UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a – 6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

W&T Offshore, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

April 17, 2009

Dear Shareholder:

It is my pleasure to invite you to the 2009 Annual Meeting of Shareholders of W&T Offshore, Inc. to be held on Monday, May 4, 2009 at 9:00 a.m., Central Daylight Time, at the Houston City Club, One City Club Drive, Houston, Texas 77046. I hope you will be able to attend.

Details of the business to be conducted at the Annual Meeting are provided in the attached Notice of Annual Meeting and Proxy Statement. Additionally, enclosed with the proxy materials is our Annual Report on Form 10-K.

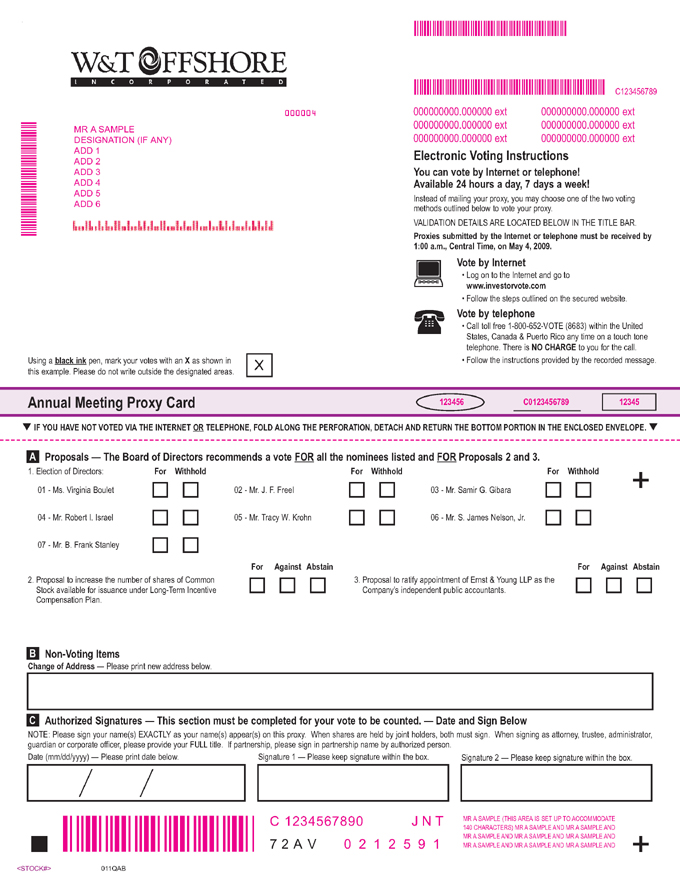

You received with this booklet a proxy card that indicates the number of votes that you will be entitled to cast at the meeting according to our records or the records of your broker or other nominee. Our board of directors has determined that owners of record of our Common Stock at the close of business on March 25, 2009 are entitled to notice of, and have the right to vote at, the Annual Meeting and any reconvened meeting following any adjournment or postponement of the meeting.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. Therefore, I urge you to promptly vote and submit your proxy by signing, dating and returning the enclosed proxy card in the enclosed envelope. If you decide to attend the Annual Meeting, you will be able to vote in person, even if you have previously submitted your proxy.

On behalf of the Board of Directors and our employees, I would like to express my appreciation for your continued interest in our affairs. I look forward to greeting as many of you as possible at the meeting.

Sincerely,

Tracy W. Krohn

Chairman of the Board and

Chief Executive Officer

Nine Greenway Plaza, Suite 300

Houston, Texas 77046

Phone (713) 626-8525

NOTICE OF 2009 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 4, 2009

Notice is hereby given that the 2009 Annual Meeting of Shareholders of W&T Offshore, Inc., a Texas corporation, will be held at the Houston City Club, One City Club Drive, Houston, Texas 77046 on May 4, 2009 at 9:00 a.m. Central Daylight Time for the following purposes:

| (1) | to elect seven (7) directors to hold office until the 2010 Annual Meeting of Shareholders and until their successors are duly elected and qualified; |

| (2) | to authorize the reservation of 2,000,000 additional shares of our Common Stock for issuance under our Long-Term Incentive Compensation Plan; |

| (3) | to ratify the appointment of Ernst & Young LLP as our independent registered public accountants for the year ending December 31, 2009; and |

| (4) | to transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

Only shareholders of record at the close of business on March 25, 2009 will be entitled to notice of, and to vote at, the Annual Meeting, or any adjournment or postponement thereof, notwithstanding the transfer of any shares after such date. A list of these shareholders will be open for examination by any shareholder at the Annual Meeting, and for ten days prior thereto at our principal executive offices at Nine Greenway Plaza, Suite 300, Houston, Texas 77046.

By Order of the Board of Directors,

J. F. Freel

Chairman Emeritus and Secretary

Houston, Texas

April 17, 2009

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE SHAREHOLDERS MEETING TO BE HELD ON MAY 4, 2009

The Proxy Statement and our Annual Report to Shareholders are also available on our website at www.wtoffshore.com.

PLEASE SIGN AND RETURN THE ENCLOSED PROXY CARD TO US, WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING IN PERSON. SHAREHOLDERS WHO ATTEND THE 2009 ANNUAL MEETING MAY REVOKE THEIR PROXIES AND VOTE IN PERSON.

Nine Greenway Plaza, Suite 300

Houston, Texas 77046

Phone (713) 626-8525

| 1 | ||

| 1 | ||

| 1 | ||

| 3 | ||

| PROPOSAL 2 AMENDMENT TO LONG-TERM INCENTIVE COMPENSATION PLAN |

5 | |

| PROPOSAL 3 RATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTS |

13 | |

| 15 | ||

| Corporate Governance Guidelines; Code of Business Conduct and Ethics |

15 | |

| 15 | ||

| 15 | ||

| 17 | ||

| 17 | ||

| 17 | ||

| 17 | ||

| 18 | ||

| 18 | ||

| 19 | ||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

20 | |

| 21 | ||

| 22 | ||

| 22 | ||

| Role of the Compensation Committee, its Consultant and Management |

22 | |

| 23 | ||

| 25 | ||

| 26 | ||

| 27 | ||

| 28 | ||

| 28 | ||

| 28 | ||

| 29 | ||

| Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards |

29 | |

| 30 | ||

| 31 | ||

| 31 | ||

| 36 | ||

| 37 | ||

| 37 |

W&T OFFSHORE, INC.

Nine Greenway Plaza, Suite 300

Houston, Texas 77046

PROXY STATEMENT

2009 ANNUAL MEETING OF SHAREHOLDERS

This proxy statement is solicited by and on behalf of the Board of Directors (the “Board”) of W&T Offshore, Inc. for use at the 2009 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on May 4, 2009 at the Houston City Club, One City Club Drive, Houston, Texas 77046, at 9:00 a.m. Central Daylight Time, or at any adjournments or postponements thereof. Unless the context requires otherwise, references in this Proxy to “we,” “us,” “our” and the “Company” refer to W&T Offshore, Inc. The solicitation of proxies by the Board of Directors will be conducted primarily by mail. Additionally, officers, directors and employees of the Company may solicit proxies personally or by telephone, e-mail or other forms of wire or facsimile communication. These officers, directors and employees will not receive any extra compensation for these services. The Company will reimburse brokers, custodians, nominees and fiduciaries for reasonable expenses incurred by them in forwarding proxy material to beneficial owners of common stock of the Company (the “Common Stock”). The costs of the solicitation will be borne by the Company. This proxy statement and the form of proxy are first being mailed to shareholders of the Company on or about April 17, 2009.

