Filed pursuant to Rule 424(b)(5)

A filing fee of $51,814, calculated in accordance with

Rule

457(r), has been transmitted to the SEC in connection

with the securities offered from the registration statement

(File No. 333-132960) by means of this prospectus supplement

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the attached prospectus are not an offer to sell nor do they seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated July 12, 2006.

PROSPECTUS SUPPLEMENT

(To Prospectus Dated April 3, 2006)

11,000,000 Shares

Common Stock

In this offering of 11,000,000 shares, we are offering 8,500,000 shares and the selling shareholders identified in this prospectus supplement are offering an additional 2,500,000 shares. We will not receive any proceeds from the sale of shares by the selling shareholders. Certain of the selling shareholders are members of our senior management. See “Selling Shareholders” on page S-27 of this prospectus supplement.

Our common stock is listed on the New York Stock Exchange under the symbol “WTI.” On July 10, 2006, the last sale price of the shares as reported on the New York Stock Exchange was $37.64 per share.

Investing in our common stock involves risks. See “ Risk Factors” beginning on page S-18 of this prospectus supplement.

| Per Share |

Total | |||||

| Public Offering Price |

$ | $ | ||||

| Underwriting Discount |

$ | $ | ||||

| Proceeds to W&T (before expenses) |

$ | $ | ||||

| Proceeds to the Selling Shareholders (before expenses) |

$ | $ | ||||

We and the selling shareholders have granted the underwriters a 30-day option to purchase up to an additional 1,650,000 shares from us and the selling shareholders on the same terms and conditions as set forth above if the underwriters sell more than 11,000,000 shares of common stock in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Lehman Brothers, on behalf of the underwriters, expects to deliver the shares on or about , 2006.

Joint Book-Running Managers

| LEHMAN BROTHERS | JEFFERIES & COMPANY | MORGAN STANLEY |

| BMO CAPITAL MARKETS | ||||||

| JPMORGAN |

||||||

| RBC CAPITAL MARKETS |

||||||

| RAYMOND JAMES | ||||||

| NATEXIS BLEICHROEDER INC. | ||||

| SUNTRUST ROBINSON HUMPHREY | ||||

| TD SECURITIES | ||||

, 2006

| Prospectus Supplement |

Page | |

| S-1 | ||

| S-18 | ||

| S-22 | ||

| S-23 | ||

| S-24 | ||

| S-25 | ||

| S-26 | ||

| S-27 | ||

| Certain United States Federal Tax Considerations for Non-United States Holders |

S-28 | |

| S-31 | ||

| S-36 | ||

| S-36 | ||

| S-37 | ||

| F-1 | ||

| A-1 | ||

| Report of Netherland, Sewell & Associates, Inc. (Kerr-McGee Properties) |

B-1 |

| Prospectus |

||

| 1 | ||

| 1 | ||

| 3 | ||

| 14 | ||

| 14 | ||

| 15 | ||

| Ratio of Earnings to Fixed Charges and Earnings to Fixed Charges Plus Preferred Stock Dividends |

15 | |

| 16 | ||

| 28 | ||

| 32 | ||

| 34 | ||

| 35 | ||

| 36 | ||

| 37 |

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of common stock. The second part is the accompanying prospectus, which gives more general information, some of which may not apply to this offering of common stock. If the information about the common stock offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement.

You should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not, the selling shareholders have not and the underwriters have not authorized anyone to provide you with information different from that contained in this prospectus supplement and the accompanying prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are, the selling shareholders are and the underwriters are offering to sell the common stock, and seeking offers to buy the common stock, only in jurisdictions where offers and sales are permitted. You should not assume that the information included in this prospectus supplement or the accompanying prospectus is accurate as of any date other than the dates shown in these documents or that any information we have incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus and the sale of the common shares offered hereby. Our business, financial condition, results of operations and prospects may have changed since such dates.

S-i

This summary highlights information contained elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference. It may not contain all the information that you consider important. We encourage you to read this prospectus supplement, the accompanying prospectus and the documents to which we have referred you in their entirety for a more complete understanding of this offering. Both estimates of our proved oil and natural gas reserves at December 31, 2005 and estimates of the proved oil and natural gas reserves of the Kerr-McGee Properties included in the Kerr-McGee Transaction discussed below at September 30, 2005, included or incorporated by reference in this prospectus supplement, are based on reports prepared by Netherland, Sewell & Associates, Inc., an independent petroleum consultant, included as Appendices A and B, respectively. You will find definitions for oil and natural gas industry terms used throughout this prospectus supplement in “Glossary of Certain Oil and Natural Gas Terms.” References to “W&T,” “we,” “our,” “us” or “the Company” refer to W&T Offshore, Inc. and its subsidiaries. Unless we state otherwise, we assume in this prospectus supplement that the underwriters will not exercise their option to purchase additional shares.

W&T Offshore, Inc.

We are an independent oil and natural gas acquisition, exploitation, exploration and development company. We are focused primarily in the Gulf of Mexico area, where we have developed significant technical expertise and where the high production rates associated with hydrocarbon deposits have historically provided us the best opportunity to achieve a rapid payback and attractive return on our invested capital. We plan to continue to acquire and exploit reserves on the Gulf of Mexico conventional shelf (water depths of 500 feet or less), the area of our traditional source of growth, as well as in the deepwater (water depths in excess of 500 feet) and the deep shelf (well depths in excess of 15,000 feet).

We believe attractive acquisition opportunities will continue to arise in the Gulf of Mexico as other oil and gas companies continue to divest properties as they shift their regional focus and increase their participation in larger, more capital intensive projects. We recently capitalized on this trend by entering into an agreement with Kerr-McGee Oil & Gas Corporation, or Kerr-McGee, to acquire through merger substantially all of Kerr-McGee’s conventional shelf properties in the Gulf of Mexico providing for base consideration of approximately $1.3 billion in cash, as described in more detail below. Consistent with our prior transactions, we believe that these properties will provide us with significant exploitation and exploration opportunities.

In addition to our exploitation and exploration drilling of conventional shelf wells in the Gulf of Mexico, we have considerable experience and historical drilling success in the deepwater and deep shelf of the Gulf of Mexico, where we believe that we can enhance our returns and growth rate through exploratory drilling. Our opportunities for deepwater exploration have been enhanced by technological advances in recent years that enable the connection of subsea wells to existing infrastructure over longer distances, eliminating the requirement for new, dedicated production facilities, the installation of which requires long lead times and large capital investments. Furthermore, we believe a significant portion of our acreage has exploration potential below currently producing zones, including deep shelf reserves. Although the cost to drill deep shelf and deepwater wells can be significantly higher than conventional shelf wells, the reserve targets are typically larger, and the use of existing infrastructure should partially offset higher drilling costs.

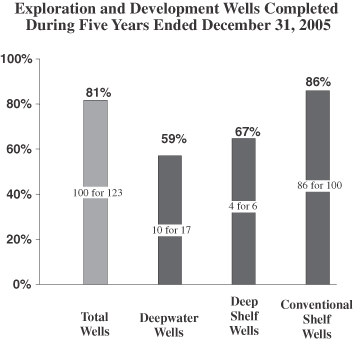

We believe that the high rate of drilling success we have achieved for both exploration and development wells, including wells drilled in the deepwater and deep shelf, is primarily due to the quality of our prospect inventory. In the five years ended December 31, 2005, we participated in the drilling of 123 wells, of which 92 were exploratory wells and 31 were development wells. In the aggregate, 100 of the 123 wells were successful, equating to an aggregate five-year success rate of 81%. Over that time, our exploratory and development success rates were 78% and 90%, respectively. Year-to-date through June 30, 2006, we have continued our high rate of

S-1

success, drilling 11 successful exploration wells in 14 attempts, of which two are deepwater discoveries and three are deep shelf discoveries. We plan to drill an additional 11 wells during the remainder of 2006, including three deepwater wells and one additional deep shelf well.

