by several factors, including the difference between the exercise price and the fair market value of the Common Stock, the potential for future appreciation or depreciation of the Common Stock, the time period of the Nonstatutory Option and the illiquidity of the Nonstatutory Option. The transferor will be subject to a federal gift tax, which will be limited by (i) the annual exclusion of $15,000 per donee (for 2020, subject to adjustment in future years), (ii) the transferor’s lifetime unified credit, or (iii) the marital or charitable deduction rules. The gifted Nonstatutory Option will not be included in the participant’s gross estate for purposes of the federal estate tax or the generation-skipping transfer tax.

This favorable tax treatment for vested Nonstatutory Options has not been extended to unvested Nonstatutory Options. Whether such consequences apply to unvested Nonstatutory Options is uncertain, and the gift tax implications of such a transfer is a risk the transferor will bear upon such a disposition.

Restricted Stock Awards. A participant will not have taxable income at the time of a grant of a Restricted Stock Award, but rather, will generally recognize ordinary compensation income at the time he receives Common Stock in settlement of the Awards in an amount equal to the fair market value of the Common Stock received. In general, a participant will recognize ordinary compensation income as a result of the receipt of Common Stock pursuant to a Restricted Stock Award in an amount equal to the fair market value of the Common Stock when such Common Stock is received; provided that, if the Common Stock is not transferable and is subject to a substantial risk of forfeiture when received, a participant will recognize ordinary compensation income in an amount equal to the fair market value of the Common Stock (i) when the Common Stock first becomes transferable or is no longer subject to a substantial risk of forfeiture, in cases where a participant does not make a valid election under Section 83(b) of the Code or (ii) when the Common Stock is received, in cases where a participant makes a valid election under Section 83(b) of the Code.

As non-employees, the directors will not be subject to withholding taxes. The directors will be responsible for all taxes associated with the grant, vesting or settlement of their Awards. The tax basis in the Common Stock received by a participant will equal the amount recognized by him or her as compensation income under the rules described in the preceding paragraph, and the participant’s capital gains holding period in those shares of Common Stock will commence on the later of the date the shares of Common Stock are received or the restrictions lapse.

Subject to the discussion immediately below, we will be entitled to a deduction for federal income tax purposes that corresponds as to timing and amount of the compensation income recognized by a participant under the foregoing rules.

Tax Consequences to our Company

In order for the amounts described above to be tax deductible, such amounts must constitute reasonable compensation for services rendered or to be rendered and must be ordinary and necessary business expenses.

New Plan Awards

The Awards that will be made to the non-employee directors under the Directors Compensation Plan are currently determined as part of our director’s compensation program. As of the date of this proposal, each non-employee director is eligible to receive, at each annual meeting of shareholders, a restricted stock grant pursuant to the Directors Compensation Plan covering shares of Common Stock of the Company having a fair market value (calculated as of the close of trading on the NYSE on the date of the annual shareholder meeting) approximately equal to $70,000. No Nonstatutory Options have ever been granted pursuant to the Directors Compensation Plan to date.

|

Name and Position |

Dollar Value ($) |

Number of Common Stock Subject to Award |

|

Virginia Boulet, Director |

$70,000 |

(1) |

|

Stuart B. Katz, Director |

$70,000 |

(1) |

|

S. James Nelson, Jr., Director |

$70,000 |

(1) |

|

B. Frank Stanley, Director |

$70,000 |

(1) |

(1) As noted above, the number of Common Stock subject to each non-employee director’s grant will be determined annually on the date of the annual shareholder meeting, which for 2020 will be held on May 6, 2020.

Required Vote

Approval of the adoption of the proposed amendment to the Directors Compensation Plan requires the affirmative vote of a majority of the shares present at the meeting in person or represented by proxy. Unless marked to the contrary, proxies received will be voted “FOR” the approval of the amendment to the Directors Compensation Plan.

Recommendation of the Board

THE BOARD RECOMMENDS YOU VOTE “FOR” APPROVAL OF THE AMENDMENT TO THE DIRECTORS COMPENSATION PLAN TO INCREASE THE SHARES OF COMMON STOCK AUTHORIZED FOR ISSUANCE UNDER OUR DIRECTORS COMPENSATION PLAN.