Purposes of the 2009 Annual Meeting

The purposes of the 2009 Annual Meeting are: (1) to elect seven directors to the Board of Directors of the Company; (2) to authorize the reservation of 2,000,000 additional shares of Common Stock for issuance under our Long-Term Incentive Compensation Plan; (3) to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accountants for the year ending December 31, 2009; and (4) to transact such other business as may properly come before the meeting and any adjournment or postponement thereof. Although the Board does not anticipate that any other matters will come before the 2009 Annual Meeting, your executed proxy gives the official proxies the right to vote your shares at their discretion on any other matter properly brought before the Annual Meeting.

Voting Rights and Solicitation

Only shareholders of record at the close of business on March 25, 2009 (the “Record Date”) will be entitled to notice of and to vote at the 2009 Annual Meeting. As of the Record Date, there were 76,820,173 shares of Common Stock outstanding, each of which is entitled to one vote on any matter to come before the meeting. Common Stock is the only class of outstanding securities of the Company. The holders of issued and outstanding shares representing at least a majority of the outstanding shares of Common Stock, present in person or represented by proxy at the Annual Meeting, will constitute a quorum necessary to hold a valid meeting. The person who is appointed by the chairman of the meeting to be the judge of election will treat the holders of all shares of Common Stock represented by a returned, properly executed proxy, including shares that abstain from voting, as present for purposes of determining the existence of a quorum at the Annual Meeting. Each share of Common Stock present or represented at the Annual Meeting will be entitled to one vote on any matter to come before the shareholders.

If you hold your shares in “street name,” you will receive instructions from your brokers or other nominees describing how to vote your shares. If you do not instruct your brokers or nominees how to vote your shares, they

1

may vote your shares as they decide as to each matter for which they have discretionary authority under the rules of the New York Stock Exchange. For Proposals 1 (Election of Directors) and 3 (Ratification of the Appointment of Ernst & Young LLP) to be voted on at the Annual Meeting, brokers and other nominees will have discretionary authority in the absence of timely instructions from you.

There are also non-discretionary matters for which brokers and other nominees do not have discretionary authority to vote unless they receive timely instructions from you. For Proposal 2 (Amendment to the Long-Term Incentive Plan) to be voted on at the Annual Meeting, you must provide timely instructions on how the broker or other nominee should vote your shares. When a broker or other nominee does not have discretion to vote on a particular matter, you have not given timely instructions on how the broker or other nominee should vote your shares and the broker or other nominee indicates it does not have authority to vote such shares on its proxy, a “broker non-vote” results. Although any broker non-vote would be counted as present at the meeting for purposes of determining a quorum, it would be treated as not entitled to vote with respect to non-discretionary matters.

Abstentions occur when stockholders are present at the Annual Meeting but fail to vote or voluntarily withhold their vote for any of the matters upon which the stockholders are voting.

| • | Item 1 (Election of Directors): To be elected, each nominee for election as a director must receive the affirmative vote of a plurality of the votes of our Common Stock, present in person or represented by proxy at the meeting and entitled to vote on the proposal. This means that director nominees with the most votes are elected. Votes may be cast in favor of or withheld from the election of each nominee. Votes that are withheld from a director’s election will be counted toward a quorum, but will not affect the outcome of the vote on the election of a director. |

| • | Item 2 (Amendment to the W&T Offshore, Inc. Long-Term Incentive Plan): A majority of the votes represented at the Annual Meeting must be cast “FOR” the amendment to the Long-Term Incentive Plan in order for the amendment to be approved at the Annual Meeting. In addition, NYSE rules require that the total votes cast on this proposal must represent greater than 50% of all the shares entitled to vote on this proposal. That is, the total number of votes cast “for” and “against” the proposal must exceed 50% of the outstanding shares. An abstention has the same effect as voting “AGAINST” the proposal and broker non-votes are not counted for purposes of determining whether a majority has been achieved. |

| • | Item 3 (Ratification of the Appointment of Ernst & Young LLP): Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2009 requires the affirmative vote of the holders of a majority of the votes of our Common Stock cast at the Annual Meeting with respect to the proposal. Abstentions and broker non-votes will not have an impact on the outcome of the vote on the proposal. |

The Board of Directors is soliciting your proxy on the enclosed proxy card to provide you with an opportunity to vote on the matters described in this proxy statement, whether or not you attend in person. If you execute and return the enclosed proxy card, your shares will be voted as you specify. If you make no specifications, your shares will be voted in accordance with the Board’s recommendations. If you submit a proxy card, you may subsequently revoke it by submitting a revised proxy card or a written revocation at any time before your original proxy is voted. You may also attend the Annual Meeting in person and vote by ballot, which would effectively cancel any proxy you previously gave.

2

ELECTION OF DIRECTORS

Currently, the Company’s Board of Directors is composed of six directors, Messrs. Tracy W. Krohn, J. F. Freel, Samir G. Gibara, S. James Nelson, Jr., Robert I. Israel and Ms. Virginia Boulet. At the Annual Meeting, seven directors are to be elected, each of whom will serve until the 2010 Annual Meeting and until his or her successor is duly elected and qualified.

The Board has nominated and, unless authority to vote is withheld or otherwise properly instructed, the persons named as official proxies on the enclosed proxy card intend to and will vote “FOR” the election of the following individuals as members of the Board of Directors: Ms. Virginia Boulet and Messrs. J. F. Freel, Samir G. Gibara, Robert I. Israel, Tracy W. Krohn, S. James Nelson, Jr. and B. Frank Stanley. Each nominee has consented to be nominated and to serve if elected.

Information about the Nominees

|

Virginia Boulet, age 55, has served on the Board of Directors of the Company since March 2005. She is currently Chair of the Nominating and Corporate Governance Committee. She has been employed as Special Counsel to Adams and Reese, LLP, a law firm, since 2002. She is also an adjunct professor of law at Loyola University Law School. Prior to 2002, Ms. Boulet was a partner at the law firm Phelps Dunbar, LLP. Additionally, she serves on the board of directors of CenturyTel, Inc., a telecommunications company. In the past, she served as President and Chief Operating Officer of IMDiversity, Inc., an on-line recruiting company. Ms. Boulet received a B.A. in Medieval History from Yale University, and a J.D., cum laude, from Tulane University Law School. | |

|

J. F. Freel, age 96, has served as a director since the Company’s founding in 1983 and Secretary of the Company since 1984. Mr. Freel has been actively involved in the oil and natural gas business since 1934, first as a geophysicist for eleven years with the Humble Oil and Refining Company (“Humble”), then, in 1945, as founder and president of Research Explorations, Inc., a geophysical survey contractor to major oil companies, including Humble, until it was sold in 1963. In 1964, he became founder and president of Kiowa Minerals Company (“Kiowa”), a company that engaged in development drilling operations in Texas and Louisiana. Since 1983, Kiowa has not been active in oil and natural gas operations. Mr. Freel is married to Mr. Krohn’s mother. | |

|

Samir G. Gibara, age 69, has served on the Board of Directors of the Company since May 2008. Mr. Gibara is a private investor and has been since his retirement from his position as Chairman of the Board of The Goodyear Tire & Rubber Company (“Goodyear”). He also served as CEO of Goodyear from 1996 through 2002. Mr. Gibara is a graduate of Cairo University and holds a M.B.A. from Harvard University. Mr. Gibara also attended the Kellogg Graduate School of Management at Northwestern University. He has served on the boards of directors of Goodyear, Sumitomo Rubber Industries, International Paper Company and Dana Corp. He currently serves on the board of directors of International Paper Company and is a member of its Audit, Compensation and Nominating Committees. | |