On January 23, 2006, we entered into the agreement with Kerr-McGee to acquire through merger substantially all of Kerr-McGee’s conventional shelf properties in the Gulf of Mexico. On June 30, 2006, these properties consisted of interests in approximately 100 producing fields in 240 offshore blocks (including 88 undeveloped blocks), most of which were in water depths of 500 feet or less. Upon the closing of this transaction, which we refer to as the Kerr-McGee Transaction, we will own properties with approximately 800 Bcfe of proved reserves and be one of the top three gross acreage holders on the conventional shelf of the Gulf of Mexico with an acreage position of greater than two million gross acres. We estimate that, upon the completion of the Kerr-McGee Transaction, approximately one-third of our proved reserves will be located in each of the eastern, western and central regions of the Gulf of Mexico.

We believe that the Kerr-McGee Transaction will provide us significant exploitation opportunities as Kerr-McGee has identified more than 92 exploration and development prospects on the properties we expect to acquire through merger from Kerr-McGee, which we refer to as the Kerr-McGee Properties, that have not been drilled. Our technical team has already reviewed a significant number of these prospects and believes they are viable. We also believe that we will identify additional prospects on these properties after the Kerr-McGee Transaction is completed. Following the closing of the transaction, we intend to more actively exploit and explore these properties than Kerr-McGee had done in recent years. We expect to close this merger transaction during the third quarter of 2006, subject to regulatory review and customary closing conditions. The base consideration for this transaction is subject to adjustment for various items, including adjustments for revenues, expenses and product imbalances recorded subsequent to October 1, 2005 applicable to the Kerr-McGee Properties. There is no assurance that this transaction will be completed, and this offering of common stock will not be conditioned on the closing of the Kerr-McGee Transaction.

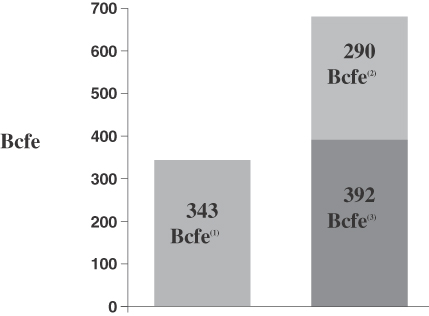

The table below sets forth certain reserve and other information related to W&T and the Kerr-McGee Properties. All reserve data for W&T was determined as of December 31, 2005 and all reserve data for the Kerr-McGee Properties was determined as of September 30, 2005. The combined reserve data combines the reserve data set forth in the table below for W&T as of December 31, 2005 and for the Kerr-McGee Properties as of September 30, 2005, but does not reflect what the proved reserve volumes would have been on a pro forma basis if a reserve report had been prepared for the Kerr-McGee Properties as of December 31, 2005 because estimated reserve quantities change over time due to factors such as revisions of previous estimates, production and extensions and discoveries. Further, commodity price levels can affect the quantities of reserves that can be economically produced and thus considered to be proved reserves.

| W&T (As of December 31, 2005)(1) |

Kerr-McGee (As of September 30, |

Combined Total(3) |

|||||||||

| Reserve data (Bcfe): |

|||||||||||

| Proved developed |

318.6 | 239.5 | 558.1 | ||||||||

| Proved undeveloped |

172.9 | 105.8 | 278.7 | ||||||||

| Total proved reserves |

491.5 | 345.3 | 836.8 | ||||||||

| Natural gas percentage of proved reserves |

43.9 | % | 72.9 | % | 55.9 | % | |||||

| Reserve report commodity prices: |

|||||||||||

| Natural gas ($/MMBtu) |

$ | 9.73 | $ | 15.48 | |||||||

| Oil ($/Bbl) |

$ | 57.75 | $ | 63.00 | |||||||

| PV-10 (in millions)(4) |

$ | 2,416 | $ | 2,999 | |||||||

| Standardized measure of discounted future net cash flow (in millions)(4) |

$ | 1,596 | $ | 2,264 | |||||||

S-2

| (1) | Our reserve estimates have been calculated using the prices for natural gas and oil as of December 31, 2005 set forth in the table above, in each case without giving effect to hedging transactions. The prices in the table above also do not reflect adjustments for quality, transportation fees, energy content and regional price differentials. We estimate that if natural gas prices decline by $0.10 per MMBtu from the price utilized in determining our proved reserves, the PV-10 of our proved reserves as of December 31, 2005 would decrease from $2,416 million to $2,401 million and the quantity of our reserves would decline by 44,500 Mcf of natural gas and 4,400 barrels of oil and natural gas liquids. We estimate that if oil prices decline by $1.00 per barrel from the price utilized in determining our proved reserves, then the PV-10 of our proved reserves as of December 31, 2005 would decrease from $2,416 million to $2,387 million and the quantity of our reserves would decline by 52,500 Mcf of natural gas and 20,400 barrels of oil and natural gas liquids. Estimates of PV-10 of reserves and the quantity of reserves would likely decline at a rate proportionately greater than specified above if natural gas and oil prices decline significantly from those used in calculating such estimates. |

| (2) | The reserve estimates for the Kerr-McGee Properties have been calculated using the prices for natural gas and oil as of September 30, 2005 set forth in the table above, in each case without giving effect to hedging transactions. The prices in the table above also do not reflect adjustments for quality, transportation fees, energy content and regional price differentials. We estimate that if natural gas prices decline by $0.10 per MMBtu from the price utilized in determining the proved reserves related to the Kerr-McGee Properties, the PV-10 of the proved reserves related to the Kerr-McGee Properties as of September 30, 2005 would decrease from $2,999 million to $2,980 million and the quantity of the reserves would decline by 116,400 Mcf of natural gas and 8,800 barrels of oil and natural gas liquids. We estimate that if oil prices decline by $1.00 per barrel from the price utilized in determining the proved reserves related to the Kerr-McGee Properties, then the PV-10 of the proved reserves related to the Kerr-McGee Properties as of September 30, 2005 would decrease from $2,999 million to $2,988 million and the reserves related to the Kerr-McGee Properties would decline by 134,800 Mcf of natural gas and 29,800 barrels of oil and natural gas liquids. Estimates of PV-10 of reserves and the quantity of reserves would likely decline at a rate proportionately greater than specified above if natural gas and oil prices decline significantly from those used in calculating such estimates. |

| (3) | Our combined reserve estimates have been calculated using December 31, 2005 estimates for W&T and using September 30, 2005 estimates for the Kerr-McGee Properties, which estimates in each case were based upon engineering reports prepared by Netherland, Sewell & Associates, Inc. The combined reserve data should not be considered as pro forma reserve data since the reserve data for W&T and for the Kerr-McGee Properties was determined as of two different dates. For purposes of preparing the unaudited footnote related to reserves that constitutes a part of the statements of revenues and direct operating expenses for the Kerr-McGee Properties, W&T prepared an estimate of reserves of the Kerr-McGee Properties at December 31, 2005 by (i) subtracting from the Netherland Sewell & Associates, Inc. reserve estimate at September 30, 2005 the quantity of oil and natural gas produced from the Kerr-McGee Properties for the period from September 30, 2005 through December 31, 2005 (approximately 10.8 Bcfe) and (ii) applying prices for natural gas and oil at December 31, 2005 (rather than the September 30, 2005 prices utilized for purposes of the September 30, 2005 reserve estimate), which resulted in an additional 8.7 Bcfe decrease. These adjustments do not account for any other factors such as discoveries, revisions or extensions that may have occurred subsequent to September 30, 2005. |

| (4) | Please see “—Summary Reserve and Operating Data—PV-10 Reconciliation.” |

S-3

During 2006, we expect to spend approximately $346 million on capital projects and approximately $54 million on major maintenance expense, workovers, seismic costs and plug and abandonment costs. These expenditures do not include estimated costs to repair damage to our facilities caused by Hurricanes Katrina and Rita in 2005, which we believe our insurance policies will adequately cover. This capital and major expenditure budget for 2006 does not include any incremental expenditures that may result from the Kerr-McGee Transaction. We expect to spend a total of approximately $50 million for the year ending December 31, 2006 to develop the Kerr-McGee Properties. We expect to fund this increase in our capital and major expenditure budget primarily from cash flow generated by these properties and available borrowing capacity under our new bank credit facility. Please read “—New Credit Facility” below.