PROPOSAL 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

Introduction

We are asking that our shareholders provide advisory, non-binding approval of the compensation paid to our Named Executive Officers, as described in the “Compensation Discussion and Analysis” (“CD&A”) section of this proxy statement. The Board recognizes that executive compensation is an important matter for our shareholders. As described in detail in the CD&A section of this proxy statement, the Compensation Committee is tasked with the implementation of our executive compensation philosophy, and the core of that philosophy has been and continues to be to pay our executive officers based on the Company’s performance. In particular, the Compensation Committee strives to attract, as needed, and retain the best possible executive talent, to incentivize the Named Executive Officers’ efforts on our behalf in a way that supports our financial performance objectives and business strategy, and to align their incentives with enhancement of shareholder value. To do so, the Compensation Committee uses a combination of short- and long-term incentive compensation to reward near-term excellent performance and to encourage executives’ commitment to our long-range, strategic business goals. It is always the intention of the Compensation Committee that our executive officers be compensated competitively and consistently with our strategy, sound corporate governance principles, and shareholder interests and concerns.

As described in the CD&A section of this proxy statement, we believe our compensation program is effective, appropriate and strongly aligned with the long-term interests of our shareholders and that the total compensation packages provided to the Named Executive Officers (including potential payouts upon a termination or change of control) are reasonable and not excessive. As you consider this Proposal 3, we urge you to read the CD&A section of this proxy statement for additional details on executive compensation, including more detailed information about our compensation philosophy and objectives and the past compensation of our Named Executive Officers, and to review the tabular disclosures regarding compensation of our Named Executive Officers together with the accompanying narrative disclosures in the “Executive Compensation and Related Information” section of this proxy statement. Among the program features incorporated by the Compensation Committee to align with our executive compensation philosophy with the long-term interests of our shareholders are the following:

|

● |

equity-based awards generally incorporate a three-year vesting period to emphasize long-term performance and executive officer commitment; |

|

● |

our annual incentive cash awards incorporate numerous financial and/or strategic performance metrics in order to properly balance risk with the incentives to drive our key annual financial and/or strategic initiatives and impose maximum payouts to further manage risk and the possibility of excessive payments; and |

|

● |

we have focused our executives on long-term shareholder value creation through our use of equity-based awards, including our RSUs. |

We believe that the shareholders, by voting for directors individually as described in Proposal 1, have had a clear ability to express their approval or disapproval of the performance of our directors and, specifically the directors serving on the Compensation Committee; however, in 2010, Congress enacted the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Act”), which requires, among other things, a non-binding advisory “say-on-pay” vote and gives our shareholders the opportunity to express their views on our Named Executive Officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers and the philosophy, policies and practices described in this proxy statement.

As an advisory vote, Proposal 3 is not binding on the Board or the Compensation Committee, will not overrule any decisions made by the Board or the Compensation Committee, or require the Board or the Compensation Committee to take any action. Although the vote is non-binding, the Board and the Compensation Committee value the opinions of our shareholders, and will carefully consider the outcome of the vote when making future compensation decisions for executive officers. In particular, to the extent there is any significant vote against the compensation of our Named Executive Officers as disclosed in this proxy statement, we will consider our shareholders’ concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns.

In prior years, the Board decided to hold the advisory vote to approve the compensation paid to our Named Executive Officers every three years. The Board has determined that it is in the best interest of the Company and its shareholders to hold an advisory vote to approve the compensation paid to our Named Executive Officers on an annual basis going forward.

Text of the Resolution to be Adopted

We are asking shareholders to vote “FOR” the following resolution:

“RESOLVED, that the Company’s shareholders approve, on an advisory basis, the compensation of the Named Executive Officers, as disclosed in the Company’s Proxy Statement for the 2020 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the 2019 Summary Compensation Table and the other related tables and disclosure.”

Recommendation of the Board

THE BOARD RECOMMENDS YOU VOTE “FOR” THE APPROVAL OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS.

PROPOSAL 4

RATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTS

The Audit Committee of the Board (the “Audit Committee”) appointed Ernst & Young LLP (“EY”), independent registered public accountants, to audit our consolidated financial statements as of and for the year ending December 31, 2020. We are advised that no member of EY has any direct or material indirect financial interest in our Company or, during the past three years, has had any connection with us in the capacity of promoter, underwriter, voting trustee, director, officer or employee.

If the appointment is not ratified, the Audit Committee will consider the appointment of other independent registered public accountants. A representative of EY is expected to be present at the Annual Meeting, will be offered the opportunity to make a statement if the representative desires to do so and will be available to respond to appropriate questions.

Recommendation of the Board

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF EY AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS.

