UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a – 6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

W&T Offshore, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

April 5, 2006

Dear Shareholder:

It is a pleasure to invite you to the Company’s 2006 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Tuesday, May 16, 2006 at 9:30 a.m. central daylight time, at the St. Regis Hotel, 1919 Briar Oaks Lane, Houston, Texas 77027. I hope you will be able to attend.

Details of the business to be conducted at the annual meeting are given in the attached Notice of Annual Meeting and Proxy Statement. Additionally, enclosed with the proxy materials is our annual report on Form 10-K.

You received with this booklet a proxy card that indicates the number of votes that you will be entitled to cast at the meeting according to the records of the Company or your broker or other nominee. Each share of the Company that you have “beneficially owned” continuously since April 4, 2006 entitles you to one vote.

Whether or not you attend the annual meeting, it is important that your shares be represented and voted at the meeting. Therefore, I urge you to promptly vote and submit your proxy by signing, dating and returning the enclosed proxy card in the enclosed envelope. If you decide to attend the annual meeting, you will be able to vote in person, even if you have previously submitted your proxy.

On behalf of the Board of Directors and the employees of W&T Offshore, Inc., I would like to express my appreciation for your continued interest in the affairs of the Company. I look forward to greeting as many of you as possible.

Sincerely,

Tracy W. Krohn

Chief Executive Officer

Chairman of the Board,

President and Treasurer

Eight Greenway Plaza

Suite 1330 • Houston, TX • 77046

(713) 626-8525 • Fax: (713) 626-8527

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 16, 2006

Notice is hereby given that the 2006 Annual Meeting of Shareholders of W&T Offshore, Inc., a Texas Corporation (the “Company”), will be held at the St. Regis Hotel, 1919 Briar Oaks Lane, Houston, Texas 77027 on May 16, 2006 at 9:30 a.m. central daylight time for the purpose of electing six (6) directors to hold office until the 2007 Annual Meeting of Shareholders and until their successors are duly elected and qualified.

Only shareholders of record at the close of business on April 4, 2006 (the “Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting, or any adjournment thereof, notwithstanding the transfer of any stock on the books of the Company after the Record Date. A list of these shareholders will be open for examination by any shareholder at the Annual Meeting, and for ten days prior thereto at the Company’s principal executive offices at Eight Greenway Plaza, Suite 1330, Houston, Texas 77046.

By Order of the Board of Directors,

Jerome F. Freel

Chairman Emeritus and Secretary

Houston, Texas

April 5, 2006

PLEASE SIGN AND RETURN THE ENCLOSED PROXY CARD TO US, WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING IN PERSON. SHAREHOLDERS WHO ATTEND THE 2006 ANNUAL MEETING MAY REVOKE THEIR PROXIES AND VOTE IN PERSON.

Eight Greenway Plaza

Suite 1330 • Houston, TX • 77046

(713) 626-8525 • Fax: (713) 626-8527

W&T OFFSHORE, INC.

Eight Greenway Plaza, Suite 1330

Houston, Texas 77046

PROXY STATEMENT

2006 ANNUAL MEETING OF SHAREHOLDERS

THE ANNUAL MEETING

This proxy statement is solicited by and on behalf of the Board of Directors of the Company for use at the 2006 Annual Meeting to be held on May 16, 2006 at the St. Regis Hotel, 1919 Briar Oaks Lane, Houston, Texas 77027, at 9:30 a.m. central daylight time, or at any adjournments thereof. The solicitation of proxies by the Board of Directors will be conducted primarily by mail. Additionally, officers, directors and employees of the Company may solicit proxies personally or by telephone, telegram or other forms of wire or facsimile communication. These officers, directors and employees will not receive any extra compensation for these services. The Company will reimburse brokers, custodians, nominees and fiduciaries for reasonable expenses incurred by them in forwarding proxy material to beneficial owners of common stock of the Company (the “Common Stock”). The costs of the solicitation will be borne by the Company. This proxy statement and the form of proxy are first being mailed to shareholders of the Company on or about April 13, 2006.

Purpose of the 2006 Annual Meeting

The purpose of the 2006 Annual Meeting is to elect six candidates to the Board of Directors of the Company. Although the Board does not anticipate that any other issue will come before the 2006 Annual Meeting, your executed proxy gives the official proxies the right to vote your shares at their discretion on any other matter properly brought before the Annual Meeting.

Voting Rights and Solicitation

Only shareholders of record at the close of business on April 4, 2006 (the “Record Date”) will be entitled to notice of and to vote at the 2006 Annual Meeting. As of the Record Date, there were 66,140,252 shares of Common Stock outstanding, each of which is entitled to one vote on any matter to come before the meeting. Common Stock is the only class of outstanding securities of the Company. The holders of issued and outstanding shares representing a majority of the outstanding shares of Common Stock, present in person or represented by proxy at the Annual Meeting, will constitute a quorum, and the act of the majority of the voting power of the quorum so represented at the Annual Meeting will constitute the act of the shareholders. The person who is appointed by the chairman of the meeting to be the judge of election will treat the holders of all shares of Common Stock represented by a returned, properly executed proxy, including shares that abstain from voting, as present for purposes of determining the existence of a quorum at the Annual Meeting.

Each share of Common Stock present or represented at the Annual Meeting will be entitled to one vote on any matter to come before the shareholders. In accordance with the Company’s Restated Articles of Incorporation, cumulative voting will not be permitted, and all directors will be elected by a plurality of the votes cast at the Annual Meeting. Votes will be counted by the judge of election, who will be selected by the chair of the Annual Meeting.

The Board of Directors is soliciting your proxy on the enclosed proxy card to provide you with an opportunity to vote on the election of directors, whether or not you attend in person. If you execute and return the enclosed proxy card, your shares will be voted as you specify. If you make no specifications, your shares will be voted in accordance with the Board’s recommendations. If you submit a proxy card, you may subsequently revoke it by submitting a revised proxy card or a written revocation at any time before your original proxy is voted. You may also attend the Annual Meeting in person and vote by ballot, which would effectively cancel any proxy you previously gave.