Business Strategy

Our goal is to generate a high return on equity and to increase our production and reserves through executing the following elements of our business strategy:

| • | acquiring reserves with substantial upside potential and additional leasehold acreage complementary to our existing acreage position at attractive prices; |

| • | exploiting existing and acquired properties to add additional reserves and production; |

| • | exploring for reserves on our extensive acreage holdings; and |

| • | maintaining adequate balance sheet strength to provide flexibility to pursue growth opportunities. |

Competitive Strengths

We believe we are well positioned to execute our business strategy because of the following competitive strengths:

Proven Acquisition Strategy. Our method of identifying and evaluating targets has translated into a high rate of return per transaction. Our strategy involves:

| • | targeting under-exploited assets; |

| • | identifying additional sources of value through the application of technical resources; and |

| • | acquiring proven reserves at an attractive rate of return along with significant upside potential from exploration opportunities. |

S-4

Since 1999, we have completed five significant transactions to acquire oil and gas properties in the Gulf of Mexico. The following table reflects the total amount of proved reserves attributable to these properties as of the date before the closing of each transaction, the total amount of production from these properties subsequent to the respective date of transaction and the proved reserves attributable to these properties as of December 31, 2005, in each case excluding reserves and production attributable to the Kerr-McGee Properties.

| (1) | Aggregate proved reserves at the date of closing of our acquired properties. |

| (2) | Production subsequent to such transactions attributable to such acquired properties through December 31, 2005. |

| (3) | Proved reserves attributable to such acquired properties as of December 31, 2005. |

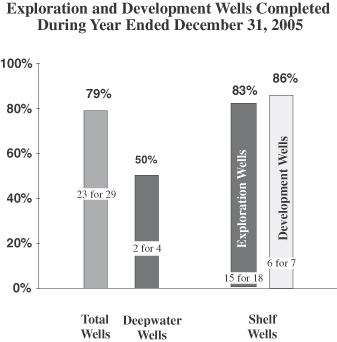

Track Record of Drilling Success. We have a proven track record of success in drilling both exploratory and development wells in the Gulf of Mexico over a substantial period. The following tables show our success rates for our exploration and development wells, which we define as completed or planned for completion, for the five-year period ending December 31, 2005 as well as our success rates for 2005.

S-5

S-6

Substantial Acreage Position and Prospect Inventory. Upon completion of the Kerr-McGee Transaction, we will be one of the top three gross acreage holders on the conventional shelf of the Gulf of Mexico with an acreage position of greater than two million gross acres, of which approximately 68% will be acreage “held-by-production.” Acreage held-by-production is attractive because it permits us to maintain all of our exploration, exploitation and development rights (including rights to explore, exploit and develop zones below currently producing zones) in the leased area as long as production continues. Most of this held-by-production acreage entitles us the right to propose future deep shelf exploration and development projects. In addition, this held-by-production acreage has significant existing infrastructure, which reduces development lead times and cost, and this infrastructure frequently allows for relatively quick tie back of production from deep shelf discoveries. During the five-year period ended December 31, 2005, we drilled 91 development and exploration wells on our held-by-production acreage, of which 78 were successful.

Deepwater and Deep Shelf Experience. We have gradually extended our acquisition and drilling activities into the deeper waters and deeper producing zones of the Gulf of Mexico. In 2000, we acquired our first deepwater interest, and in 2001, we drilled our first deep shelf well. In the five years ended December 31, 2005, we have drilled or participated in 17 wells on properties in the deepwater with a 59% success rate and six deep shelf wells with a 67% success rate. During this period, we placed three deepwater discoveries onstream and plan to have authorization to develop three more deepwater fields in 2006. Also during this period, we made four discoveries in the deep shelf. We have made three other deepwater discoveries, which may be authorized for development this year and developed in 2007 or 2008. As of June 2006, we have made three additional deep shelf discoveries, which should all be on production by the end of the third quarter. We have at least 20 additional deepwater prospects in inventory at present and plan to drill three more prospects during 2006.

Committed, Experienced Management. We have assembled a senior management team with considerable technical expertise and industry experience. Our founders, Tracy W. Krohn, Chairman, Chief Executive Officer, President and Treasurer, and Jerome F. Freel, Chairman Emeritus and Secretary, each have more than 20 years of experience as executive managers of oil and gas companies. Mr. Krohn and his immediate family will collectively own more than 50% of our outstanding capital stock after this offering. The other members of our management team average more than 20 years of experience in the industry, including an average of approximately seven years with us.

Conservative Financial Approach. We believe our conservative financial approach has contributed to our success and positioned us to capitalize on new opportunities as they develop. We have typically relied solely on net cash provided by operating activities and traditional commercial bank credit facilities to fund our growth. We have historically limited annual capital spending for exploration, exploitation and development activities to net cash provided by operating activities and typically used our bank credit facility for acquisitions and to balance working capital fluctuations. In the future, as we further expand our operations into the higher impact deepwater and deep shelf areas of the Gulf of Mexico, our capital spending may exceed net cash provided by operating activities, in which event we may issue debt or additional equity securities to fund such future expenditures.

Recent Developments

2006 Drilling Update. As of June 30, 2006, we have successfully drilled 11 out of 14 exploration wells and five out of five development wells during 2006. Of the 14 exploration wells, three were in the deepwater, three were in the deep shelf and eight were conventional shelf wells. In the second quarter of 2006, we drilled five successful exploration wells and three successful development wells of which one was a deep shelf discovery and seven were on the conventional shelf. Three non-commercial exploration wells were also drilled during the second quarter, including two conventional shelf wells and one in the deepwater. The combined non-commercial well cost of the two conventional shelf wells was approximately $13 million, which is approximately 5% of our conventional shelf budget, and the cost of the non-commercial well in the deepwater was approximately $6 million, which is approximately 3% of our deepwater budget.

S-7

Production and Hurricane Update. As of June 30, 2006, we were producing approximately 221 MMcfe net per day, which represents approximately 88% of our pre-Hurricane Katrina production rate. We anticipate achieving pre-Hurricane Katrina production levels in the third quarter of 2006. As of June 30, 2006, we estimated that 17 MMcfe per day of net production was shut-in because of Hurricanes Katrina and Rita in 2005, primarily due to issues related to field infrastructure and product sales pipelines. We have approximately $28 million in hurricane insurance receivables that we believe we will collect over the course of this year. We estimate that additional receivables of approximately $50 million, which are also expected to be collected, will accrue during the year as repair work continues. The estimated production for the Kerr-McGee Properties for the fourth quarter of 2005 was approximately 11.0 Bcfe, which represents approximately 50% of their pre-Hurricane Katrina production rate. The production as of June 11, 2006 was approximately 178 MMcfe/d. Kerr-McGee is obligated to pay for all necessary repairs to the field infrastructure related to the damage caused by Hurricanes Katrina and Rita.

2006 Lease Sale Activity. During the first half of 2006, we were the high bidder on four of the seven bids submitted for blocks in the central region of the Gulf of Mexico and the MMS has awarded leases to W&T on all four high bids. Three of these blocks are in the deepwater and one block is on the conventional shelf. The next outer continental shelf sale is scheduled for August 16, 2006 covering the western Gulf of Mexico.

New Credit Facility

In connection with the Kerr-McGee Transaction, we have entered into a new credit agreement that provides for a $1.3 billion senior secured credit facility. The credit facility will consist of (1) a revolving loan facility with an initial availability of $300 million, (2) a Tranche A term loan in the amount of $500 million and (3) a Tranche B term loan in the amount of $300 million. Upon the completion of the Kerr-McGee Transaction, our initial availability under this credit facility will be $1.1 billion. Availability under the new credit facility is subject to re-determination on March 1 and September 1 of each year commencing September 1, 2007. Borrowings under the credit facility are subject to satisfaction of availability determinations. In addition, the credit facility includes a letter of credit facility in the amount of $90 million, under which letters of credit may be issued as long as revolving loans may be advanced and subject to availability under the revolving loan facility. If the funding of the Tranche A loan occurs on or after May 31, 2006, the Tranche A term loan amount will be reduced by $37.5 million; if the funding of the Tranche A loan occurs on or after June 30, 2006, such amount will be further reduced by an additional $37.5 million; and if the funding of the Tranche A loan occurs on or after July 31, 2006, such amount will be further reduced by an additional $37.5 million. The revolving loan facility matures three years from the closing date of the Kerr-McGee Transaction (the “Closing Date”), the Tranche A loan matures 15 months from the Closing Date and the Tranche B loan matures four years from the Closing Date.