CORPORATE GOVERNANCE

Corporate Governance Guidelines; Code of Business Conduct and Ethics

A complete copy of the Company’s corporate governance guidelines, which the Board reviews at least annually, is posted under the “Governance—Governance Documents” subsection of the “Investors” section of the Company’s website at www.wtoffshore.com and is available in print to any shareholder who requests it. The Board has adopted a Code of Business Conduct and Ethics that applies to all employees, officers and directors. A complete updated version copy of the Code of Business Conduct and Ethics is posted on the Company’s website at www.wtoffshore.com and is available in print to any shareholder who requests it. Any amendments to the Code of Business Conduct and Ethics will be posted on the Company’s website at www.wtoffshore.com under the “Governance—Governance Documents” subsection of the “Investors” section.

Independence

After reviewing the qualifications of our current directors and nominees, and any relationships they may have with the Company that might affect their independence, the Board has determined that each director and nominee, other than Mr. Krohn, is “independent” as that concept is defined by the NYSE’s Listed Company Manual. In making the determinations of director independence, the Board considered the relationship described below.

Board Leadership Structure

Tracy W. Krohn serves as the Company’s Chairman, Chief Executive Officer and President and controls approximately 33.0% of the outstanding shares of Common Stock. The Board believes its leadership structure is justified by the efficiencies of having the Chief Executive Officer and President also serve in the role of Chairman of the Board, as well as due to Mr. Krohn’s role in founding the Company and his significant ownership interest in the Company. Stuart B. Katz is the independent director who has been elected to serve as the presiding director of the Board.

Standing Committees of the Board

The Board has three standing committees—the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee.

Audit Committee

Messrs. Nelson, Katz and Stanley sit on the Company’s Audit Committee. Mr. Nelson is Chair of the Audit Committee. The Board has determined that each of Messrs. Nelson, Katz and Stanley are “independent” under the standards of both the NYSE and Section 10A of the Exchange Act and are financially literate and Mr. Nelson has been designated as the “audit committee financial expert,” as defined under Item 407 of Regulation S-K promulgated under the Exchange Act.

The Audit Committee establishes the scope of and oversees the annual audit, including recommending the independent registered public accountants that audit the Company’s financial statements and approving any other services provided by the independent registered public accountants. The Audit Committee also assists the Board in fulfilling its oversight responsibilities by (1) overseeing the Company’s system of financial reporting, auditing, controls and legal compliance, (2) overseeing the operation of such system and the integrity of the Company’s financial statements, overseeing the qualifications, independence and performance of the outside auditors and any internal auditors who the Company may engage, and (3) periodically reporting to the Board concerning the activities of the Audit Committee. In performing its obligations, it is the responsibility of the Audit Committee to maintain free and open communication between it, the Company’s independent auditors, the internal audit function and the management of the Company. The Audit Committee’s functions are further described under the heading “Audit Committee and Independent Registered Public Accounting Firm—Audit Committee Report.” A copy of the Audit Committee’s Charter is posted under the “Governance—Governance Documents” subsection of the “Investors” section of the Company’s website at www.wtoffshore.com and is available in print to any shareholder who requests it.

Nominating and Corporate Governance Committee

Ms. Boulet and Messrs. Nelson and Stanley serve as members of the Nominating and Corporate Governance Committee of the Board. Ms. Boulet is Chair of the Nominating and Corporate Governance Committee. All of these individuals qualify as (i) independent under NYSE listing standards, Section 10C of the Exchange Act, and the Company’s corporate governance guidelines, (ii) ”non-employee directors” under Rule 16b-3 promulgated under the Exchange Act and (iii) “outside directors” under Section 162(m). The purpose of the Nominating and Corporate Governance Committee is to nominate candidates to serve on the Board and to recommend director compensation. Once the Nominating and Corporate Governance Committee has recommended director compensation, the Board accepts or rejects the recommendation. The factors and processes used to select potential nominees are more fully described in the section entitled “—Identifying and Evaluating Nominees for Directors.” The Nominating and Corporate Governance Committee is also responsible for monitoring a process to annually assess Board effectiveness, developing and implementing corporate governance guidelines and taking a leadership role in regulating the corporate governance of the Company. A copy of the Nominating and Corporate Governance Committee’s Charter is posted under the “Governance—Governance Documents” subsection of the “Investors” section of the Company’s website at www.wtoffshore.com and is available in print to any shareholder who requests it.