3

|

Robert I. Israel, age 59, has served on the Board of Directors of the Company since 2007. He is currently a Partner at Compass Advisers, LLP, a private equity and investment banking firm. Prior to joining Compass in 2000, he was the head of the Energy Department of Schroder & Co., Inc. from 1990 to 2000. Additionally, he serves on the board of Randgold Resources Limited, an African-based gold mining company, and several non-public energy related companies. Mr. Israel holds a M.B.A. from Harvard University and a B.A. from Middlebury College. | |

|

Tracy W. Krohn, age 54, has served as Chief Executive Officer (“CEO”) since he founded the Company in 1983, as President from 1983 until 2008, as Chairman of the Board since 2004 and as Treasurer from 1997 until 2006. Mr. Krohn has been actively involved in the oil and gas business since graduating with a B.S. in Petroleum Engineering from Louisiana State University in 1978. He began his career as a petroleum engineer and offshore drilling supervisor with Mobil Oil Corporation. Prior to founding the Company, from 1982 to 1983, Mr. Krohn was senior engineer with Taylor Energy. From 1996 to 1997, Mr. Krohn was also Chairman and CEO of Aviara Energy Corporation in Houston, Texas. Mr. Krohn’s mother is married to Mr. Freel. | |

|

S. James Nelson, Jr., age 66, has served on the Board of Directors of the Company since January 2006. He is currently Chair of the Audit Committee and the Compensation Committee and also serves as Presiding Director. In 2004 Mr. Nelson retired after 15 years of service, from Cal Dive International, Inc. (now known as Helix Energy Solutions Group, Inc.), a marine contractor and operator of offshore oil and natural gas properties and production facilities, where he was a founding shareholder, Chief Financial Officer from 1990 to 2000, Vice Chairman from 2000 to 2004 and a director. From 1985 to 1988, Mr. Nelson was the Senior Vice President and Chief Financial Officer of Diversified Energies, Inc., and from 1980 to 1985 was the Chief Financial Officer of Apache Corporation, an oil and gas exploration and production company. From 1966 to 1980, Mr. Nelson was employed with Arthur Andersen & Co., where he became a partner in 1976. Mr. Nelson is also a certified public accountant. Additionally, Mr. Nelson serves on the boards of directors and audit committees of Oil States International, Inc., a diversified oilfield service company, and ION Geophysical (formerly Input/Output, Inc.), a seismic services provider. From 2005 until the company’s sale in 2008, he was also a member of the Board of Directors, compensation committee and audit committee of Quintana Maritime LTD, a provider of dry bulk shipping services based in Athens, Greece. Mr. Nelson received a B.S. in Accounting from Holy Cross College and holds a M.B.A. from Harvard University. | |

|

B. Frank Stanley, age 54, has been nominated to the Board of Directors to fill the seventh seat. He is currently President and Chief Financial Officer of Retail Concepts, Inc., a privately-held retail chain of 21 stores in 10 states. Prior to joining Retail Concepts, Inc. in 1988, he was Chief Financial Officer of Southpoint Porsche Audi WGW Ltd. from 1987 to 1988. From 1985 to 1987, he was employed by KPMG Peat Marwick, holding the position of Manager, Audit in 1987. From 1983 to 1984, he was Chief Financial Officer of Design Research, Inc., a manufacturer of housing for offshore drilling platforms. From 1980 to 1982, he was Chief Financial Officer of Tiger Oilfield Rental Co., Inc. and from 1977 to 1979, he was an accountant with Trunkline Gas Co. Mr. Stanley holds a B.B.A. in Accounting from Texas A&M University and is a certified public accountant. |

Recommendation of the Board of Directors

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE SEVEN NOMINEES LISTED ABOVE.

4

AMENDMENT TO LONG-TERM INCENTIVE COMPENSATION PLAN

Introduction

The Board of Directors, subject to the approval of our shareholders as required under the NYSE’s rules, has approved a third amendment to the W&T Offshore, Inc. Long-Term Incentive Compensation Plan (the “Incentive Compensation Plan”), which would authorize us to reserve up to an additional 2,000,000 shares of Common Stock beyond the number of shares initially authorized for issuance under the Incentive Compensation Plan. If our shareholders approve this proposal, we intend to file, pursuant to the Securities Act of 1933, as amended, a registration statement on Form S-8 to register the additional shares available for issuance under the Incentive Compensation Plan.

The proposed third amendment to the Incentive Compensation Plan is attached hereto as Appendix A, and the Incentive Compensation Plan, prior to giving effect to this proposed amendment, is attached hereto as Appendix B.

Reason for Proposed Amendment

The use of stock-based awards under the Incentive Compensation Plan has been a key component of our compensation program since its adoption in 2004. The awards granted under the Incentive Compensation Plan assist us in attracting and retaining capable, talented individuals to serve in the capacity of employees and officers. The Incentive Compensation Plan authorized us to issue up to 1,667,293 shares of Common Stock. As of December 31, 2008, 1,116,615 shares were available for us to issue as awards under the Incentive Compensation Plan. As a result of the 2008 General Bonus grant of March 12, 2009, substantially all of the authorized and available shares have been issued. Accordingly, the Compensation Committee has determined that there are not sufficient shares available for issuance under the Incentive Compensation Plan to meet the remaining share requirements of the 2008 General Bonus, should we in our sole discretion choose to pay the remaining amounts in shares of Common Stock, and to meet our needs for future grants during the coming years, and an increase in available shares is necessary to continue granting incentive and reward opportunities to eligible participants while assisting us in retaining a competitive edge in today’s volatile business environment.

Summary of the Incentive Compensation Plan

The following summary provides a general description of the material features of the Incentive Compensation Plan, and is qualified in its entirety by reference to the full text of the plan attached as Appendix B. The purpose of the Incentive Compensation Plan is to provide incentives to our employees, officers, consultants, and advisors to devote their abilities and energies to our success. The Incentive Compensation Plan provides for the granting or awarding of incentive and nonqualified stock options, stock appreciation rights, restricted stock and performance shares. Individual terms applicable to the various awards, such as vesting or transferability, may be established by the Compensation Committee at the time of grant. Awards may currently be made under the Incentive Compensation Plan only until April 15, 2014, although any outstanding awards in existence at this time shall remain subject to the terms and conditions of the Incentive Compensation Plan beyond that date.

Administration. The Compensation Committee of the Board of Directors administers the Incentive Compensation Plan. No individual who participates in making an award under the plan may either make or participate in making an award to him or herself. Subject to the express provisions of the plan, the Compensation Committee has full authority, among other things, to:

| • | select the persons to whom stock, options and other awards will be granted; |

| • | determine the type, size and terms and conditions of stock options and other awards; and |

| • | establish the terms for treatment of stock options and other awards upon a termination of employment. |

5

All determinations by the Compensation Committee regarding the plan or an individual award shall be final and binding on all persons in the absence of clear and convincing evidence that the Compensation Committee acted arbitrarily or capriciously.

Eligibility. The employees eligible to receive awards under the Incentive Compensation Plan are our regular full-time or part-time employees, or those of our affiliates. Our directors who are not also regular employees are not eligible to receive awards under the plan, although consultants and advisors are considered eligible. If an eligible employee is terminated or a consultant’s services are terminated for cause, an award may be canceled or required to be forfeited, as determined by the Board of Directors.

Individual Limits on Awards. Consistent with certain provisions of the Internal Revenue Code of 1986, as amended (the “Code”), there are restrictions providing for a maximum number of shares that may be granted in any one year to a named executive officer and a maximum amount of compensation payable as an award under the Incentive Compensation Plan to a named executive officer. No eligible employee may receive an award covering, nor may any qualified performance-based incentive award payment be made that constitutes, more than 20% of the aggregate number of shares which may be issued under the Incentive Compensation Plan in any given year. In the event that the award is an incentive stock option, the value of the stock covered by such an award may not exceed $100,000 in any one year.