The new credit facility will not be effective unless the Kerr-McGee Transaction has been consummated on or before September 30, 2006, and until this new credit facility becomes effective, no loan advances will be made or letters of credit issued under this new credit facility. Our existing credit facility will remain in full force and effect in accordance with its terms until the new credit facility becomes effective.

Corporate Information

We are a Texas corporation. Our principal executive offices are located at Eight Greenway Plaza, Suite 1330, Houston, Texas 77046. Our telephone number is (713) 626-8525. We maintain a website at www.wtoffshore.com, which contains information about us. Our website and the information contained on it and connected to it will not be deemed incorporated by reference into this prospectus supplement.

S-8

The Offering

| Common stock offered by W&T |

8,500,000 shares(1) |

| Common stock offered by the selling shareholders |

2,500,000 shares(1) |

| Common stock outstanding after this offering |

74,633,226 shares(1)(2) |

| Option to Purchase Additional Shares |

1,650,000 shares. The shares to be sold upon any exercise of the underwriters’ option to purchase additional shares will be sold by us and the selling shareholders on a pro rata basis. Please read “Selling Shareholders” and “Underwriting—Option to Purchase Additional Shares” for more information. |

| Use of proceeds |

The net proceeds to us from this offering, after deducting discounts to the underwriters and estimated expenses of the offering, will be approximately $308.8 million, based on an assumed offering price to the public of $37.64 per share. Net proceeds to us, together with cash on hand and borrowings under our bank credit facility, are expected to be used to finance the cash consideration related to our pending Kerr-McGee Transaction and to pay related fees and expenses. Any net proceeds from this offering that we do not use for the purposes described above will be used for general corporate purposes, which may include among other things, funding capital expenditures related to our drilling activities. We will not receive any of the proceeds from the sale of our common stock by the selling shareholders. Certain of the selling shareholders are members of our senior management. Please read “Use of Proceeds.” |

| NYSE symbol |

WTI |

| (1) | Excludes shares that may be issued to the underwriters pursuant to their option to purchase additional shares. If the underwriters exercise their option to purchase additional shares in full, the total number of shares of common stock offered will be 12,650,000, of which 9,775,000 will be offered by us and 2,875,000 will be offered by the selling shareholders, and the total number of shares of our common stock outstanding after this offering will be 75,908,226. We had 66,133,226 shares of our common stock outstanding at June 30, 2006. |

| (2) | Excludes 2,151,008 shares of common stock potentially issuable upon awards under our stock compensation plans that may be granted in the future. |

S-9

Risk Factors

You should carefully consider all information in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein. In particular, you should evaluate the specific risk factors set forth in the section entitled “Risk Factors” beginning on page S-18 of this prospectus supplement, beginning on page 3 of the accompanying prospectus and beginning on page 9 of our Annual Report on Form 10-K for the year ended December 31, 2005, for a discussion of risks relating to an investment in our common stock. These risks include, but are not limited to, the following:

| • | acquisitions may prove to be worth less than we paid because of uncertainties in evaluating recoverable reserves and potential liabilities; |

| • | our acquisition strategy involves risks that may adversely affect our business; |

| • | our pending Kerr-McGee Transaction may not close as anticipated; |

| • | if the Kerr-McGee Transaction closes, we will have substantial indebtedness under our credit facility and may incur substantially more debt. Any failure to meet our debt obligations would adversely affect our business and financial condition; |

| • | lower oil and gas prices could negatively impact our ability to borrow; |

| • | the unavailability or high cost of additional drilling rigs, equipment, supplies, personnel and oil field services could adversely affect our ability to execute on a timely basis our exploration and development plans within our budget; |

| • | we may decide not to drill some of the prospects we have identified; |

| • | prospects that we decide to drill may not yield oil or natural gas in commercially viable quantities or quantities sufficient to meet our targeted rate of return; |

| • | losses and liabilities from uninsured or underinsured drilling and operating activities could have a material adverse effect on our financial condition and operations; and |

| • | our stock price and trading volume may be volatile, which could result in substantial losses for our shareholders. |

S-10

SUMMARY CONSOLIDATED HISTORICAL AND PRO FORMA FINANCIAL DATA

The following table shows summary historical financial data as of and for the three years in the period ended December 31, 2005, as of March 31, 2006 and for the three months ended March 31, 2005 and 2006, and summary pro forma financial data for the year ended December 31, 2005 and as of and for the three months ended March 31, 2006. All weighted average shares and per share data have been adjusted for the 6.669173211-for-one stock split effected November 30, 2004. The historical financial data below should be read together with, and are qualified in their entirety by reference to, our historical consolidated financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which are set forth in our annual report on Form 10-K for the year ended December 31, 2005 and our quarterly report on Form 10-Q for the quarter ended March 31, 2006, which are incorporated by reference into this prospectus supplement.

The summary unaudited pro forma data set forth below was derived from the unaudited pro forma financial statements included elsewhere in this prospectus supplement and should be read in conjunction with those statements. The unaudited pro forma condensed consolidated statement of income gives effect to the Kerr-McGee Transaction as if it occurred on January 1, 2005 and is based on assumptions and includes adjustments as explained in the notes to the unaudited pro forma financial statements included in this prospectus supplement. The unaudited pro forma financial information is not necessarily indicative of the results that actually would have been achieved during the year ended December 31, 2005 or the three months ended March 31, 2006 or that may be achieved in the future. The unaudited pro forma consolidated balance sheet information gives effect to the Kerr-McGee Transaction as if it occurred on March 31, 2006.

On July 12, 2006, we filed a current report on Form 8-K with the Securities and Exchange Commission (“SEC”) which included historical statements of revenues and direct operating expenses related to the Kerr-McGee Properties and related pro forma financial statements showing the pro forma effects of the Kerr-McGee Transaction. We refer you to the Form 8-K, which is incorporated by reference into this prospectus supplement, for additional information about the Kerr-McGee Transaction. The pro forma financial statements are also included in this prospectus supplement beginning on page PF-1.

S-11

| Pro Forma |

||||||||||||||||||||||||||

| Year Ended December 31, |

Three Months Ended March 31, |

Year Ended 2005 |

Three Months 2006 |

|||||||||||||||||||||||

| 2003(1) |

2004 |

2005 |

2005 |

2006 |

||||||||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||||||||

| Statement of Income Information: |

||||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||||

| Oil and gas |

$ | 421,435 | $ | 508,195 | $ | 584,564 | $ | 128,724 | $ | 156,852 | $ | 1,146,090 | $ | 268,120 | ||||||||||||

| Other |

1,152 | 520 | 572 | 348 | 5,278 | 1,110 | 5,558 | |||||||||||||||||||

| Total revenues |

422,587 | 508,715 | 585,136 | 129,072 | 162,130 | 1,147,200 | 273,678 | |||||||||||||||||||

| Expenses: |

||||||||||||||||||||||||||

| Lease operating |

65,947 | 73,475 | 71,758 | 16,153 | 15,780 | 159,363 | 45,772 | |||||||||||||||||||

| Gathering, transportation and production taxes |

10,213 | 14,099 | 12,702 | 4,496 | 1,256 | 20,807 | 3,241 | |||||||||||||||||||

| Depreciation, depletion and amortization |

136,249 | 155,640 | 174,771 | 38,957 | 46,838 | 465,826 | 103,800 | |||||||||||||||||||

| Asset retirement obligation accretion(2) |

7,443 | 9,168 | 9,062 | 2,312 | 2,254 | 18,670 | 4,777 | |||||||||||||||||||

| General and administrative(3)(4)(5) |

22,912 | 25,001 | 28,418 | 6,909 | 11,660 | 36,444 | 13,666 | |||||||||||||||||||

| Total operating expenses |

242,764 | 277,383 | 296,711 | 68,827 | 77,788 | 701,110 | 171,256 | |||||||||||||||||||

| Income from operations |

179,823 | 231,332 | 288,425 | 60,245 | 84,342 | 446,090 | 102,422 | |||||||||||||||||||

| Net interest income (expense) |

(2,229 | ) | (1,842 | ) | 1,601 | (221 | ) | 1,322 | (49,259 | ) | (6,136 | ) | ||||||||||||||