ELECTION OF DIRECTORS

Currently, the Company’s Board of Directors is composed of six directors, Messrs. Krohn, Freel, Luikart, Nelson and Katz, and Ms. Boulet. At the Annual Meeting, six directors are to be elected, each of whom will serve until the 2007 Annual Meeting and until his or her successor is duly elected and qualified. The persons named as official proxies on the enclosed proxy card intend to vote FOR the election of each of the six nominees listed below, unless authority to vote is withheld or they are otherwise instructed.

The Board has nominated and the official proxy holders will vote to elect the following individuals as members of the Board of Directors: Tracy W. Krohn, Jerome F. Freel, James L. Luikart, Stuart B. Katz, S. James Nelson, Jr. and Virginia Boulet. Each nominee has consented to be nominated and to serve if elected.

Information about the Nominees

|

Tracy W. Krohn, age 51, has served as Chief Executive Officer (“CEO”) and President since he founded the Company in 1983, as Chairman of the Board since 2004 and as Treasurer since 1997. Mr. Krohn has been actively involved in the oil and gas business since graduating with a B.S. in Petroleum Engineering from Louisiana State University in 1978. He began his career as a petroleum engineer and offshore drilling supervisor with Mobil Oil Corporation. Prior to founding W&T in 1983, Mr. Krohn was senior engineer with Taylor Energy. From 1996 to 1997, Mr. Krohn was also Chairman and CEO of Aviara Energy Corporation in Houston, Texas. Mr. Krohn’s mother is married to Mr. Freel. | |

|

Jerome F. Freel, age 93, has served as a director since the Company’s founding in 1983 and Secretary of the Company since 1984. Mr. Freel has been actively involved in the oil and natural gas business since 1934, first as a geophysicist for eleven years with the Humble Oil and Refining Company, then in 1945 as founder and president of Research Explorations, Inc., a geophysical survey contractor to major oil companies, including Humble, until it was sold in 1963. In 1964, he became founder and president of Kiowa Minerals Company, a company that engaged in development drilling operations in Texas and Louisiana. Since 1983, Kiowa has not been active in oil and natural gas operations. Mr. Freel is married to Mr. Krohn’s mother. | |

|

Stuart B. Katz, age 51, has served on the Board of the Company since 2002. He is a Managing Director of Jefferies Capital Partners. Prior to joining Jefferies Capital Partners in 2001, Mr. Katz was an investment banker with Furman Selz LLC and its successors for over sixteen years. Mr. Katz received a B.S. in engineering from Cornell University and a J.D. from Fordham Law School. Mr. Katz is a member of the bar of the State of New York. Mr. Katz also serves as a member of the boards of directors of Telex Communications, Inc. and various non-public portfolio companies of Jefferies Capital Partners. | |

|

James L. Luikart, age 60, has served on the Company’s Board since 2002. Mr. Luikart has been Executive Vice President of Jefferies Capital Partners for more than five years. Mr. Luikart received a B.A. in History magna cum laude from Yale University and a M.I.A. from Columbia University. Mr. Luikart also serves as a member of the boards of directors of The Sheridan Group and various non-public portfolio companies of Jefferies Capital Partners. |

2

|

Virginia Boulet, age 52, has served on the Board of Directors of the Company since March 2005. She has been employed as Special Counsel to Adams and Reese, LLP, a law firm, since 2002. She is also an adjunct professor of law at Loyola University Law School. Prior to 2002, Ms. Boulet was a partner at the law firm Phelps Dunbar, LLP. Additionally, she serves on the board of directors of CenturyTel, Inc., a telecommunications company. In the past, she served as President and Chief Operating Officer of IMDiversity, Inc., an on-line recruiting company. Ms. Boulet received a B.A. in Medieval History from Yale University, and a J.D., cum laude, from Tulane University Law School. | |

|

S. James Nelson, Jr., age 63, has served on the Board of Directors of the Company since January 2006. In 2004, he retired, after 15 years of service, from Cal Dive International, Inc. (now known as Helix Energy Solutions Group, Inc.), a marine contractor and operator of offshore oil and natural gas properties and production facilities, where he was a founding shareholder, Chief Financial Officer from 1990 to 2000, Vice Chairman from 2000 to 2004 and a director. From 1985 to 1988, Mr. Nelson was the Senior Vice President and Chief Financial Officer of Diversified Energies, Inc., a NYSE-traded company, and from 1980 to 1985 was the Chief Financial Officer of Apache Corporation, an oil and gas exploration and production company. From 1966 to 1980, Mr. Nelson was employed with Arthur Anderson & Co., where he became a partner in 1976. Mr. Nelson is also a certified public accountant. Additionally, Mr. Nelson serves on the boards of directors of Oil States International, Inc., Input/Output, Inc. and Quintana Maritime Ltd. Mr. Nelson received a Bachelor of Science degree in Accounting from Holy Cross College and a Masters in Business Administration from Harvard University. |

Recommendation of the Board of Directors

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE SIX NOMINEES LISTED ABOVE.

CORPORATE GOVERNANCE

Corporate Governance Guidelines; Code of Business Conduct and Ethics

A complete copy of the Company’s corporate governance guidelines, which the Board reviews at least annually, is posted on the Company’s website at www.wtoffshore.com and is available in print to any shareholder who requests it. The Board of Directors has adopted a code of business conduct and ethics that applies to all employees, officers and directors. A complete copy of the code is posted on the Company’s website at www.wtoffshore.com and is available in print to any shareholder who requests it. Because Tracy W. Krohn, the Company’s Chairman and Chief Executive Officer, controls approximately 62% of the outstanding shares of Common Stock, the Company is a “controlled company” under New York Stock Exchange (“NYSE”) Corporate Governance Rules. Accordingly, the Company is not required to maintain a (i) majority of independent directors on the Board, (ii) Nominating and Corporate Governance Committee composed entirely of independent directors or (iii) Compensation Committee composed entirely of independent directors. Notwithstanding these exemptions, the Company requires that the Compensation Committee of the Board consist entirely of independent directors, as is more fully discussed under the heading Standing Committees of the Board of Directors on page 4.