Source of Shares. Stock issued under the Incentive Compensation Plan may come from authorized but unissued shares of our stock, or from stock held in our company treasury. If there is a forfeiture, termination or other surrender of stock that underlies an award, or our stock was used to pay withholding taxes or an option exercise price, those shares will again be available for issuance under the plan unless an applicable law or regulation prevents such re-issuance.

Recapitalization Adjustments. In the event that we undergo a reorganization, recapitalization, stock split, merger or other similar transaction that affects the stock issuable under the Incentive Compensation Plan, the Compensation Committee will have the discretion to make certain adjustments as it deems appropriate. These adjustments may include: (i) altering the number or kind of shares authorized by the plan or covered by an award, (ii) adjust the price of a stock option, or (iii) revise the fair market value of a stock appreciation right award. No adjustment will be made, however, if such an adjustment would cause an award intended to qualify as performance-based compensation (as described below) to fail under Section 162(m) of the Code, or would cause an incentive option to fail under Section 422 of the Code.

Qualified Performance-Based Awards. Under the Incentive Compensation Plan, awards given to our executive officers who are considered “covered employees” may be designed to qualify as “performance-based compensation” as defined in Section 162(m) of the Code. A “covered employee” is an individual that meets the definition of the same term as found within the regulations relating to Section 162(m) of the Code, and is generally an individual whose compensation must be disclosed in the Company’s annual securities filings and who is subject to the limitations imposed by Section 162(m) of the Code. Performance-based incentive awards must be based on the attainment of certain performance goals established by the Board of Directors or the Compensation Committee, though the grant of any award intended to qualify as performance-based compensation must be made by the Compensation Committee only so long as all of the members are “outside directors” within the meaning of the applicable Internal Revenue Service regulations regarding Section 162(m) of the Code. If all Compensation Committee members are not outside directors, the grant shall be made by a subcommittee that consists solely of such outside directors.

The performance measures under the Incentive Compensation Plan are currently limited to: (i) pre- or after-tax net earnings, (ii) sales growth, (iii) operating earnings, (iv) operating cash flow, (v) return on net assets, (vi) return on shareholders’ equity, (vii) return on assets, (viii) return on capital, (ix) stock price growth, (x) shareholder returns, (xi) gross or net profit margin, (xii) earnings per share, (xiii) price per share of stock, and (xiv) market share, any of which may be measured either in absolute terms or as compared to any incremental increase or as compared to results of a peer group. Additionally, the performance goals must include formulas for

6

calculating the amount of compensation payable if the goals are met, and both the goals and the formulas must be sufficiently objective so that a third party with knowledge of the relevant performance results could assess that the goals were met and calculate the amount to be paid.

In the event that stock options are granted as qualified performance-based compensation awards, the exercise price shall not be less than the fair market value on the date of that grant. Other types of awards that are intended to qualify as performance-based compensation will have terms and restrictions as determined at the full discretion of the Compensation Committee (or subcommittee, if applicable), though in accordance with all applicable laws and regulations. Payment or settlement of any award intended to qualify as performance-based compensation will not occur until the applicable performance goals are achieved within the applicable performance period, and the amount or size of the award may be reduced or eliminated if the Compensation Committee (or subcommittee, if applicable) determines that such a reduction is appropriate, though the amount will never be increased.

Options. The Incentive Compensation Plan may grant options to purchase one or more shares of our Common Stock. The Compensation Committee may determine to award stock options that are either incentive stock options governed by Section 422 of the Code, or stock options that are not intended to meet these requirements. The Compensation Committee will determine the specific terms and conditions of any option award at the time of grant, though all options will be restricted by certain conditions. The exercise price of any option will not be less than 100% of the fair market value of our stock on the date of the grant, and in the case of an incentive stock option granted to an eligible employee that owns more than 10% of our Common Stock, the exercise price will not be less than 110% percent of the fair market value of our stock on the date of grant. Options may be exercised by paying the exercise price in cash, or by delivering shares of our stock the fair market value of which equals the portion of the exercise price the participant is intending to pay with such stock. No option will be exercisable following the expiration of ten years following the grant date of that option (despite whether the termination date of the Incentive Compensation Plan itself extends beyond this time period), and will only be exercisable so long as the grantee remains in service to us.

Following the grant of an option to an eligible employee, in the event that they are terminated other than for cause, their normal retirement or death (as discussed below), the grantee (or their representative in the case of death) will have limited privileges to exercise the option, and those exercise privileges will be restricted to the portion of the award that was exercisable immediately prior to the termination of services with us, unless the Compensation Committee determines otherwise at its sole discretion. Nonstatutory options may be exercised during the period of time as set forth in the award agreement governing such options, though an incentive stock option must be exercised within three months of the termination event unless the termination was due to a disability (in which case the exercise must occur within one year of the termination). A termination of employment or a consulting assignment for cause will terminate all exercise privileges as of the date of the individual’s receipt of his or her termination notice.

If an individual terminates services with us due to retirement or death, their exercise privileges will apply only to those shares immediately exercisable on the date of retirement or death, as applicable. The Compensation Committee may, however, provide that any or all of the options not eligible for exercise will become eligible, either immediately or according to a schedule. The options must be exercised during the time period determined by the Compensation Committee for such individual, though in no event will the options be exercisable following the options’ expiration date.

If an incentive stock option is ordered to be transferred pursuant to a divorce order, the statutory restrictions relating to the Code will cease to exist, and the stock option will become a nonstatutory stock option in the hands of the transferee.

Stock Appreciation Rights. The Incentive Compensation Plan provides for the grant of stock appreciation rights, or “SARs”, which are the rights to receive the excess of the fair market value of our stock over a specified exercise price that the Compensation Committee will determine appropriate at the time the award is granted, in

7

its discretion. SARs may be granted either individually or in connection with a stock option under the plan. If the SAR is granted in connection with an option award, the grantee will have the right to surrender an exercisable option in exchange for a payment equal to the excess of the fair market value per share, as of the date of the surrender, of one share of our Common Stock over the exercise price of the option multiplied by the number of shares covered by the option award being surrendered. If the SAR is granted alone, the grantee will receive upon exercise a payment equal to the fair market value of our Common Stock on the date of exercise over the fair market value of our Common Stock on the date of grant, multiplied by the number of shares covered by the SAR. Payment of an SAR, whether or not the award is granted in connection with an option, may be made in cash, our Common Stock, or any combination of cash and stock, as determined by the Compensation Committee.

Performance Shares. The Incentive Compensation Plan provides for performance shares, which are contingent awards granted by the Compensation Committee where the attainment of one or more performance goals will be measured for purposes of determining a grantee’s right to, and the payment of, an award during a specified performance period. Performance shares that are not designed to qualify as performance-based compensation should not be confused with qualified performance-based compensation awards as described above, and are not restricted by the same limitations, such as Section 162(m) of the Code, but are governed by the terms and conditions imposed by the Compensation Committee and the Incentive Compensation Plan. The Compensation Committee will determine both the performance goals and the performance period that will be associated with an award of performance shares, as well as the method to be used in calculating the payment, if any, of the performance shares at the end of the performance period. The Compensation Committee shall also determine whether performance shares will be paid in cash, our Common Stock, a combination of both cash and stock, or whether dividends may be paid with respect to the shares underlying the performance share award. Individuals who receive an award of performance shares must remain in our employment or service until the completion of the performance period in order to receive payments related to performance shares, although the Compensation Committee may determine that a partial payment is equitable in certain situations, in its sole discretion.