| Income before income taxes |

177,594 | 229,490 | 290,026 | 60,024 | 85,664 | 396,831 | 96,286 | |||||||||||||||||||

| Income taxes |

61,156 | 80,008 | 101,003 | 20,742 | 29,833 | 138,385 | 33,551 | |||||||||||||||||||

| Cumulative effect of change in accounting principle, net of tax(2) |

144 | — | — | — | — | — | — | |||||||||||||||||||

| Net income |

116,582 | 149,482 | 189,023 | 39,282 | 55,831 | 258,446 | 62,735 | |||||||||||||||||||

| Less preferred stock dividends |

5,876 | 900 | — | — | — | — | — | |||||||||||||||||||

| Net income applicable to common shareholders |

$ | 110,706 | $ | 148,582 | $ | 189,023 | $ | 39,282 | $ | 55,831 | $ | 258,446 | $ | 62,735 | ||||||||||||

| Net income per common share: |

||||||||||||||||||||||||||

| Basic earnings per share |

$ | 2.14 | $ | 2.82 | $ | 2.91 | $ | 0.63 | $ | 0.85 | $ | 3.52 | $ | 0.84 | ||||||||||||

| Diluted earnings per share |

1.79 | 2.27 | 2.87 | 0.60 | 0.85 | 3.47 | 0.84 | |||||||||||||||||||

| Common stock dividends |

35,124 | 3,550 | 5,938 | 1,319 | 1,984 | |||||||||||||||||||||

| Cash dividends per common share |

0.67 | 0.07 | 0.09 | 0.02 | 0.03 | |||||||||||||||||||||

| Consolidated Cash Flow Information: |

||||||||||||||||||||||||||

| Net cash provided by operating activities |

$ | 263,155 | $ | 377,275 | $ | 444,043 | $ | 72,428 | $ | 113,305 | ||||||||||||||||

| Capital expenditures |

203,400 | 284,847 | 323,743 | 56,040 | 122,894 | |||||||||||||||||||||

| Other Financial Information: |

||||||||||||||||||||||||||

| EBITDA(6) |

$ | 323,659 | $ | 396,140 | $ | 472,258 | $ | 101,514 | $ | 133,434 | $ | 930,586 | $ | 210,999 | ||||||||||||

| Adjusted EBITDA (6) |

323,659 | 396,140 | 472,258 | 101,514 | 128,158 | 930,586 | 205,723 | |||||||||||||||||||

S-12

| As of December 31, |

As of March 31, 2006 | ||||||||||||||

| 2003 |

2004 |

2005 |

Actual |

Pro Forma | |||||||||||

| (in thousands) | |||||||||||||||

| Consolidated Balance Sheet Information: |

|||||||||||||||

| Total assets |

$ | 546,729 | $ | 760,784 | $ | 1,064,520 | $ | 1,121,186 | $ | 2,258,461 | |||||

| Long-term debt |

67,000 | 35,000 | 40,000 | — | 339,138 | ||||||||||

| Shareholders’ equity |

214,455 | 359,878 | 543,383 | 598,660 | 906,898 | ||||||||||

| (1) | In December 2003, we acquired working interests through merger in 13 oil and gas fields located in the Gulf of Mexico from ConocoPhillips. |

| (2) | Effective January 1, 2003, we adopted Statement of Financial Accounting Standards No. 143, Accounting for Asset Retirement Obligations. The cumulative effect of the change in accounting principle was $221,000 ($144,000 net of income taxes). |

| (3) | The amounts for 2004 and 2005 include approximately $1.5 million and $0.9 million, respectively, of expenses associated with our initial public offering, which was completed in January 2005. Also included in general and administrative for 2005 are expenses of $2.4 million associated with the temporary displacement of the employees who worked in our operations office in Metairie, Louisiana due to damage caused by Hurricane Katrina and the subsequent relocation of the majority of those employees to Houston, Texas. |

| (4) | In December 2004, our board of directors granted an employee bonus to all employees of record on December 31, 2004 (other than our Chief Executive Officer and our Corporate Secretary) in amounts equal to their 2004 salaries. The bonus was paid in two installments on June 1, 2005 and January 3, 2006 to eligible individuals who were still in our employ on those dates. Approximately $5.2 million and $2.6 million of expenses related to this bonus are included in general and administrative for 2004 and 2005, respectively. |

| (5) | General and administrative expenses related to our long-term incentive compensation plans were $9.3 million, $0.6 million and $2.3 million in 2003, 2004 and 2005, respectively. |

| (6) | We define EBITDA as net income plus income tax expense, net interest expense, depreciation, depletion, amortization and accretion. We define Adjusted EBITDA as EBITDA minus non-cash change in commodity derivatives (before tax). Although not prescribed by generally accepted accounting principles, or GAAP, we believe the presentation of EBITDA and Adjusted EBITDA are relevant and useful because they help our investors understand our operating performance and make it easier to compare our results with those of other companies that have different financing, capital or tax structures. Neither EBITDA nor Adjusted EBITDA should be considered in isolation from or as a substitute for net income, as an indication of operating performance or cash flows from operating activities or as a measure of liquidity. EBITDA and Adjusted EBITDA, as we calculate them, may not be comparable to EBITDA or Adjusted EBITDA measures reported by other companies. In addition, EBITDA and Adjusted EBITDA do not represent funds available for discretionary use. The following presents a reconciliation of our consolidated net income to consolidated EBITDA to Adjusted EBITDA. |

| Pro Forma |

||||||||||||||||||||||||

| Year Ended December 31, |

Three Months Ended March 31, |

Year Ended 2005 |

Three Months 2006 |

|||||||||||||||||||||

| 2003 |

2004 |

2005 |

2005 |

2006 |

||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| Net income |

$ | 116,582 | $ | 149,482 | $ | 189,023 | $ | 39,282 | $ | 55,831 | $ | 258,446 | $ | 62,735 | ||||||||||

| Income taxes |

61,156 | 80,008 | 101,003 | 20,742 | 29,833 | 138,385 | 33,551 | |||||||||||||||||

| Net interest (income) expense |

2,229 | 1,842 | (1,601 | ) | 221 | (1,322 | ) | 49,259 | 6,136 | |||||||||||||||

| Depreciation, depletion, amortization and accretion |

143,692 | 164,808 | 183,833 | 41,269 | 49,092 | 484,496 | 108,577 | |||||||||||||||||

| EBITDA |

323,659 | 396,140 | 472,258 | 101,514 | 133,434 | 930,586 | 210,999 | |||||||||||||||||

| Non-cash change in commodity derivatives (before tax) |

— | — | — | — | (5,276 | ) | — | (5,276 | ) | |||||||||||||||

| Adjusted EBITDA |

$ | 323,659 | $ | 396,140 | $ | 472,258 | $ | 101,514 | $ | 128,158 | $ | 930,586 | $ | 205,723 | ||||||||||

S-13

SUMMARY RESERVE AND OPERATING DATA

The following presents summary information regarding our estimated net proved oil and natural gas reserves as of December 31, 2003, 2004 and 2005 and on a combined basis as described below and our historical operating data for each of the three years in the period ended December 31, 2005 and for the three months ended March 31, 2005 and 2006, as well as pro forma operating data for the year ended December 31, 2005 and for the three months ended March 31, 2005. All calculations of estimated net proved reserves have been made in accordance with the rules and regulations of the SEC and, except as otherwise indicated, give no effect to federal or state income taxes. The historical operating data below should be read together with, and is qualified in its entirety by reference to, our historical consolidated financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which are set forth in our annual report on Form 10-K for the year ended December 31, 2005 and in our quarterly report on Form 10-Q for the quarter ended March 31, 2006, which are incorporated by reference into this prospectus supplement. The summary combined information regarding estimated net proved oil and natural gas reserves set forth in the table below combines our proved reserves as of December 31, 2005 with the proved reserves attributable to the Kerr-McGee Properties as of September 30, 2005 and was derived from reserve reports prepared by Netherland, Sewell & Associates. The summary pro forma information regarding our operating data gives effect to the Kerr-McGee Transaction as if it occurred on January 1, 2005, but does not reflect what the proved reserve volumes would have been on a pro forma basis if a reserve report had been prepared for the Kerr-McGee Properties as of December 31, 2005 because estimated reserve quantities change over time due to factors such as revisions of previous estimates, production and extensions and discoveries. Further, commodity price levels can affect the quantities of reserves that can be economically produced and thus considered to be proved reserves.