Independence

The Board has determined that each nominee, other than Messrs. Krohn and Freel and Ms. Boulet, is “independent” as defined by the NYSE listing standards.

3

Standing Committees of the Board of Directors

The Board has three standing committees—the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Because a single person controls the Company, the Company is a “controlled company” within the meaning of the rules of the NYSE, and, accordingly, the Company is not required to maintain an independent Compensation Committee or independent Nominating and Corporate Governance Committee. The Company believes, however, that it is in its best interests to have a Compensation Committee consisting entirely of independent directors. As such, the Company’s Compensation Committee Charter adopted by the Board of Directors requires all members to be independent.

Audit Committee

Currently, Messrs. Luikart, Katz and Nelson sit on the Company’s Audit Committee. The Board has determined that Messrs. Luikart, Katz and Nelson are “independent” under the standards of both the NYSE and Securities and Exchange Commission (the “SEC”) regulations. The Board considers both Messrs. Katz and Nelson to be “audit committee financial experts,” as defined under the Securities Act of 1933. In connection with his appointment, the Board of Directors considered the fact that Mr. Nelson is a member of the audit committees of three other public companies, and found that such simultaneous service will not, and does not, impair his ability to effectively serve on the Audit Committee of the Board of Directors of the Company.

The Audit Committee establishes the scope of and oversees the annual audit, including recommending the independent public accountants that audit the Company’s financial statements and approving any other services provided by the accountants. The Audit Committee also assists the Board in fulfilling its oversight responsibilities by (1) overseeing the Company’s system of financial reporting, auditing, controls and legal compliance, (2) monitoring the operation of such system and the integrity of the Company’s financial statements, monitoring the qualifications, independence and performance of the outside auditors and any internal auditors who the Company may engage, and (3) reporting to the Board periodically concerning the activities of the Audit Committee. In performing its obligations, it is the responsibility of the Audit Committee to maintain free and open communication between it, the Company’s independent auditors, the internal accounting function and the management of the Company. The Audit Committee’s functions are further described under the heading Audit Committee Report on page 14. A copy of the Audit Committee’s Charter is posted on the Company’s website at www.wtoffshore.com and is available in print to any shareholder who requests it.

Nominating and Corporate Governance Committee

Mr. Krohn, Mr. Freel and Ms. Boulet serve as members of the Nominating and Corporate Governance Committee of the Board. None of these directors meets the NYSE standards for independence. The purpose of the committee is to nominate candidates to serve on the Board of Directors and to approve director compensation. The factors and processes used to select potential nominees are more fully described in the section entitled Identifying and Evaluating Nominees for Directors on page 5. The committee is also responsible for monitoring a process to assess Board effectiveness; developing and implementing corporate governance guidelines; and taking a leadership role in shaping the corporate governance of the Company. A copy of the Nominating and Corporate Governance Committee’s Charter is posted on the Company’s website at www.wtoffshore.com and is available in print to any shareholder who requests it.

Compensation Committee

Mr. Luikart and Mr. Katz, both independent under NYSE listing standards, serve as members of the Compensation Committee. The Compensation Committee reviews the compensation and benefits of the executive officers, establishes and reviews general policies related to employee compensation and benefits and administers the Long-Term Incentive Compensation Plan, the Directors Compensation Plan and the 2005 Annual Incentive Plan. Under the terms of its charter, the Compensation Committee also determines the compensation for Mr. Krohn, the CEO of the Company.

4

None of the Company’s executive officers serve as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Board of Directors or Compensation Committee.

Meetings of the Board and the Committees of the Board

During 2005, the Board of Directors held eight regular and two special meetings. The Compensation Committee held one meeting in 2005, and the Nominating and Corporate Governance Committee held one meeting in 2005. In 2005, the Audit Committee met six times. All of the directors attended at least seventy-five percent of the meetings of the Board and of the committees on which they served during that period.

Legal Proceedings

Currently, no director or executive officer is a party to any material legal proceeding adverse to the interests of the Company. Additionally, no director or executive officer has a material interest in any material proceeding adverse to the Company.

Director Nomination Process

The Nominating and Corporate Governance Committee will consider all properly submitted shareholder recommendations of candidates for election to the Board of Directors. Pursuant to Section 12 of the Company’s Bylaws, any shareholder may nominate candidates for election to the Board by giving timely notice of the nomination to the Secretary of the Corporation. The Company’s Bylaws require that any such shareholder must be a shareholder of record at the time it gives notice of the nomination. To be considered a timely nomination, the shareholder’s notice must be delivered to the Secretary at the Company’s principal office no later than 90 days prior to the first anniversary of the preceding year’s annual meeting and no earlier than 120 days prior to the first anniversary of the preceding year’s annual meeting. In evaluating the recommendations of the shareholders for director nominees, as with all other possible director nominees, the Nominating and Corporate Governance Committee will address the criteria set forth below under the heading Identifying and Evaluating Nominees for Directors.

Any shareholder recommendations for director nominees should include the candidate’s name, qualifications and written consent to being named in the proxy statement and to serving on the Board if elected. The shareholder must also include any other business that the shareholder proposes to bring before the meeting, the reasons for conducting such business at the meeting, any material interest in such business of such shareholder and the beneficial owner, if any, on whose behalf the proposal is made. Additionally, the shareholder must provide his name and address, the name and address of any beneficial owner on whose behalf the shareholder is acting, and the number of shares of Common Stock beneficially owned by the shareholder and any beneficial owner for whom the shareholder is acting. Such written notice should be sent to:

Jerome F. Freel

Secretary

W&T Offshore, Inc.

Eight Greenway Plaza, Suite 1330

Houston, Texas 77046

Identifying and Evaluating Nominees for Directors

The Nominating and Corporate Governance Committee is responsible for leading the search for individuals qualified to serve as directors. The Nominating and Corporate Governance Committee evaluates candidates for nomination to the Board, including those recommended by shareholders, and conducts appropriate inquiries into the backgrounds and qualifications of possible candidates. The Nominating and Corporate Governance

5

Committee then recommends to the Board, nominees as directors to be presented for election at meetings of the shareholders or of the Board. As indicated above, shareholders may recommend possible director nominees for consideration to the Nominating and Corporate Governance Committee.