Compensation Committee

Ms. Boulet and Messrs. Katz and Stanley serve as members of the Compensation Committee. Mr. Katz is the Chair of the Compensation Committee. All of these individuals qualify as (i) independent under NYSE listing standards, Section 10C of the Exchange Act, and the Company’s corporate governance guidelines, (ii) ”non-employee directors” under Rule 16b-3 promulgated under the Exchange Act and (iii) “outside directors” under Section 162(m).

The Compensation Committee performs an annual review of the compensation and benefits of the executive officers and senior management, establishes and reviews general policies related to employee compensation and benefits and administers the W&T Offshore, Inc. Amended and Restated Incentive Compensation Plan, as amended (the “Incentive Compensation Plan”) and the Directors Compensation Plan. Under the terms of its charter, the Compensation Committee also determines the compensation for Mr. Krohn, the Chief Executive Officer and President of the Company. The Compensation Committee has the power to delegate some or all of its power and authority in administering the Incentive Compensation Plan of the Company to the Chief Executive Officer, other senior members of management or committee or subcommittee, as the Committee deems appropriate; however, the Compensation Committee may not delegate its authority to an individual with regard to any matter or action under the Incentive Compensation Plan for an officer that is subject to Section 16 of the Exchange Act. If you would like additional information on the responsibilities of the Compensation Committee, please refer to its charter, which is available on our website at www.wtoffshore.com under the “Governance—Governance Documents” subsection of the “Investors” section of our website and is available in print to any shareholder who requests it.

Risk Oversight

Our Board oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance shareholder value. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. The involvement of the full Board in setting the Company’s business strategy is a key part of its assessment of management’s tolerance for risk and also a determination of what constitutes an appropriate level of risk for the Company.

While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. In particular, the Audit Committee focuses on financial risk, including internal controls, and receives an annual risk assessment report from the Company’s internal auditors. In addition, in setting compensation, the Compensation Committee strives to create incentives that encourage a level of risk-taking behavior consistent with the Company’s business strategy.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee are set forth above. The Compensation Committee is comprised entirely of independent directors. In addition, none of the Company’s executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Board or Compensation Committee.

Consulting Fees and Services and Conflicts of Interest

The Compensation Committee selects our compensation consultants and other Compensation Committee advisors taking into consideration the factors identified by the SEC rules and regulations and the NYSE listing standards. At the August 2018 meeting of the Compensation Committee, the Compensation Committee elected to continue to utilize Meridian Compensation Partners, LLC as the Company’s executive compensation consultant for 2019. Other than services involving only broad-based non-discriminatory plans or providing survey information, neither our current nor our prior compensation consultant provided non-executive compensation consulting services to the Company in an amount in excess of $120,000 in 2019. The Compensation Committee has concluded that the work of our compensation consultants has not raised any conflict of interest. Please read “Compensation Discussion and Analysis—Role of the Compensation Committee, its Consultants and Management” for more information about the role of our compensation consultant in our executive compensation programs.

Meetings of the Board and the Committees of the Board

During 2019, the Board held five meetings, the Compensation Committee held eight meetings, the Nominating and Corporate Governance Committee held one meeting and the Audit Committee held four meetings. All of the directors attended all meetings of the Board and all meetings of the committees on which they served during 2019.

The Company’s directors are encouraged to attend the Annual Meeting, but the Company does not otherwise have a policy regarding such attendance. All directors were present at the Annual Meeting held in 2019.

Legal Proceedings

Currently, no director or executive officer, to our knowledge, is a party to any material legal proceeding adverse to the interests of the Company. Additionally, to our knowledge no director or executive officer has a material interest in a material proceeding adverse to the Company.

Director Nomination Process

The Nominating and Corporate Governance Committee will consider all properly submitted shareholder recommendations of candidates for election to the Board. Pursuant to Section 12 of the Company’s Bylaws, any shareholder may nominate candidates for election to the Board by giving timely notice of the nomination to the Corporate Secretary of the Company. The Company’s Bylaws require that any such shareholder must be a shareholder of record at the time it gives notice of the nomination. To be considered a timely nomination, the shareholder’s notice must be delivered to the Corporate Secretary at the Company’s principal office no later than 90 days prior to the first anniversary of the preceding year’s Annual Meeting and no earlier than 120 days prior to the first anniversary of the preceding year’s Annual Meeting. In evaluating the recommendations of the shareholders for director nominees, as with all other possible director nominees, the Nominating and Corporate Governance Committee will address the criteria set forth below under the heading “—Identifying and Evaluating Nominees for Directors.”