| As of December 31, |

||||||||||||

| 2003 |

2004 |

2005 |

Combined(1)(2)(3) |

|||||||||

| Reserve Data: |

||||||||||||

| Estimated net proved reserves: |

||||||||||||

| Natural gas (Bcf) |

231.1 | 227.6 | 215.9 | 467.6 | ||||||||

| Oil (MMBbls) |

35.6 | 40.0 | 45.9 | 61.5 | ||||||||

| Total natural gas and oil (Bcfe)(4) |

444.7 | 467.5 | 491.5 | 836.8 | ||||||||

| Proved developed producing (Bcfe)(4) |

135.5 | 145.8 | 120.1 | 216.2 | ||||||||

| Proved developed non-producing (Bcfe)(4)(5) |

160.1 | 144.4 | 198.5 | 341.9 | ||||||||

| Total proved developed (Bcfe)(4) |

295.6 | 290.1 | 318.6 | 558.1 | ||||||||

| Proved undeveloped (Bcfe) |

149.1 | 177.3 | 172.9 | 278.7 | ||||||||

| Proved developed reserves as a percentage of proved reserves |

66.5 | % | 62.1 | % | 64.8 | % | 66.7 | % | ||||

| Pro Forma | ||||||||||||||

| Year Ended December 31, |

Three Months Ended March 31, |

Year Ended 2005 |

Three Months Ended March 31, 2006 | |||||||||||

| 2003 |

2004 |

2005 |

2005 |

2006 |

||||||||||

| Operating Data: |

||||||||||||||

| Net sales: |

||||||||||||||

| Natural gas (MMcf) |

52,807 | 53,348 | 46,548 | 12,375 | 10,904 | 93,680 | 19,069 | |||||||

| Oil (MBbls) |

4,373 | 4,847 | 4,085 | 1,154 | 1,067 | 7,955 | 1,812 | |||||||

| Total natural gas and oil (MMcfe)(4) |

79,045 | 82,432 | 71,060 | 19,299 | 17,307 | 141,410 | 29,941 | |||||||

| Average daily equivalent sales (MMcfe/d)(4) |

216.6 | 225.2 | 194.7 | 214.4 | 192.3 | 387.4 | 332.7 | |||||||

S-14

| Pro Forma | |||||||||||||||||||||

| Year Ended December 31, |

Three Months Ended March 31, |

Year Ended 2005 |

Three Months Ended March 31, 2006 | ||||||||||||||||||

| 2003 |

2004 |

2005 |

2005 |

2006 |

|||||||||||||||||

| Average realized sales prices: |

|||||||||||||||||||||

| Natural gas ($/Mcf) |

$ | 5.60 | $ | 6.18 | $ | 8.27 | $ | 6.33 | $ | 8.82 | $ | 8.03 | $ | 8.64 | |||||||

| Oil ($/Bbl) |

28.74 | 36.77 | 48.85 | 43.67 | 56.90 | 49.06 | 56.19 | ||||||||||||||

| Natural gas equivalent ($/Mcfe) |

5.33 | 6.16 | 8.23 | 6.67 | 9.06 | 8.08 | 8.90 | ||||||||||||||

| Average per Mcfe data ($/Mcfe): |

|||||||||||||||||||||

| Lease operating expenses |

$ | 0.83 | $ | 0.89 | $ | 1.01 | $ | 0.84 | $ | 0.91 | $ | 1.13 | $ | 1.53 | |||||||

| Gathering, transportation costs and production taxes |

0.13 | 0.17 | 0.18 | 0.23 | 0.07 | 0.15 | 0.11 | ||||||||||||||

| Depreciation, depletion, amortization and accretion |

1.82 | 2.00 | 2.59 | 2.14 | 2.84 | 3.43 | 3.63 | ||||||||||||||

| General and administrative expenses |

0.29 | 0.30 | 0.40 | 0.36 | 0.67 | 0.26 | 0.46 | ||||||||||||||

| (1) | Our reserve estimates have been calculated using the prices for natural gas and oil at December 31, 2005, which were $9.73 per MMBtu of natural gas and $57.75 per barrel of oil, in each case without giving effect to hedging transactions. These prices do not reflect adjustments for quality, transportation fees, energy content and regional price differentials. We estimate that if natural gas prices decline by $0.10 per MMBtu from the price utilized in determining our proved reserves, the PV-10 of our proved reserves as of December 31, 2005 would decrease from $2,416 million to $2,401 million and that the quantity of our reserves would decline by 44,500 Mcf of natural gas and 4,400 barrels of oil and natural gas liquids. We estimate that if oil prices decline by $1.00 per barrel from the price utilized in determining our proved reserves, then the PV-10 of our proved reserves as of December 31, 2005 would decrease from $2,416 million to $2,387 million and that the quantity of our reserves would decline by 52,500 Mcf of natural gas and 20,400 barrels of oil and natural gas liquids. Estimates of PV-10 of reserves and the quantity of reserves would likely decline at a rate proportionately greater than specified above if natural gas and oil prices decline significantly from those used in calculating such estimates. |

| (2) | The reserve estimates for the Kerr-McGee Properties have been calculated using the prices for natural gas and oil at September 30, 2005, which were $15.48 per MMBtu of natural gas and $63.00 per barrel of oil, in each case without giving effect to hedging transactions. These prices do not reflect adjustments for quality, transportation fees, energy content and regional price differentials. We estimate that if natural gas prices decline by $0.10 per MMBtu from the price utilized in determining the proved reserves related to the Kerr-McGee Properties, the PV-10 of the proved reserves related to the Kerr-McGee Properties as of September 30, 2005 would decrease from $2,999 million to $2,980 million and that the quantity of the reserves would decline by 116,400 Mcf of natural gas and 8,800 barrels of oil and natural gas liquids. We estimate that if oil prices decline by $1.00 per barrel from the price utilized in determining the proved reserves related to the Kerr-McGee Properties, then the PV-10 of the proved reserves related to the Kerr-McGee Properties as of September 30, 2005 would decrease from $2,999 million to $2,988 million and that the reserves related to the Kerr-McGee Properties would decline by 134,800 Mcf of natural gas and 29,800 barrels of oil and natural gas liquids. Estimates of PV-10 of reserves and the quantity of reserves would likely decline at a rate proportionately greater than specified above if natural gas and oil prices decline significantly from those used in calculating such estimates. |

| (3) | Our combined reserve estimates have been calculated using December 31, 2005 estimates for W&T and using September 30, 2005 estimates for the Kerr-McGee Properties, which estimates in each case were based upon engineering reports prepared by Netherland, Sewell & Associates, Inc. The combined reserve data should not be considered as pro forma reserve data since the reserve data for W&T and for the Kerr-McGee Properties was determined as of two different dates. For purposes of preparing the unaudited footnote related to reserves that constitutes a part of the statements of revenues and direct operating |

S-15

| expenses for the Kerr-McGee Properties, W&T prepared an estimate of reserves of the Kerr-McGee Properties at December 31, 2005 by (i) subtracting from the Netherland Sewell & Associates, Inc. reserve estimate at September 30, 2005 the quantity of oil and natural gas produced from the Kerr-McGee Properties for the period from September 30, 2005 through December 31, 2005 (approximately 10.8 Bcfe) and (ii) applying prices for natural gas and oil at December 31, 2005 (rather than the September 30, 2005 prices utilized for purposes of the September 30, 2005 reserve estimate), which resulted in an additional 8.7 Bcfe decrease. These adjustments do not account for any other factors such as discoveries, revisions or extensions that may have occurred subsequent to September 30, 2005. |

| (4) | One billion cubic feet equivalent (Bcfe), one million cubic feet equivalent (MMcfe) and one thousand cubic feet equivalent (Mcfe) are determined using the ratio of six Mcf of natural gas to one Bbl of crude oil, condensate or natural gas liquids (totals may not add due to rounding). |

| (5) | Includes 23.5 Bcfe of reserves for W&T that were shut-in at December 31, 2005 and 63.7 Bcfe of reserves for the Kerr-McGee Properties that were shut-in at September 30, 2005 because of Hurricanes Katrina and Rita. |

PV-10 Reconciliation

We use the term “PV-10” in this prospectus supplement to reflect the present value of estimated future net revenues attributable to reserves as of a particular date using constant prices, as of the calculation date, discounted at 10% per year on a pre-tax basis. PV-10 is the computation of standardized measure of discounted net cash flows on a pre-tax basis. The standardized measure of discounted future net cash flows represents the present value of future cash flows after income tax, discounted at 10%. For purposes of making a determination of the PV-10 for us as of December 31, 2005, we utilized oil prices based on the December 31, 2005 West Texas Intermediate posted price, adjusted by lease for quality, transportation fees, and regional price differentials and gas prices based on the December 31, 2005 Tennessee (LA, 500 leg) spot market price, adjusted for energy content, transportation fees and regional price differentials, with prices held constant in accordance with SEC guidelines. The PV-10 for our properties has been reduced by our estimated discounted cost of future plug and abandonment expenses attributable to these properties.