In evaluating nominees to serve as directors on the Board and in accordance with the Company’s Corporate Governance Guidelines, the Nominating and Corporate Governance Committee selects candidates with the appropriate skills and characteristics required of Board members. Pertinent to this inquiry is the following non-exhaustive list of factors: independent business or professional experience; integrity and judgment; records of public service; ability to devote sufficient time to the affairs of the Company; diversity, age, skills, occupation, and understanding of financial statements and financial reporting systems. The Committee will also consider and weigh these factors in light of the current make-up of the Board and needs of the Board and the Company.

Director Compensation

Directors who are also employees of the Company receive no additional compensation for serving as directors or committee members. The Company’s Board and shareholders adopted the 2004 Directors Compensation Plan, which provides that the Compensation Committee may grant stock options or restricted or unrestricted stock to non-employee directors. A total of 666,918 shares of Common Stock have been reserved for issuance under the 2004 Directors Compensation Plan. To date, no shares or options have been issued under this plan.

In January 2006, the Board of Directors revised the compensation paid to non-officer directors of the Company to provide that each would receive the following compensation: (i) an annual retainer of $30,000, payable in equal quarterly installments; (ii) at each annual meeting of shareholders, a restricted stock grant pursuant to the Company’s 2004 Director Compensation Plan covering shares of common stock of the Company having a fair market value (calculated as of the closing of trading on the NYSE on the date of the annual board meeting) equal to $40,000; and (iii) compensation of $1,250 for each meeting of the board or any board committee meeting attended. The terms of the restricted stock grant are as set forth in the Company’s 2004 Director Compensation Plan, with restrictions lapsing with respect to 1/3 of the shares subject to the restricted stock grant on each of the first, second and third anniversary dates of the date of grant. Additionally, Mr. Nelson, as chairman of the Audit Committee, receives an annual retainer of $15,000. Prior to the revision to the non-officer director compensation in 2006, each of the Company’s non-employee directors was paid an annual retainer of $24,000, payable in quarterly installments of $6,000, and received a meeting fee of $1,000 for each meeting attended. Additionally, each non-employee director of the Company who also served as a committee chairman received an additional $500 for each committee meeting held outside a regular board meeting.

To the extent that any of the director’s employers (or affiliates of their employer) require that a director pay or turn over any fees and stock compensation earned from service on the Company’s Board, the Company will pay or deliver any fees and stock compensation related to the director’s service on the Board as directed by the director’s employer or its affiliate.

Communications with the Board of Directors

At each regular meeting of the Board of Directors, the outside directors meet in executive session. The outside directors elected Stuart B. Katz as the presiding director of those meetings. As set forth on the Company’s website (www.wtoffshore.com), shareholders who would like to contact Mr. Katz on a confidential basis may do so by sending an email to Presiding_Director@wtoffshore.net or by mailing a written communication to Presiding Director, W&T Offshore, Inc., Eight Greenway Plaza, Suite 1330, Houston, Texas 77046.

6

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of Common Stock as of February 14, 2006, based on the 65,979,875 shares of Common Stock outstanding on that date, of (i) the Company’s Chief Executive Officer and each of the Company’s other four most highly compensated executive officers as of February 14, 2006, (ii) each of the Company’s directors and nominees, (iii) all executive officers and directors of the Company as a group, and (iv) each person who beneficially owns more than five percent of the Company’s Common Stock. Unless otherwise indicated, each of the persons below has sole voting and investment power with respect to the shares beneficially owned by such person. To the knowledge of the Company, no person or entity holds more than 5% of the outstanding shares of Common Stock, except as set forth in the following table.

| Name of Beneficial Owner |

Shares of Common Stock Beneficially Owned (1) |

Percent of Outstanding Common Stock |

|||

| Tracy W. Krohn Eight Greenway Plaza Suite 1330 Houston, Texas 77046 |

40,752,007 | 61.8 | % | ||

| Jerome F. Freel Eight Greenway Plaza Suite 1330 Houston, Texas 77046 |

7,087,271 | 10.7 | % | ||

| James L. Luikart |

42,304 | * | |||

| Stuart B. Katz |

10,739 | * | |||

| W. Reid Lea |

132,711 | * | |||

| Jeffery M. Durrant |

140,766 | * | |||

| Joseph P. Slattery |

45,206 | * | |||

| Virginia Boulet |

0 | * | |||

| S. James Nelson, Jr. |

0 | * | |||

| Directors and Executive Officers as a Group (10 persons) |

48,224,947 | 73.1 | % | ||

| FMR Corp. 82 Devonshire Street Boston, Massachusetts 02109 |

4,279,800 | 6.5 | % | ||

| * | Less than one percent |

| (1) | Under the regulations of the SEC, shares are deemed to be “beneficially owned” by a person if he directly or indirectly has or shares the power to vote or dispose of, or to direct the voting of or disposition of, such shares, whether or not he has any pecuniary interest in such shares, or if he has the power to acquire such power through the exercise of any option, warrant or right. |

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely on a review of their Form 3, 4 and 5 filings with the SEC, and amendments thereto, the Company believes that during the fiscal year ended December 31, 2005, all of its officers and directors timely complied with the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934, except for Joseph P. Slattery and William W. Talafuse, each of whom inadvertently filed two reports late.