Restricted Stock. Restricted stock may be granted under the Incentive Compensation Plan, which means that a share of our Common Stock is granted to an individual subject to a “risk of forfeiture.” The “risk of forfeiture” will include all restrictions placed on the stock awarded to a grantee, including our right to reacquire the share of stock at less than its then fair market value due to the occurrence or non-occurrence of specified events or conditions during a specified time period, as determined by the Compensation Committee in its discretion at the time of the grant of the restricted stock. In the event that restricted stock is granted to a grantee that is not a party to an employment agreement with us, the terms of the plan and any award agreement shall also govern the effect of a termination of the grantee’s employment on the restricted stock. Subject to any exceptions determined to be appropriate by the Compensation Committee and described in such an award agreement, however, a grantee will forfeit all restricted stock upon his or her termination of service prior to the satisfaction of both the restricted period and the restrictions placed upon the stock in question. In the event that the employee is a party to an employment agreement with us, a termination of employment due to the individual’s death or permanent disability, a termination by us without cause, or by the employee for “good reason,” will cause all unvested restricted stock held on the date of that termination to fully vest. During the restricted period, the grantee may not sell, assign or otherwise dispose of the restricted stock, and each stock certificate will contain an appropriate legend noting the restrictions upon such stock until such time as all restrictions have been met.

Change in Control and Other Acquisition Events. In the event of our “change of control,” all outstanding options, stock appreciation rights and restricted stock will become exercisable, realizable or vested in full, or shall be free of all conditions or restrictions, as applicable to each award. Notwithstanding the foregoing, the lapse of restrictions, or vesting, will not occur with regard to restricted stock if, in the event of a merger into and with an acquiring entity, each unvested share of restricted stock is converted into the same number of unvested shares of restricted stock of the acquiring company and such conversion is consummated within thirty days of the change in control event. The Incentive Compensation Plan defines a change of control to include: (i) when at least 35% of our shares are not owned by Mr. Krohn, his spouse and descendents, or entities or trusts under

8

Mr. Krohn’s control; (ii) any merger or consolidation whereby our outstanding stock prior to the transaction constitutes less than 50% of the voting power in the resulting entity; (iii) an acquisition of beneficial ownership by a person if, after the acquisition, the person beneficially owns 35% or more of our outstanding stock or our voting power (this does not include any acquisition directly from or by our company, through an employee benefit plan sponsored by us, or that results in beneficial owners of our outstanding stock prior to the acquisition by another corporation beneficially owning more than 50% of the then-outstanding shares of the corporation in the same proportion as their previous ownership of our stock); (iv) any sale of all or substantially all of our assets; or (v) our complete liquidation. The second amendment to the Incentive Compensation Plan modified clauses (i) and (iii) of this definition for grants made on or after April 8, 2009 by: (a) deleting clause (i) in its entirety, (b) substituting the number “51” for “35” in clause (iii), and (c) excluding acquisitions by Mr. Krohn and his family for purposes of the triggering event in clause (iii).

An “acquisition event” is defined under the Incentive Compensation Plan as our merger or consolidation with or into another entity that results in our stock being converted into or exchanged for the right to receive cash, securities or property of another entity, or an exchange of our stock for cash, securities or property of another entity pursuant to a statutory share exchange transaction. Upon the occurrence of an acquisition event, all outstanding options will be assumed, or equivalent options will be substituted, by the acquiring entity. The risk of forfeiture associated with any restricted stock will inure to the benefit of the acquiring entity, and the Compensation Committee will have the discretion to determine the effect of an acquisition event on all remaining awards under the plan at the time of the grant of such award.

Discontinuance or Amendment of the Plan. The Board of Directors may discontinue the Incentive Compensation Plan, or amend the terms of the plan as permitted by applicable statutes, except that it may not revoke or unfavorably alter any outstanding award. The Board of Directors may also not amend the plan without shareholder approval where such approval is required by Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or any other applicable law or regulation.

Tax Withholding. We are entitled to withhold the amount of any tax attributed to any award granted under the plan, at such times as we deem necessary or appropriate under the laws in effect at such time.

United States Federal Income Tax Consequences

The following is a brief summary of certain United States federal income tax consequences of certain transactions contemplated under the Incentive Compensation Plan based on federal income tax laws in effect on March 25, 2009. This summary applies to the Incentive Compensation Plan as normally operated and is not intended to provide or supplement tax advice to eligible employees or directors. The summary contains general statements based on current United States federal income tax statutes, regulations and currently available interpretations thereof. This summary is not intended to be exhaustive and does not describe state, local or foreign tax consequences or the effect, if any, of gift, estate and inheritance taxes.

Tax Consequences to Grantees under the Incentive Compensation Plan.

Options and Stock Appreciation Rights. Grantees will not realize taxable income upon the grant of an option that is not intended to qualify as an incentive option, or an SAR. Upon the exercise of a nonstatutory option or an SAR, a grantee will recognize ordinary compensation income (subject to our withholding obligations) in an amount equal to the excess of (i) the amount of cash and the fair market value of the Common Stock received, over (ii) the exercise price (if any) paid. A grantee will generally have a tax basis in any shares of Common Stock received pursuant to the exercise of an SAR, or pursuant to the cash exercise of a nonstatutory option, that equals the fair market value of such shares on the date of exercise. Subject to the discussion under “—Tax Consequences to the Company” below, we will be entitled to a deduction for federal income tax purposes that corresponds as to timing and amount with the compensation income recognized by a grantee under the foregoing rules.

9

Grantees eligible to receive an option intended to qualify as an incentive option under Section 422 of the Code will not recognize taxable income on the grant of an incentive option. Upon the exercise of an incentive option, a grantee will not recognize taxable income, although the excess of the fair market value of the shares of Common Stock received upon exercise of the incentive option (“ISO Stock”) over the exercise price will increase the alternative minimum taxable income of the grantee, which may cause such grantee to incur alternative minimum tax. The payment of any alternative minimum tax attributable to the exercise of an incentive option would be allowed as a credit against the grantee’s regular tax liability in a later year to the extent the grantee’s regular tax liability is in excess of the alternative minimum tax for that year.

Upon the disposition of ISO Stock that has been held for the required holding period (generally, at least two years from the date of grant and one year from the date of exercise of the incentive option), a grantee will generally recognize capital gain (or loss) equal to the excess (or shortfall) of the amount received in the disposition over the exercise price paid by the grantee for the ISO Stock. However, if a grantee disposes of ISO Stock that has not been held for the requisite holding period (a “Disqualifying Disposition”), the grantee will recognize ordinary compensation income in the year of the Disqualifying Disposition in an amount equal to the amount by which the fair market value of the ISO Stock at the time of exercise of the incentive option (or, if less, the amount realized in the case of an arm’s length disposition to an unrelated party) exceeds the exercise price paid by the grantee for such ISO Stock. A grantee would also recognize capital gain to the extent the amount realized in the Disqualifying Disposition exceeds the fair market value of the ISO Stock on the exercise date. If the exercise price paid for the ISO Stock exceeds the amount realized (in the case of an arm’s-length disposition to an unrelated party), such excess would ordinarily constitute a capital loss.

We will generally not be entitled to any federal income tax deduction upon the grant or exercise of an incentive option, unless a grantee makes a Disqualifying Disposition of the ISO Stock. If a grantee makes a Disqualifying Disposition, we will then, subject to the discussion below under “—Tax Consequences to the Company,” be entitled to a tax deduction that corresponds as to timing and amount with the compensation income recognized by a grantee under the rules described in the preceding paragraph.