For purposes of making a determination of the PV-10 for the Kerr-McGee Properties as of September 30, 2005, we utilized oil prices based on the September 30, 2005 West Texas Intermediate posted price, adjusted by lease for quality, transportation fees, and regional price differentials and gas prices based on the September 30, 2005 Tennessee (LA, 500 leg) spot market price, adjusted for energy content, transportation fees and regional price differentials, with prices held constant in accordance with SEC guidelines. The PV-10 for the Kerr-McGee Properties has been reduced by the estimated discounted cost of future plug and abandonment expenses attributable to these properties.

PV-10 may be considered a non-GAAP financial measure; therefore, the following table reconciles our calculation of PV-10 to standardized measure of discounted net cash flows, which is the most directly comparable GAAP financial measure. Management believes that the presentation of the non-GAAP financial measure of PV-10 provides useful information to investors because it is widely used by professional analysts and sophisticated investors in evaluating natural gas and oil companies. Management believes that PV-10 is relevant and useful for evaluating the relative monetary significance of natural gas and oil properties. Further, professional analysts and sophisticated investors may utilize the measure as a basis for comparison of the relative size and value of our reserves to other companies’ reserves. Management also uses this pre-tax measure when assessing the potential return on investment related to natural gas and oil properties and in evaluating acquisition candidates. Because there are many unique factors that can impact an individual company when estimating the amount of future income taxes to be paid, we believe the use of a pre-tax measure is valuable for evaluating us and the Kerr-McGee Properties. PV-10 is not a measure of financial or operating performance under GAAP, nor is it intended to represent the current market value of our estimated natural gas and oil reserves. PV-10 should

S-16

not be considered in isolation or as a substitute for the standardized measure of discounted net cash flows as defined under GAAP. The PV-10 and standardized measure of discounted future cash flows relating to our proved oil and gas reserves and those of the Kerr-McGee Properties are as follows (in thousands):

| W&T (As of December 31, 2005) |

Kerr-McGee Properties (As of September 30, 2005) | |||||

| Future cash inflows |

$ | 4,697,926 | $ | 4,908,703 | ||

| Less: Future production costs |

504,741 | 505,868 | ||||

| Less: Future development costs |

433,572 | 226,145 | ||||

| Less: Dismantlement and abandonment costs |

220,943 | 181,698 | ||||

| Future net cash flows |

3,538,670 | 3,994,992 | ||||

| Less: 10% discount factor |

1,122,138 | 996,472 | ||||

| PV-10 |

2,416,532 | 2,998,520 | ||||

| Less: Undiscounted income taxes |

1,146,073 | 924,146 | ||||

| Plus: 10% discount factor |

325,987 | 190,085 | ||||

| Discounted income taxes |

820,086 | 734,061 | ||||

| Standardized measure of discounted net cash flows |

$ | 1,596,446 | $ | 2,264,459 | ||

S-17

You should carefully consider the risks described below and in the accompanying prospectus and the other information in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference before deciding to invest in our securities. If any of the following risks were actually to occur, our business, financial condition or results of operations could be materially and adversely affected.

Risks Relating to the Oil and Natural Gas Industry and Our Business

Acquisitions may prove to be worth less than we paid because of uncertainties in evaluating recoverable reserves and potential liabilities.

Our recent growth is due in part to acquisitions of exploration and production companies, producing properties and undeveloped leasehold interests. We expect acquisitions will also contribute to our future growth. Successful acquisitions require an assessment of a number of factors, including estimates of recoverable reserves, exploration potential, future oil and gas prices, operating costs and potential environmental and other liabilities. Such assessments are inexact and their accuracy is inherently uncertain. In connection with our assessments, we perform a review of the acquired properties which we believe is generally consistent with industry practices. However, such a review will not reveal all existing or potential problems. In addition, our review may not permit us to become sufficiently familiar with the properties to fully assess their deficiencies and capabilities. We are generally not entitled to contractual indemnification for pre-closing liabilities, including environmental liabilities. Normally, we acquire interests in properties on an “as is” basis with limited remedies for breaches of representations and warranties. As a result of these factors, we may not be able to acquire oil and gas properties that contain economically recoverable reserves or be able to complete such acquisitions on acceptable terms.

Our acquisition strategy involves risks that may adversely affect our business.

Increasing our reserve base through acquisitions is an important part of our business strategy. Any acquisition, including the Kerr-McGee Transaction, involves potential risks, including:

| • | a significant increase in our indebtedness and working capital requirements; |

| • | the inability to timely and effectively integrate the operations of recently acquired businesses or assets; |

| • | the incurrence of substantial unforeseen environmental and other liabilities arising out of the acquired businesses or assets, including liabilities arising from the operation of the acquired businesses or assets before our acquisition; |

| • | costs of increased scope and complexity of our operations; |

| • | an increase in exposure to weather-related complications in the Gulf of Mexico; |

| • | customer or key employee loss from the acquired businesses; and |

| • | the diversion of management’s attention from other business concerns. |

The scope and cost of these risks may ultimately be materially greater than estimated at the time of the acquisition. Any of these factors could adversely affect our ability to achieve anticipated levels of revenue from our acquisitions or realize other anticipated benefits.

Our pending Kerr-McGee Transaction may not close as anticipated.

We expect that our pending Kerr-McGee Transaction will close during the third quarter of 2006, subject to the satisfaction of customary closing conditions. There is no assurance that this transaction will close at that time, or at all, or close without material adjustment. If the transaction does not close as anticipated, subject to our compliance with restrictions under our credit facility, we will have a significant amount of cash that may be applied for such purposes as we deem appropriate. We can not currently determine how we would allocate such amounts.

S-18

If the Kerr-McGee Transaction closes, we will have substantial indebtedness under our credit facility and may incur substantially more debt. Any failure to meet our debt obligations would adversely affect our business and financial condition.

If the Kerr-McGee Transaction closes, we will have substantial debt under of credit facility. As of June 30, 2006, we expect to borrow between $0.7 billion and $1.0 billion under our new credit facility. As a result of our indebtedness, we will need to use a portion of our cash flow to pay principal and interest, which will reduce the cash available to finance our operations and other business activities and could limit our flexibility in planning for or reacting to changes in our business and the industry in which we operate. Interest rates for our new credit facility vary based upon utilization and whether the borrowings are at the base rate or the London Interbank Offering Rate, or LIBOR. The amount of our debt may also cause us to be more vulnerable to economic downturns and adverse developments in our business.

Our ability to meet our debt obligations and other expenses will depend on our future performance, which will be affected by financial, business, economic, regulatory and other factors, many of which we are unable to control. If our cash flow is not sufficient to service our debt, we may be required to refinance the debt, sell assets or sell additional shares of common stock on terms that we do not find attractive, if it can be done at all.