7

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Summary Compensation Table

The following table sets forth certain information with respect to the compensation paid to Mr. Krohn, our Chairman, Chief Executive Officer, President and Treasurer and the Company’s four other most highly compensated executive officers for the year ended December 31, 2005.

| Annual Compensation |

Long-Term Compensation Awards Restricted Stock Awards (1) |

All Other Compensation (4) | |||||||||||||||

| Name and Principal Position |

Year |

Salary |

Bonuses Granted (1) (2) |

Other Annual Compensation (3) |

|||||||||||||

| Tracy W. Krohn Chairman/Chief Executive Officer/ President/Treasurer |

2005 2004 |

$ |

500,000 500,000 |

$ |

250,000 250,000 |

$ |

420,450 405,624 |

$ |

— — |

$ |

18,021 2,983 | ||||||

| W. Reid Lea Executive Vice President/Manager of Corporate Development |

2005 2004 |

|

348,000 347,250 |

|

208,800 377,250 |

|

— — |

|

339,300 — |

|

13,944 2,815 | ||||||

| Jerome F. Freel Secretary |

2005 2004 |

|

237,716 237,716 |

|

— — |

|

— — |

|

— — |

|

— — | ||||||

| Jeffery M. Durrant Senior Vice President of Exploration/Geoscience |

2005 2004 |

|

230,168 222,862 |

|

138,101 243,122 |

|

— — |

|

224,414 — |

|

17,242 2,815 | ||||||

| Joseph P. Slattery Senior Vice President of Operations |

2005 2004 |

|

230,769 220,000 |

|

138,462 240,000 |

|

— — |

|

225,000 — |

|

11,204 2,983 | ||||||

| (1) | In 2005, the amounts reflect bonuses awarded under the W&T Offshore, Inc. 2005 Annual Incentive Plan and paid in March 2006, except for Messrs. Krohn and Freel. Mr. Krohn’s bonus is paid in accordance with his employment agreement, as further described in this report. |

| (2) | In the fourth quarter of 2004, the Company awarded bonuses to all of our employees of record on December 31, 2004 (other than the Chief Executive Officer and the Corporate Secretary) in amounts equal to their 2004 salaries. The bonuses were paid in two installments, on June 1, 2005 and January 3, 2006 to individuals still employed on those dates. |

| (3) | Excludes perquisites and other personal benefits if the total incremental cost in a given year did not exceed the lesser of $50,000 or 10% of the total annual salary and bonus reported for each executive officer. For Mr. Krohn, the amounts include the incremental costs associated with Mr. Krohn’s personal use of aircraft in which the Company owns a fractional interest. |

| (4) | Company matching contributions to our 401(k) plan and the taxable value of Company provided life insurance. |

Employment Contracts

Tracy W. Krohn serves as the Company’s Chairman, Chief Executive Officer, President and Treasurer. Mr. Krohn serves under an employment agreement with an initial term expiring three years from January 28, 2005. On the third anniversary date, and on the same date every year thereafter, his agreement will automatically renew for one additional year, unless terminated before any such renewal date by Mr. Krohn or the Company.

Mr. Krohn’s employment agreement provides for an annual base salary of $500,000 and a nondiscretionary bonus of $250,000, subject to review from time to time by the Compensation Committee for possible increases based on Mr. Krohn’s performance. The Compensation Committee also has the authority to pay additional cash bonuses to Mr. Krohn in its discretion, during the term of his agreement.

8

If, during the term of his agreement, the Company terminates the employment of Mr. Krohn for any reason other than for cause, as defined in the agreement, he will be entitled to receive his base salary until the actual termination date of his agreement and a severance payment in the amount of 2.99 times his average annual income over the most recent five taxable years. If the Company should undergo a change in control while the agreement is in effect and Mr. Krohn is either constructively or actually terminated under the conditions set forth in his agreement within two years of a change of control, then he will be entitled to receive 2.99 times his average annual taxable income from the Company over the five taxable years that end before the change of control transaction.

Mr. Krohn has agreed that during the term of his agreement and for a period of two years thereafter, he will not compete with the Company or solicit any of our customers, employees, consultants or independent contractors with whom we do business.

W. Reid Lea serves under an employment agreement that expires on September 28, 2008 and that provides for a base salary of $348,000. His agreement also provides for termination benefits, triggered in certain situations including a change in control, in an amount of three times his base salary less $1.00.

Jeffery M. Durrant serves under an employment agreement that expires on September 28, 2008 and that provides for a base salary $250,000 per year. His agreement also provides for termination benefits, triggered in certain situations including a change in control, in an amount of three times his base salary less $1.00.

Joseph P. Slattery serves under an employment agreement that expires on September 28, 2008 and that provides for a base salary $260,000 per year. His agreement also provides for termination benefits, triggered in certain situations including a change in control, in an amount of three times his base salary less $1.00.

Long-Term Incentive Compensation Plan

The Company maintains a Long-Term Incentive Compensation Plan, the purpose of which is to provide incentives to the Company’s employees, officers, consultants, and advisors to devote their abilities and energies to our success. The Long-Term Incentive Compensation Plan provides for the granting or awarding of incentive and nonqualified stock options, stock appreciation rights, restricted stock and performance shares. At December 31, 2005, the Company had reserved 1,637,442 shares for issuance pursuant to awards made under the Long-Term Incentive Compensation Plan and available for future grant.

The Compensation Committee of the Board administers the Long-Term Incentive Compensation Plan. Subject to the express provisions of the plan, the Compensation Committee has full authority, among other things:

| • | to select the persons to whom stock, options and other awards will be granted; |

| • | to determine the type, size and terms and conditions of stock options and other awards; and |

| • | to establish the terms for treatment of stock options and other awards upon a termination of employment. |

Under the Long-Term Incentive Compensation Plan, awards other than stock options and stock appreciation rights given to any of the Company’s executive officers whose compensation must be disclosed in the Company’s annual securities filings and who is subject to the limitations imposed by Section 162(m) of the tax code must be based on the attainment of certain performance goals established by the Board of Directors or the Compensation Committee. The performance measures are limited to earnings per share, return on assets, return on equity, return on capital, net profits after taxes, net profits before taxes, operating profits, stock price and sales or expenses. Additionally, the performance goals must include formulas for calculating the amount of compensation payable if the goals are met; and both the goals and the formulas must be sufficiently objective so that a third party with knowledge of the relevant performance results could assess that the goals were met and calculate the amount to be paid.

9

Consistent with certain provisions of the tax code, there are other restrictions providing for a maximum number of shares that may be granted in any one year to a named executive officer and a maximum amount of compensation payable as an award under the Long-Term Incentive Compensation Plan (other than stock options and stock appreciation rights) to a named executive officer.

2005 Annual Incentive Plan

In October 2005, the Board of Directors amended the Long-Term Incentive Compensation Plan with the 2005 Annual Incentive Compensation Plan (the “Annual Plan”). The purpose of the Annual Plan is to retain the Company’s key employees, to attract talented and dedicated employees, to reward superior job performance and to encourage teamwork among the Company’s employees by linking every employee’s bonus opportunity with the overall annual performance of the Company.