Any shareholder recommendations for director nominees should include the candidate’s name, qualifications and written consent to being named in the proxy statement and to serving on the Board if elected. The shareholder must also include any other business that the shareholder proposes to bring before the meeting, the reasons for conducting such business at the meeting, any material interest in such business of such shareholder and the beneficial owner, if any, on whose behalf the proposal is made. Additionally, the shareholder must provide his name and address, the name and address of any beneficial owner on whose behalf the shareholder is acting and the number of shares of Common Stock beneficially owned by the shareholder and any beneficial owner for whom the shareholder is acting. Such written notice should be sent to:

Shahid A. Ghauri, Esq.

Corporate Secretary

W&T Offshore, Inc.

Nine Greenway Plaza, Suite 300

Houston, Texas 77046

Identifying and Evaluating Nominees for Directors

The Nominating and Corporate Governance Committee is responsible for leading the search for individuals qualified to serve as directors. The Nominating and Corporate Governance Committee evaluates candidates for nomination to the Board, including those recommended by shareholders, and conducts appropriate inquiries into the backgrounds and qualifications of possible candidates. The Nominating and Corporate Governance Committee then recommends nominees to the Board to be presented for election as directors at meetings of the shareholders or of the Board. As indicated above, shareholders may recommend possible director nominees for consideration to the Nominating and Corporate Governance Committee.

In evaluating nominees to serve as directors on the Board and in accordance with the Company’s Corporate Governance Guidelines, the Nominating and Corporate Governance Committee selects candidates with the appropriate skills and characteristics required of Board members. Pertinent to this inquiry is the following non-exhaustive list of factors: independent business or professional experience; integrity and judgment; records of public service; ability to devote sufficient time to the affairs of the Company; diversity of background, experience and competencies that the Board desires to have represented; age; skills; occupation; and understanding of financial statements and financial reporting systems.

The Nominating and Corporate Governance Committee will also consider and weigh these factors in light of the current composition and needs of the Board.

Director Skills Matrix

Currently, our Board embodies a diverse set of experiences, qualifications, attributes and skills as shown below:

|

Executive Leadership |

Financial |

Energy/ Oilfield Services |

International Operations |

Past or Present CEO |

Past or Present CFO |

Outside Board Experience |

||||||||

|

Virginia Boulet |

✔ |

✔ |

||||||||||||

|

Stuart B. Katz |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

||||||||

|

Tracy W. Krohn |

✔ |

✔ |

✔ |

✔ |

✔ |

|||||||||

|

S. James Nelson |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

||||||||

|

B. Frank Stanley |

✔ |

✔ |

✔ |

✔ |

✔ |

Director Compensation

Directors who are also employees of the Company receive no additional compensation for serving as directors or committee members. The Board and shareholders adopted the Directors Compensation Plan, which provides that the Compensation Committee may grant stock options or restricted or unrestricted stock to non-employee directors. A total of 666,917 shares of Common Stock were initially reserved for issuance under the Directors Compensation Plan; as of December 31, 2019, a total of 82,620 shares remain available for issuance under the Directors Compensation Plan. If Proposal 2 (Amendment to the W&T Offshore, Inc. 2004 Directors Compensation Plan) is approved, a total of 582,620 shares will be available for issuance under the Directors Compensation Plan.

We provide each of the non-employee directors of the Company the following compensation:

(i) an annual retainer of $110,000, payable in equal quarterly installments;

(ii) at each annual meeting of shareholders, a restricted stock grant pursuant to the Company’s Directors Compensation Plan covering shares of Common Stock of the Company having a fair market value (calculated as of the close of trading on the NYSE on the date of the annual meeting of shareholders) equal to $70,000;

(iii) compensation of $1,500 for each meeting of the Board or any Board committee meeting attended;

(iv) compensation of $1,000 for each Board unanimous written consent executed;

(v) compensation of $1,500 for each day that a Board member attends a seminar (up to two seminars a year) concentrating on matters relating to responsibilities of Board members;

(vi) compensation of $5,000 each year for serving on any committee of the Board (except Chair of the Audit Committee);

(vii) compensation of $5,000 each year for serving as chair of any committee of the Board (except Chair of the Audit Committee);

(viii) compensation of a one-time fee of $10,000 for serving on any Special Committee of the Board that may be formed; and

(ix) compensation of $15,000 each year for serving as Chair of the Audit Committee.