Under current rulings, if a grantee transfers previously held shares of Common Stock (other than ISO Stock that has not been held for the requisite holding period) in satisfaction of part or all of the exercise price of a option, either nonstatutory or incentive, no additional gain will be recognized on the transfer of such previously held shares in satisfaction of the nonstatutory option or incentive option exercise price (although a grantee would still recognize ordinary compensation income upon exercise of a nonstatutory option in the manner described above). Moreover, that number of shares of Common Stock received upon exercise which equals the number of shares of previously held Common Stock surrendered in satisfaction of the nonstatutory option or incentive option exercise price will have a tax basis that equals, and a capital gains holding period that includes, the tax basis and capital gains holding period of the previously held shares of Common Stock surrendered in satisfaction of the nonstatutory option or incentive option exercise price. Any additional shares of Common Stock received upon exercise will have a tax basis that equals the amount of cash (if any) paid by the grantee, plus the amount of compensation income recognized by the grantee under the rules described above.

The Incentive Compensation Plan allows the Compensation Committee to permit the transfer of Awards in limited circumstances. For income and gift tax purposes, certain transfers of nonstatutory options and SARs generally should be treated as completed gifts, subject to gift taxation.

The Internal Revenue Service has not provided formal guidance on the income tax consequences of a transfer of nonstatutory options (other than in the context of divorce) or SARs. However, the Internal Revenue Service has informally indicated that after a transfer of stock options, the transferor will recognize income, which will be subject to withholding, and FICA/FUTA taxes will be collectible at the time the transferee exercises the stock options.

In addition, if the grantee transfers a vested nonstatutory option to another person and retains no interest in or power over it, the transfer is treated as a completed gift. The amount of the transferor’s gift (or generation-

10

skipping transfer, if the gift is to a grandchild or later generation) equals the value of the nonstatutory option at the time of the gift. The value of the nonstatutory option may be affected by several factors, including the difference between the exercise price and the fair market value of the stock, the potential for future appreciation or depreciation of the stock, the time period of the nonstatutory option and the illiquidity of the nonstatutory option. The transferor will be subject to a federal gift tax, which will be limited by (i) the annual exclusion of $13,000 per donee, (ii) the transferor’s lifetime unified credit, or (iii) the marital or charitable deductions. The gifted nonstatutory option will not be included in the grantee’s gross estate for purposes of the federal estate tax or the generation-skipping transfer tax.

This favorable tax treatment for vested nonstatutory options has not been extended to unvested nonstatutory options. Whether such consequences apply to unvested nonstatutory options is uncertain and the gift tax implications of such a transfer is a risk the transferor will bear upon such a disposition. The Internal Revenue Service has not specifically addressed the tax consequences of a transfer of SARs.

Restricted Stock. A recipient of restricted stock generally will be subject to tax at ordinary income tax rates on the fair market value of the restricted stock reduced by any amount paid by the recipient at such time as the shares are no longer subject either to a risk of forfeiture or restrictions on transfer for purposes of Section 83 of the Code. However, a recipient who so elects under Section 83(b) of the Code (a “Section 83(b) election”) within thirty days of the date of transfer of the shares will have taxable ordinary income on the date of transfer of the shares equal to the excess of the fair market value of the shares (determined without regard to the risk of forfeiture or restrictions on transfer) over any purchase price paid for the shares. If a Section 83(b) election is made and the shares are subsequently forfeited, the recipient will not be allowed to take a deduction for the value of the forfeited shares. If a Section 83(b) election has not been made, any dividends received with respect to restricted stock that are subject at that time to a risk of forfeiture or restrictions on transfer generally will be treated as compensation that is taxable as ordinary income to the recipient; otherwise the dividends will be treated as dividends. Awards of restricted stock to covered employees will not qualify as performance-based compensation and the company will be subject to the limitation on deductibility under Section 162(m) of the Code.

Performance Awards. An individual who has been granted performance shares generally will not realize taxable income at the time of grant. Whether performance shares are paid in cash or shares of our Common Stock, the recipient will have ordinary compensation income in the amount of (i) any cash paid at the time of such payment and (ii) the fair market value of any shares of our Common Stock either at the time the performance shares are paid in such shares or at the time any restrictions on the shares (including restrictions under Section 16(b) of the Exchange Act) subsequently lapse, depending on the nature, if any, of the restrictions imposed and whether the recipient elects under Section 83(b) of the Code to be taxed without regard to any such restrictions.

Tax Consequences to the Company. Section 162(m) of the Code limits our ability to deduct compensation paid during any year to a “covered employee” in excess of $1,000,000, unless such compensation is based on performance criteria established by the Compensation Committee or meets another exception specified in Section 162(m) of the Code. Certain awards described above will not qualify as performance-based compensation or meet any other exception under Section 162(m) of the Code and, therefore, the Company’s deductions with respect to such awards will be subject to the limitations imposed by such section. To the extent a recipient recognizes ordinary income in the circumstances described above, we will be entitled to a corresponding deduction provided that, among other things, (i) the income meets the test of reasonableness, is an ordinary and necessary business expense and is not an “excess parachute payment” within the meaning of Section 280G of the Code, and (ii) either the compensation is performance-based within the meaning of Section 162(m) of the Code or the $1,000,000 limitation of Section 162(m) of the Code is not exceeded. No deduction will be available to us for any amount paid under the Incentive Compensation Plan with respect to (a) any excise taxes due under Section 4999 of the Code with respect to amounts that are vested and/or payable due to a change in control and (b) any taxes due on the payment of such excise taxes described in clause (a).

11

New Plan Awards

The awards, if any, that will be made to eligible participants under the Incentive Compensation Plan are subject to the discretion of the Compensation Committee, and thus we cannot currently determine the benefits or number of shares subject to awards that may be granted in the future to its executive officers, employees or directors under the Incentive Compensation Plan, as proposed to be amended, and therefore no New Plan Benefits Table is provided. No options have been granted under the Incentive Compensation Plan since its inception in 2004.

Securities Authorized for Issuance under Equity Compensation Plans

The following table summarizes information about each of our equity compensation plans as of December 31, 2008:

| Number of Securities to be Issued Upon Exercise of Outstanding Options |

Weighted Average Exercise Price of Outstanding Options |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in First Column) | ||||

| Equity compensation plans approved by security holders: |

— | — | 1,116,615 | |||

| Equity compensation plans not approved by security holders: |

— | — | — | |||

| — | — | 1,116,615 | ||||

As a result of the 2008 General Bonus grant of March 12, 2009, substantially all of the authorized and available shares have been issued to our employees.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS YOU VOTE “FOR” APPROVAL OF THE AMENDMENT TO INCREASE THE SHARES OF COMMON STOCK AUTHORIZED FOR ISSUANCE UNDER OUR INCENTIVE COMPENSATION PLAN.

12

RATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTS

The Audit Committee of our Board appointed Ernst & Young LLP (“Ernst & Young”), independent public accountants, to audit our consolidated financial statements as of and for the year ending December 31, 2009. We are advised that no member of Ernst & Young has any direct or material indirect financial interest in our Company or, during the past three years, has had any connection with us in the capacity of promoter, underwriter, voting trustee, director, officer or employee.

If the appointment is not ratified, the Audit Committee will consider the appointment of other independent accountants. A representative of Ernst & Young is expected to be present at the Annual Meeting, will be offered the opportunity to make a statement if the representative desires to do so and will be available to respond to appropriate questions.