Eligible employees will be able to earn bonuses in the form of cash compensation and restricted stock awards. All bonuses paid under the Annual Plan for any fiscal year will be limited generally to 5% of the Company’s pre-tax net income for such year. Part of the bonus will be a general bonus that is paid to the extent that 5% of the Company’s pre-tax income is sufficient for the payment. An additional bonus, referred to as the Extraordinary Performance Bonus, is to be paid only if the Company achieves a 5% growth in year-to-year production and a 5% growth in proved oil and natural gas reserves over the year for which the bonus is paid. If these financial targets are met, one-half of the Extraordinary Performance Bonus is paid. An additional one-quarter of the Extraordinary Performance Bonus is due if the Company’s lease operating expenses, per Mcfe of production, do not grow by more than 5% in the fiscal year for which the bonus is paid, and another one-quarter of the Extraordinary Performance Bonus is due if the Company’s general and administrative expenses, per Mcfe of production, do not grow by more than 5% in the fiscal year for which the bonus is paid.

The Annual Plan provides that, subject to the limitation that all bonuses paid annually under the Annual Plan are generally limited to 5% of the Company’s pre-tax net income, each executive officer shall be entitled to receive a general bonus payable in (a) cash equal to 40% of his or her base salary and (b) restricted stock valued at 65% of his or her base salary. Each executive officer is also eligible to receive a maximum Extraordinary Performance Bonus payable in (a) cash in an amount of up to 20% of his or her base salary and (b) restricted stock valued at up to 32.5% of his or her base salary. Stock awarded under the Annual Plan is issued pursuant to the Long-Term Incentive Compensation Plan. Tracy W. Krohn and Jerome F. Freel were not participants in the Annual Plan in 2005.

The Compensation Committee of the Board of Directors, which administers the Plan, has the authority to adjust financial targets when unforeseen events affect the Company’s results of operations.

In March 2006, our Board of Directors approved payment of a general bonus and an extraordinary bonus for 2005 under our incentive compensation plan. Although not all of the performance measures for the extraordinary bonus were met, our board determined that substantially all of the performance measures would have been met were it not for the effects of Hurricanes Katrina and Rita. The total cash portion of the 2005 general bonus is $2.8 million. The total cash portion of the extraordinary bonus is $1.4 million. The total restricted stock portion of the general bonus is $4.0 million, and the total restricted stock portion of the extraordinary bonus is $2.0 million. The restricted stock will vest in three equal increments on December 31 of 2006, 2007 and 2008. A total of 160,377 restricted shares were granted in connection with the 2005 bonuses. Messrs. Lea, Slattery and Durrant will receive bonuses under the plan for 2005.

10

Equity Compensation Plan Information

The following table provides information concerning securities to be issued upon the exercise of outstanding options, the weighted average price of such options and the securities remaining available for future issuance, as of December 31, 2005.

| Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) |

Weighted-average exercise price of outstanding options, warrants and rights (b) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | ||||

| Equity compensation plans approved by security holders (1) |

0 | — | 2,304,360 | |||

| Equity compensation plans not approved by security holders |

— | — | — | |||

| Total |

0 | — | 2,304,360 | |||

| (1) | 1,637,442 shares authorized for issuance under the Long-Term Incentive Compensation Plan and 666,918 shares authorized for issuance under the 2004 Directors Compensation Plan. |

11

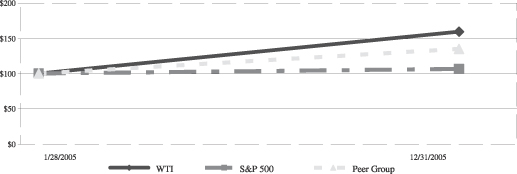

Performance Graph

We completed our initial public offering in January 2005. Our common stock began trading on the New York Stock Exchange on January 28, 2005. The following graph compares the cumulative total shareholder return for the Company’s common stock to that of (i) the Standard & Poor’s 500 Index, and (ii) a Company peer group, for the period indicated as prescribed by the SEC’s rules. “Cumulative total return” is defined as the change in share price during the measurement period, plus cumulative dividends for the measurement period (assuming dividend reinvestment), divided by the share price at the beginning of the measurement period. The graph assumes $100 was invested on January 28, 2005 in our common stock, the Standard & Poor’s Composite 500 Index and a Company peer group.

COMPARISON OF CUMULATIVE TOTAL RETURN

AMONG W&T OFFSHORE, INC., THE S&P 500 INDEX, AND A PEER GROUP

| Note: | The stock price performance for the Company’s common stock is not necessarily indicative of future performance. |

| Cumulative Total Return (1) | ||||

| Initial |

12/31/05 | |||

| W&T Offshore, Inc. |

100.00 | 159.31 | ||

| S&P Index |

100.00 | 106.57 | ||

| Peer Group (2) |

100.00 | 134.99 | ||

| (1) | Total return assuming reinvestment of dividends. Assumes $100 invested on January 28, 2005 in our common stock, S&P 500 Index, and a peer group of companies. Initial data is taken from January 28, 2005, which corresponds with the Initial Public Offering date for W&T Offshore, Inc. |

| (2) | Composed of the following eight (8) independent oil and gas exploration and production companies with activities focused in the Gulf of Mexico area: ATP Oil & Gas Corporation, Callon Petroleum Company, Energy Partners, Ltd., The Houston Exploration Company, Newfield Exploration Company, Remington Oil and Gas Corporation, Stone Energy Corporation and The Meridian Resource Corporation. |

12

COMPENSATION COMMITTEE REPORT

The Board’s Compensation Committee monitors and approves the compensation of the Company’s Chief Executive Officer, administers the Company’s incentive compensation programs and performs other related tasks. The Committee is composed of two Board members who qualify as independent directors under the Company’s corporate governance guidelines, “non-employee directors” under Rule 16b-3 promulgated under the Securities Exchange Act of 1934 and “outside directors” under Section 162(m) of the Internal Revenue Code. If you would like additional information on the responsibilities of the Compensation Committee, please refer to its charter, which is available on our website at www.wtoffshore.com and is available in print to any shareholder who requests it.