The new credit facility obligates us to comply with certain financial covenants calculated as of the last day of each fiscal quarter:

| • | commencing with the fiscal quarter ending on March 31, 2007, the ratio of our consolidated current assets to consolidated current liabilities will not be less than (a) before but not including September 30, 2007, 0.75 to 1.0, (b) from and after September 30, 2007 to but excluding September 30, 2008, 0.875 to 1.0 and (c) from and after September 30, 2008, 1.0 to 1.0; |

| • | our leverage ratio (as defined in the credit agreement) will not be greater than 2.0 to 1.0; |

| • | the ratio of (a) our EBITDA (as defined in the credit agreement) for the four quarter period then ended to (b) our consolidated interest expense (as defined in the credit agreement) for the four quarter period then ended will not be less than 4.0 to 1.0; and |

| • | the minimum asset coverage ratio (as defined in the credit agreement) will not be greater than (a) a ratio of 1.50 to 1.00 from the closing date through and including the second fiscal quarter to occur following the closing date, (b) a ratio of 1.75 to 1.00 from the start of the third fiscal quarter to occur following the closing date through and including the fourth fiscal quarter to occur following the closing date and (c) a ratio of 2.00 to 1.00 for any fiscal quarter thereafter. |

Our failure to comply with the financial and other restrictive covenants relating to our indebtedness could result in a default under the indebtedness, which could materially adversely affect our business, financial condition and results of operations.

Lower oil and gas prices could negatively impact our ability to borrow.

The availability under our new credit facility as of June 30, 2006 is limited to approximately $1.0 billion, which may be increased under certain circumstances. Availability under our new credit facility is determined periodically at the discretion of the banks and is based in part on oil and gas prices. Additionally, we may enter into agreements in the future that contain covenants limiting our ability to incur indebtedness in addition to that incurred under our bank credit facility. These agreements may limit our ability to incur additional indebtedness based on specified financial covenants, ratios or other criteria. Lower oil and gas prices in the future could affect our ability to satisfy these covenants, ratios or other criteria and thus could reduce our ability to incur additional indebtedness.

S-19

The unavailability or high cost of additional drilling rigs, equipment, supplies, personnel and oil field services could adversely affect our ability to execute on a timely basis our exploration and development plans within our budget.

The offshore oil and gas industry is experiencing significant shortages in the availability of drilling rigs as well as significant increases in the cost of utilizing drilling rigs. Shortages or the high cost of drilling rigs, equipment, supplies or personnel could delay or adversely affect our development and exploration operations, which could have a material adverse effect on our business, financial condition or results of operations. In addition, our proved reserve estimates and the standardized measure of discounted cash flows from our proved reserves are based on various assumptions related to the timing of the drilling and completion of development wells, and any significant delays in drilling these wells could adversely affect the estimated reserve quantities and the standardized measure of discounted cash flows from our proved reserves.

We may decide not to drill some of the prospects we have identified.

We describe some of our current prospects and our plans to explore those prospects in this prospectus supplement and the accompanying prospectus. A prospect is a property on which we have identified what our geoscientists believe to be indications of oil or natural gas, based on available seismic and geological information. Our prospects are in various stages of evaluation, ranging from a prospect that is ready to drill to a prospect that will require substantial additional seismic data processing and interpretation. Based on a variety of factors, including future oil and natural gas prices, the generation of additional seismic or geological information, the availability of drilling rigs and other factors, we may decide not to drill one or more of these prospects. As a result, we may not be able to increase or maintain our reserves or production, which in turn could have an adverse effect on our business, financial condition or results of operations.

Prospects that we decide to drill may not yield oil or natural gas in commercially viable quantities or quantities sufficient to meet our targeted rate of return.

Our prospects are in various stages of evaluation, ranging from a prospect that is ready to be drilled to a prospect that will require substantial additional seismic data processing and interpretation. There is no way to predict in advance of drilling and testing whether any particular prospect will yield oil or natural gas in sufficient quantities to recover drilling or completion cost or to be economically viable. The use of seismic data and other technologies and the study of producing fields in the same area will not enable us to know conclusively before drilling whether oil or natural gas will be present or, if present, whether oil or natural gas will be present in commercial quantities. We cannot assure you that the analysis we perform using data from other wells, more fully explored prospects and/or producing fields will be useful in predicting the characteristics and potential reserves associated with our drilling prospects. As we focus our drilling efforts on deepwater and deep shelf targets, our drilling activities will likely become more expensive. In addition, the geological complexity of deepwater and deep shelf formations may make it more difficult for us to sustain our historical rates of drilling success. As a result, there can be no assurance that we will find commercially viable quantities of oil and natural gas.

Losses and liabilities from uninsured or underinsured drilling and operating activities could have a material adverse effect on our financial condition and operations.

We will be exposed to larger uninsured losses in the future. The substantial insurance claims made by oil and gas producers in the Gulf of Mexico as a result of Hurricanes Katrina and Rita have caused the cost of insurance to rise dramatically. Our insurance renewal is scheduled to occur on or before July 31, 2006. We believe that we will be able to obtain insurance for our properties and those that we will own upon completion of the Kerr-McGee Transaction; however, the cost of the insurance will be significantly higher than our current coverage. Our deductible for the storm damage from Hurricanes Katrina and Rita was $5 million for the policy period ending July 31, 2006. We believe that the deductible or retention portion of our policy as renewed will be

S-20

$15 million to $20 million. The cost of our control of well and offshore property insurance was approximately $4 million for the twelve-month period ending July 31, 2006. We believe that the cost of comparable insurance, if available, could be as high as $40 million for the combined W&T and Kerr-McGee Properties. If we determine to purchase insurance, we believe it will have a $100 million aggregate limit for windstorm losses.

Our stock price and trading volume may be volatile, which could result in substantial losses for our shareholders.

The equity trading markets may experience periods of volatility, which could result in highly variable and unpredictable pricing of equity securities. The market price of our common stock could change in ways that may or may not be related to our business, industry or operating performance and financial condition. In addition, the trading volume in our common stock may fluctuate and cause significant price variations to occur. Our current market price and valuation may not be sustainable. We cannot assure you that the market price of our common stock will not fluctuate or decline significantly in the future. In addition, the stock markets in general can experience considerable price and volume fluctuations.

S-21

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, including documents incorporated by reference, contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements give our current expectations or forecasts of future events. They include statements regarding our future operating and financial performance. Although we believe the expectations and forecasts reflected in these and other forward-looking statements are reasonable, we can give no assurance they will prove to have been correct. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. You should understand that the following important factors, in addition to those discussed in “Risk Factors” elsewhere in this prospectus supplement, the accompanying prospectus and in the documents that are incorporated by reference into this prospectus supplement, could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in the forward-looking statements relating to:

| • | amount, nature and timing of capital expenditures; |

| • | drilling of wells and other planned exploitation activities; |

| • | timing and amount of future production of oil and natural gas; |

| • | increases in production growth and proved reserves; |

| • | operating costs such as lease operating expenses, administrative costs and other expenses; |

| • | our future operating or financial results; |

| • | cash flow and anticipated liquidity; |

| • | our business strategy, including expansion into the deep shelf and the deepwater of the Gulf of Mexico, and the availability of acquisition opportunities; |

| • | hedging strategy; |

| • | exploration and exploitation activities and property acquisitions; |

| • | marketing of oil and natural gas; |

| • | governmental and environmental regulation of the oil and gas industry; |

| • | environmental liabilities relating to potential pollution arising from our operations; |

| • | our level of indebtedness; |

| • | timing and amount of future dividends; |

| • | industry competition, conditions, performance and consolidation; |

| • | natural events such as severe weather, hurricanes, floods, fire and earthquakes; and |

| • | uncertainties and difficulties associated with closing our pending Kerr-McGee Transaction and the integration and operation of its properties thereafter. |

We caution you not to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus supplement or as of the date of the report or document in which they are contained, and we undertake no obligation to update such information. We urge you to carefully review and consider the disclosures made in this prospectus supplement, the accompanying prospectus and our reports filed with the SEC and incorporated by reference herein that attempt to advise interested parties of the risks and factors that may affect our business.

S-22

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports and other information with the Securities and Exchange Commission, or SEC (File No. 001-32414), pursuant to the Securities Exchange Act of 1934. You may read and copy any documents that are filed at the SEC Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may also obtain copies of these documents at prescribed rates from the Public Reference Section of the SEC at its Washington address. Please call the SEC at l-800-SEC-0330 for further information. In addition, because our common stock is listed on the New York Stock Exchange, reports and other information about us can be inspected at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005.

Our filings are also available to the public free of charge through the SEC’s website at http://www.sec.gov and on our website at www.wtoffshore.com. However, the information on our website is not part of this prospectus supplement or the accompanying prospectus.