Principal Accounting Fees and Services

Ernst & Young has served as independent auditor for the Company since 2000. The aggregate fees and costs billed by Ernst & Young and its affiliates to the Company for the years ended December 31, 2008 and 2007 are identified below.

| 2008 | 2007 | |||||

| Audit fees (1) |

$ | 1,623,000 | $ | 1,711,050 | ||

| Tax fees (2) |

137,000 | 204,145 | ||||

| All other fees (3) |

2,257 | 1,624 | ||||

| $ | 1,762,257 | $ | 1,916,819 | |||

| (1) | Includes fees for audit of our annual consolidated financial statements, including the effectiveness of our internal control over financial reporting, reviews of our quarterly consolidated financial statements, fees for issuance of comfort letters and consents related to our debt and equity offerings, and reviews of various documents filed with the Securities and Exchange Commission. |

| (2) | Includes fees for preparation of federal and state tax returns, tax planning advice and review of tax related issues with respect to proposed transactions. |

| (3) | Includes an annual fee for access to an accounting literature database. |

Recommendation of the Board of Directors

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG AS THE COMPANY’S INDEPENDENT ACCOUNTANTS.

Audit Committee Report

The Board of Directors appointed the undersigned directors as members of the Audit Committee and adopted a written charter setting forth the procedures and responsibilities of the Audit Committee. Each year, the Audit Committee reviews the charter and reports to the Board on its adequacy in light of applicable New York Stock Exchange (“NYSE”) rules. In addition, the Company furnishes an annual written affirmation to the NYSE relating to Audit Committee membership, the independence and financial management expertise of the Audit Committee and the adequacy of the Audit Committee charter.

During the last year, and earlier this year in preparation for the filing with the Securities and Exchange Commission (the “SEC”) of the Company’s Annual Report on Form 10-K for the year ended December 31, 2008 (the “10-K”), the Audit Committee:

| • | reviewed and discussed the audited financial statements with management and the Company’s independent auditors; |

13

| • | reviewed the overall scope and plans for the audit and the results of the independent auditors’ examinations; |

| • | met with management periodically during the year to consider the adequacy of the Company’s internal controls and the quality of its financial reporting and discussed these matters with the Company’s independent auditors and with appropriate Company financial personnel; |

| • | discussed with the Company’s senior management, independent auditors and appropriate Company financial personnel the process used for the Company’s chief executive officer and chief financial officer to make the certifications required by the SEC and the Sarbanes-Oxley Act of 2002 in connection with the 10-K and other periodic filings with the SEC; |

| • | reviewed and discussed with the independent auditors (1) their judgments as to the quality (and not just the acceptability) of the Company’s accounting policies, (2) the written communication required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees” and the independence of the independent auditors, and (3) the matters required to be discussed with the Audit Committee under auditing standards generally accepted in the United States, including Statement on Auditing Standards No. 61, “Communication with Audit Committees”; |

| • | based on these reviews and discussions, as well as private discussions with the independent auditors and appropriate Company financial personnel, recommended to the Board of Directors the inclusion of the audited financial statements of the Company and its subsidiaries in the 10-K; and |

| • | determined that the non-audit services provided to the Company by the independent auditors (discussed above under the Proposal to Ratification of Appointment of Independent Accountants (Proposal 2)), are compatible with maintaining the independence of the independent auditors. The Committee’s pre-approval policies and procedures are discussed below. |

Notwithstanding the foregoing actions and the responsibilities set forth in the Audit Committee charter, the charter clarifies that it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and in accordance with generally accepted accounting principles. Management is responsible for the Company’s financial reporting process including its system of internal controls, and for the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States. The independent auditors are responsible for expressing an opinion on those financial statements and on the effectiveness of internal control over financial reporting. Audit Committee members are not employees of the Company or accountants or auditors by profession or experts in the fields of accounting or auditing. Therefore, the Audit Committee has relied, without independent verification, on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States, that the Company’s internal controls over financial reporting were effective as of December 31, 2008 and on the representations of the independent auditors included in their report on the Company’s financial statements.

The Audit Committee met regularly with management and the independent and internal auditors, including private discussions with the independent auditors and the Company’s internal auditors and received the communications described above. The Audit Committee has also established procedures for (a) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and (b) the confidential, anonymous submission by the Company’s employees of concerns regarding questionable accounting or auditing matters. However, this oversight does not provide us with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, our considerations and discussions with management and the independent auditors do not assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles or that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards.

14

The Audit Committee maintains written procedures that require it to annually pre-approve the scope of all auditing services to be performed by the Company’s independent auditor. The Audit Committee’s procedures prohibit the independent auditor from providing any non-audit services unless the service is permitted under applicable law and is pre-approved by the Audit Committee or its Chair. Although applicable regulations waive these pre-approval requirements in certain limited circumstances, the Audit Committee reviews and pre-approves all non-audit services provided by Ernst & Young. The Audit Committee has determined that the provision of Ernst & Young’s non-audit services is compatible with maintaining Ernst & Young’s independence.

If you would like additional information on the responsibilities of the Audit Committee, please refer to its charter, a copy of which is posted on the Company’s website at www.wtoffshore.com and is available in print to any shareholder who requests it.

Submitted by the Audit Committee.

| S. James Nelson, Jr. (Chair) |

Robert I. Israel | Samir G. Gibara |

Corporate Governance Guidelines; Code of Business Conduct and Ethics

A complete copy of the Company’s corporate governance guidelines, which the Board reviews at least annually, is posted on the Company’s website at www.wtoffshore.com and is available in print to any shareholder who requests it. The Board of Directors has adopted a Code of Business Conduct and Ethics that applies to all employees, officers and directors. A complete copy of the Code of Business Conduct and Ethics is posted on the Company’s website at www.wtoffshore.com and is available in print to any shareholder who requests it. Because Tracy W. Krohn, the Company’s Chairman and Chief Executive Officer, controls approximately 51.1% of the outstanding shares of Common Stock, the Company is a “controlled company” under NYSE Corporate Governance Rules. Accordingly, the Company is not required to maintain a (i) majority of independent directors on the Board, (ii) Nominating and Corporate Governance Committee composed entirely of independent directors or (iii) Compensation Committee composed entirely of independent directors. Notwithstanding these exemptions, the Company requires that the Compensation Committee of the Board consist entirely of independent directors, as is more fully discussed under the heading Standing Committees of the Board of Directors below.

After reviewing the qualifications of our current directors and nominees, and any relationships they may have with the Company that might affect their independence, the Board has determined that each director and nominee, other than Messrs. Krohn and Freel and Ms. Boulet, is “independent” as that concept is defined by the NYSE’s Listed Company Manual. A business relationship with the Company or family relationship with an officer or director would prevent a director from being considered by the Board as “independent.”

Standing Committees of the Board of Directors

The Board has three standing committees—the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The Audit Committee was established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As discussed above, the Company is a “controlled company” within the meaning of the rules of the NYSE, and, accordingly, is not required to maintain an independent Compensation Committee or independent Nominating and Corporate Governance Committee. The Company believes, however, that it is in its best interests to have the Compensation Committee consisting entirely of independent directors. As such, the Company’s Compensation Committee Charter adopted by the Board of Directors requires all members to be independent.

15

Audit Committee

Currently, Messrs. Israel, Gibara and Nelson sit on the Company’s Audit Committee. Mr. Nelson is Chair of the Audit Committee. If elected, Mr. Stanley has agreed to serve on the Audit Committee. The Board has determined that Messrs. Nelson, Israel, Gibara and Stanley are “independent” under the standards of both the NYSE and Section 10A of the Exchange Act. The Board considers Messrs. Nelson, Israel, Gibara and Stanley to be “audit committee financial experts,” as defined under the Exchange Act and the rules and regulations promulgated thereunder. In connection with his appointment, the Board of Directors considered the fact that Mr. Nelson is a member of the audit committees of three other public companies, and found that such simultaneous service will not, and does not, impair his ability to effectively serve on the Audit Committee of the Company.