Prior to the Company’s initial public offering effective January 28, 2005, the Compensation Committee of the Board did not take an active role in executive compensation. The Company paid the Chief Executive Officer in accordance with an employment agreement that was negotiated between Mr. Krohn and representatives of Jefferies Capital Partners at the time funds managed by Jefferies Capital Partners were initially invested in the Company. All other executive compensation was determined by our Chief Executive Officer. In contemplation of our initial public offering, the Compensation Committee adopted a charter and began to hold its first working meetings.

Currently, the Compensation Committee is responsible for establishing the compensation of the executive officers of the Company, including salary, bonuses and stock-related compensation. The Compensation Committee plans to establish metrics by which executive bonuses and stock-related incentives will be awarded. In that effort, the Committee plans to apply the following compensation objectives in connection with its deliberations:

| • | compensating the Company’s executives with salaries comparable to those of similarly-situated executives at comparable companies, |

| • | providing a substantial portion of the executives’ compensation in the form of incentive compensation based upon (i) the Company’s short and long-term performance and (ii) the individual, departmental or divisional achievements of the executives, |

| • | encouraging team orientation, and |

| • | providing sufficient benefit levels for executives and their families in the event of disability, illness or retirement. |

In addition, to the extent that it is practicable and consistent with the Company’s executive compensation objectives, the Committee seeks to comply with Section 162(m) of the Internal Revenue Code and any regulations promulgated thereunder (collectively, “Section 162(m)”) in order to preserve the tax deductibility of performance-based compensation in excess of $1 million per taxable year to each of the named officers. If compliance with Section 162(m) conflicts with the Committee’s compensation objectives or is contrary to the best interests of the shareholders, the Committee will pursue its objectives, regardless of the attendant tax implications.

Submitted by the Compensation Committee of the Board of Directors.

| James L. Luikart (Chairman) |

Stuart B. Katz |

13

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Brooke Companies, Inc. provides people to fill temporary staffing and employee placement needs of the Company from time to time. The Company paid Brooke Companies approximately $246,000 in 2005, $426,000 in 2004 and $300,000 in 2003. Susan Krohn, the wife of Tracy W. Krohn, owns 100% of Brooke Companies. Brooke Companies currently provides staffing services to our Company, and we expect that it will continue to provide those services for the foreseeable future.

Effective January 1, 2004, the Company entered into a management agreement with W&T Offshore, LLC pursuant to which the Company manages certain oil and gas properties. The Company is paid $8,000 per month for these services. Tracy W. Krohn and Jerome F. Freel are the owners of W&T Offshore, LLC.

On February 2, 2005, the Company closed its initial public offering of common stock. Tracy W. Krohn, W. Reid Lea, Joseph P. Slattery and Jeffery M. Durrant, sold a total of 2,666,442 shares of common stock in the initial public offering. Funds managed by Jefferies Capital Partners, with which Messrs. Katz and Luikart are associated, sold a total of 9,988,821 shares of common stock in the initial public offering. Additionally, Steve Landry, who was not employed by the Company as an executive officer until October 1, 2005, sold 8,647 shares of common stock in the initial public offering. The Company paid all legal, accounting, engineering, printing and certain other expenses and all registration and listing fees associated with the initial public offering. These expenses and fees aggregated approximately $2.5 million. The Company also agreed to indemnify and hold harmless the underwriters in the initial public offering for certain liabilities in connection with the offering.

During 2005, the Chief Executive Officer reimbursed the Company $0.4 million for personal use in 2005 of an aircraft in which it owns a fractional interest.

The grandson of Jerome F. Freel is employed by an insurance agency that writes certain insurance coverage for the Company. Mr. Freel’s personal commissions on the writing of such insurance totaled approximately $51,000 and $47,000 in 2005 and 2004, respectively. In each case, the cost of premiums were in excess of $60,000, and the business was awarded to Mr. Freel as the low bidder in a competitive process in which the Company received at least one other quote.

The Company paid Adams and Reese, LLP legal fees aggregating $922,000 in 2004 and $411,000 in 2005. Virginia Boulet is special counsel to Adams and Reese LLP, but is currently on leave of absence.

AUDIT COMMITTEE REPORT

Activities of the Committee

The Audit Committee of the Board of Directors is currently composed of three directors, Messrs. Katz, Luikart and Nelson, all of whom qualify as independent directors under the rules and regulations of the NYSE, the Company’s corporate governance guidelines and the federal laws and regulations governing the make-up of public company audit committees.

Management is responsible for the Company’s internal controls and the financial reporting process. The Company’s independent auditor is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Committee’s responsibility is to monitor and oversee these processes.

In this context, the Committee has met and held discussions with the Company’s management and its independent auditor, Ernst & Young LLP (“Ernst & Young”). Management represented to the Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted U.S. accounting principles, and the Committee has reviewed and discussed the consolidated financial statements with

14

management and Ernst & Young. The Committee discussed with Ernst & Young matters required to be discussed by Statements on Auditing Standards No. 61 and 90 (Communication with Audit Committees).

Ernst & Young also provided to the Committee the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). The Committee discussed with Ernst & Young that firm’s independence, and considered the effects that the provision of non-audit services may have on Ernst & Young’s independence.

Based on and in reliance upon the reviews and discussions referred to above, and subject to the limitations on the role and responsibilities of the Committee referred to in its charter, the Committee recommended that the Board of Directors include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005.

Other Information

Ernst & Young has acted as independent certified public auditor for the Company since 2000, and has been selected by the Audit Committee to serve again in that capacity for 2006. The following table lists the aggregate fees and costs billed by Ernst & Young and its affiliates to the Company and its subsidiaries for the 2005 and 2004 services identified below.

| 2005 |

2004 | |||||

| Audit fees (1) |

$ | 357,151 | $ | 614,493 | ||

| Audit related fees (2) |

— | 4,000 | ||||

| Tax fees (3) |

157,840 | 217,375 | ||||

| All other fees |

1,500 | — | ||||

| $ | 516,491 | $ | 835,868 | |||

| (1) | Includes fees for audit of our annual consolidated financial statements, fees related to our initial public offering, issuance of comfort letters and consents and reviews of various documents filed with the SEC. |

| (2) | Includes fees for consultations related to accounting, financial reporting or disclosure matters and review of proposed transactions not classified as “Audit fees.” |

| (3) | Includes fees for preparation of federal and state tax returns, assistance during an examination of our Louisiana tax returns in 2004, tax advice and planning and review of proposed transactions. |

| (4) | Includes an annual subscription fee for access to an accounting literature database. |

The Audit Committee maintains written procedures that require it to annually pre-approve the scope of all auditing services to be performed by the Company’s independent auditor. The Committee’s procedures prohibit the independent auditor from providing any non-audit services unless the service is permitted under applicable law and is pre-approved by the Audit Committee or its Chairman. The Audit Committee has pre-approved the Company’s independent auditor to provide up to $5,000 per quarter of miscellaneous tax services that do not constitute discrete and separate projects. Although applicable regulations waive these pre-approval requirements in certain limited circumstances, the Audit Committee reviews and pre-approves all non-audit services provided by Ernst and Young. The Audit Committee has determined that the provision of Ernst & Young’s non-audit services are compatible with maintaining Ernst & Young’s independence.

If you would like additional information on the responsibilities of the Audit Committee, please refer to its charter, which is an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 and is posted on the Company’s website at www.wtoffshore.com and is available in print to any shareholder who requests it.

Submitted by the Audit Committee of the Board of Directors.

| S. James Nelson, Jr. (Chairman) |

James L. Luikart | Stuart B. Katz |

15

SHAREHOLDER PROPOSALS

At the annual meeting each year, the Board of Directors submits to shareholders its nominees for election as directors. The Board of Directors may also submit other matters to the shareholders for action at the annual meeting. Shareholders of the Corporation may also submit proposals for inclusion in the proxy materials. If you want the Company to consider including a proposal in next year’s proxy statement, you must submit the proposal in writing to our Secretary no later than December 27, 2006. If you want us to consider including a nominee for election to the Board of Directors, you must submit the nominees name in accordance with the procedures discussed more fully in the section entitled Director Nomination Process on page 5, no earlier than January 16, 2007 and no later than February 15, 2007. Please mail any nominations or proposals following the prescribed guidelines to Secretary, W&T Offshore, Inc., Eight Greenway Plaza, Suite 1330, Houston, Texas 77046.

OTHER MATTERS

Neither us nor any of the persons named as proxies knows of any matters other than those described above to be voted on at the 2006 Annual Meeting. However, if any other matters are properly presented at the Annual Meeting, it is the intention of the persons named as proxies to vote in accordance with their judgment on these matters, subject to the discretion of the Board of Directors.

A copy of our Annual Report on Form 10-K for the year ended December 31, 2005, accompanies this Proxy Statement, but it is not to be deemed a part of the proxy soliciting material.

Shareholders may obtain additional copies of our current Annual Report on Form 10-K without charge by writing to our Secretary at W&T Offshore, Inc. Eight Greenway Plaza, Suite 1330, Houston, Texas 77046. Our Annual Report on Form 10-K and other filings with the SEC may also be accessed through our website at www.wtoffshore.com or the SEC’s website at www.sec.gov.

By order of the Board of Directors,

Jerome F. Freel

Secretary

16

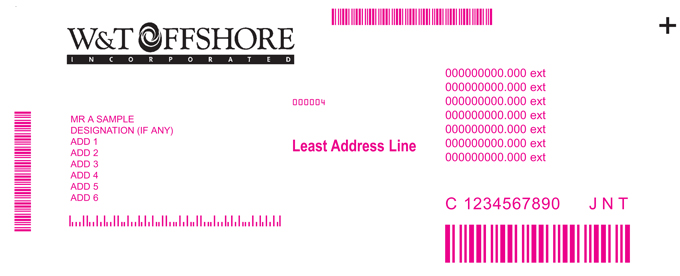

| ¨ | Mark this box with an X if you have made changes to your name or address details above. |

Annual Meeting Proxy Card

A Election of Directors

1. The Board of Directors recommends a vote FOR the listed nominees.

| For Withhold | For Withhold | |||||||||

| 01 - Tracy W. Krohn | ¨ ¨ | 04 - Stuart B. Katz | ¨ ¨ | |||||||

| 02 - Jerome F. Freel | ¨ ¨ | 05 - Virginia Boulet | ¨ ¨ | |||||||

| 03 - James L. Luikart | ¨ ¨ | 06 - S. James Nelson, Jr. | ¨ ¨ | |||||||

B Authorized Signatures - Sign Here - This section must be completed for your instructions to be executed.

NOTE: Please sign your name(s) EXACTLY as your name(s) appear(s) on this proxy. All joint holders must sign. When signing as attorney, trustee, administrator, guardian or corporate officer, please provide your FULL title. If partnership, please sign in partnership name by authorized person.

| Signature 1 - Please keep signature within the box

|

Signature 2 - Please keep signature within the box

|

Date (mm/dd/yyyy)

| ||||||

| / / |

| n | 0 0 8 4 4 1 | 1 U P X | C O Y | + |

Proxy - W&T Offshore, Inc.

PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

FOR THE 2006 MEETING OF SHAREHOLDERS

May 16, 2006

The undersigned hereby appoints Tracy W. Krohn and Jerome F. Freel and each of them, proxies with full power of substitution, to vote as designated on the reverse side, on behalf of the undersigned all shares of W&T Offshore, Inc. common stock, that the undersigned may be entitled to vote at the Annual Meeting of Shareholders of W&T Offshore, Inc. on May 16, 2006, and any adjournments thereof, with all the powers that the undersigned would possess if personally present. In their discretion, the proxies are hereby authorized to act upon such other business as may properly come before the meeting and any adjournments or postponements thereof.

The Board of Directors recommends that you vote FOR the nominees listed on the reverse side hereof. If this Proxy is properly executed but no specific directions are given, all of your votes will be voted for such nominees.

(See Reverse Side)