The Audit Committee establishes the scope of and oversees the annual audit, including recommending the independent public accountants that audit the Company’s financial statements and approving any other services provided by the accountants. The Audit Committee also assists the Board in fulfilling its oversight responsibilities by (1) overseeing the Company’s system of financial reporting, auditing, controls and legal compliance, (2) monitoring the operation of such system and the integrity of the Company’s financial statements, monitoring the qualifications, independence and performance of the outside auditors and any internal auditors who the Company may engage, and (3) reporting to the Board periodically concerning the activities of the Audit Committee. In performing its obligations, it is the responsibility of the Audit Committee to maintain free and open communication between it, the Company’s independent auditors, the internal accounting function and the management of the Company. The Audit Committee’s functions are further described under the heading Audit Committee Report. A copy of the Audit Committee’s Charter is posted on the Company’s website at www.wtoffshore.com and is available in print to any shareholder who requests it.

Nominating and Corporate Governance Committee

Mr. Krohn, Mr. Freel and Ms. Boulet serve as members of the Nominating and Corporate Governance Committee of the Board. Ms. Boulet is Chair of the Nominating and Corporate Governance Committee. None of these directors is independent as defined by the NYSE’s Listed Company Manual. The purpose of the Nominating and Corporate Governance Committee is to nominate candidates to serve on the Board of Directors and to approve director compensation. The factors and processes used to select potential nominees are more fully described in the section entitled Identifying and Evaluating Nominees for Directors . The Nominating and Corporate Governance Committee is also responsible for monitoring a process to assess Board effectiveness, developing and implementing corporate governance guidelines and taking a leadership role in regulating the corporate governance of the Company. A copy of the Nominating and Corporate Governance Committee’s Charter is posted on the Company’s website at www.wtoffshore.com and is available in print to any shareholder who requests it.

Compensation Committee

Currently, Messrs. Nelson and Gibara serve as members of the Compensation Committee. Mr. Nelson is Chair of the Compensation Committee. If elected, Mr. Stanley has agreed to serve on the Compensation Committee. Both of these directors and Mr. Stanley qualify as independent directors under NYSE listing standards, the Company’s corporate governance guidelines, “non-employee directors” under Rule 16b-3 promulgated under the Exchange Act and “outside directors” under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). The Compensation Committee performs an annual review of the compensation and benefits of the executive officers, establishes and reviews general policies related to employee compensation and benefits and administers the Incentive Compensation Plan and the Directors Compensation Plan. Under the terms of its charter, the Compensation Committee also determines the compensation for Mr. Krohn, the CEO of the Company. The Compensation Committee has the power to delegate some or all of its power and authority in administering the Incentive Compensation Plan of the Company to the Chief Executive

16

Officer, other senior members of management, or committee or subcommittee, as the Committee deems appropriate. However, the Compensation Committee may not delegate its authority with regard to any matter or action affecting an officer subject to Section 16 of the Exchange Act. If you would like additional information on the responsibilities of the Compensation Committee, please refer to its charter, which is available on our website at www.wtoffshore.com and is available in print to any shareholder who requests it.

Compen sation Committee Interlocks and Insider Participation

The members of the Compensation Committee are set forth above. The Compensation Committee is comprised entirely of independent directors. In addition, none of the Company’s executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Board of Directors or Compensation Committee.

Meetings of the Board and the Committees of the Board

During 2008, the Board of Directors held seven meetings. The Compensation Committee held five meetings in 2008, and the Nominating and Corporate Governance Committee held one meeting in 2008. In 2008, the Audit Committee met five times. All of the directors attended at least seventy-five percent of the meetings of the Board and of the committees on which they served during 2008, except for J.F. Freel who attended five of the seven Board of Directors meetings held in 2008.

The Company’s directors are encouraged to attend the Annual Meeting, but the Company does not otherwise have a policy regarding such attendance. All directors were present at the Annual Meeting held in 2008.

Currently, no director or executive officer, to our knowledge, is a party to any material legal proceeding adverse to the interests of the Company. Additionally, no director or executive officer has a material interest in a material proceeding adverse to the Company.

The Nominating and Corporate Governance Committee will consider all properly submitted shareholder recommendations of candidates for election to the Board of Directors. Pursuant to Section 12 of the Company’s Bylaws, any shareholder may nominate candidates for election to the Board by giving timely notice of the nomination to the Secretary of the Company. The Company’s Bylaws require that any such shareholder must be a shareholder of record at the time it gives notice of the nomination. To be considered a timely nomination, the shareholder’s notice must be delivered to the Secretary at the Company’s principal office no later than 90 days prior to the first anniversary of the preceding year’s Annual Meeting and no earlier than 120 days prior to the first anniversary of the preceding year’s Annual Meeting. In evaluating the recommendations of the shareholders for director nominees, as with all other possible director nominees, the Nominating and Corporate Governance Committee will address the criteria set forth below under the heading Identifying and Evaluating Nominees for Directors.

Any shareholder recommendations for director nominees should include the candidate’s name, qualifications and written consent to being named in the proxy statement and to serving on the Board if elected. The shareholder must also include any other business that the shareholder proposes to bring before the meeting, the reasons for conducting such business at the meeting, any material interest in such business of such shareholder and the beneficial owner, if any, on whose behalf the proposal is made. Additionally, the shareholder must provide his name and address, the name and address of any beneficial owner on whose behalf the

17

shareholder is acting, and the number of shares of Common Stock beneficially owned by the shareholder and any beneficial owner for whom the shareholder is acting. Such written notice should be sent to:

J. F. Freel

Secretary

W&T Offshore, Inc.

Nine Greenway Plaza, Suite 300

Houston, Texas 77046

Identifying and Evaluating Nominees for Directors

The Nominating and Corporate Governance Committee is responsible for leading the search for individuals qualified to serve as directors. The Nominating and Corporate Governance Committee evaluates candidates for nomination to the Board, including those recommended by shareholders, and conducts appropriate inquiries into the backgrounds and qualifications of possible candidates. The Nominating and Corporate Governance Committee then recommends to the Board, nominees as directors to be presented for election at meetings of the shareholders or of the Board. As indicated above, shareholders may recommend possible director nominees for consideration to the Nominating and Corporate Governance Committee.

In evaluating nominees to serve as directors on the Board and in accordance with the Company’s Corporate Governance Guidelines, the Nominating and Corporate Governance Committee selects candidates with the appropriate skills and characteristics required of Board members. Pertinent to this inquiry is the following non-exhaustive list of factors: independent business or professional experience; integrity and judgment; records of public service; ability to devote sufficient time to the affairs of the Company; diversity, age, skills, occupation, and understanding of financial statements and financial reporting systems. The Nominating and Corporate Governance Committee will also consider and weigh these factors in light of the current composition and needs of the Board. In 2009, the Nominating and Corporate Governance Committee approved Mr. Stanley’s inclusion on the Company’s proxy card for election to the Board of Directors at the 2009 Annual Meeting based on its own recommendation and aforementioned review process.

Directors who are also employees of the Company receive no additional compensation for serving as directors or committee members. The Board and shareholders adopted the 2004 Directors Compensation Plan, which provides that the Compensation Committee may grant stock options or restricted or unrestricted stock to non-employee directors. A total of 666,918 shares of Common Stock were initially reserved for issuance under the 2004 Directors Compensation Plan.

In February 2008, the Board accepted the recommendation of the Compensation Committee and the Nominating and Corporate Governance Committee to revise the compensation paid to non-employee directors of the Company to provide that each would receive the following compensation: